Custom Liability Payments

Hi, I am paying employees tax via the custom liability function. I have found that the previous month has been overpaid. How can I see how the previous cheque was allocated? Ie. which employees and how much?

Comments

-

Employee PAYG is accumulated & paid as a total however you can see the breakdown per employee/Paycheque on payroll reports.

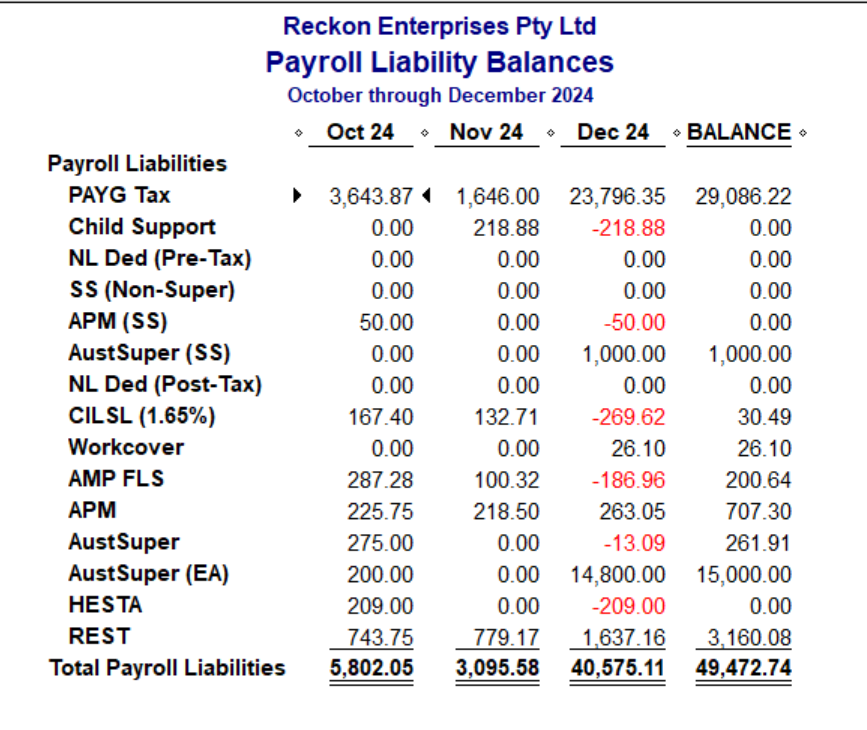

You can also see what liabilities should be/have been paid on the Payroll Liability Balances report:

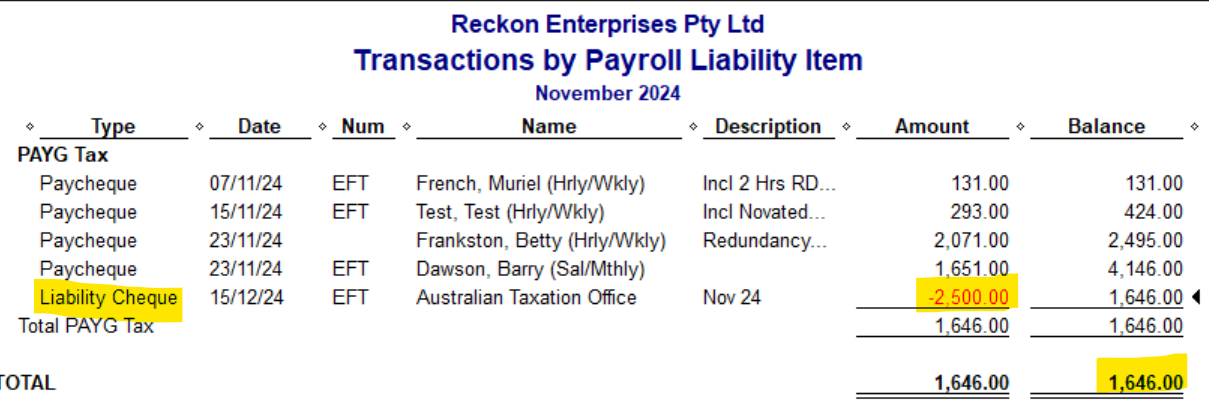

If you drill down on any balance, it will display all the Paycheque transactions for that amount eg this is the drilldown on Nov 24's $ 1,646.00 balance of PAYG Tax:

You can see here the PAYG component for each Nov 24 Paycheque & also the Liability Chq payment made for that selected period.

0 -

Hi Sharon,

Thanks so much for your reply. Is there a way to drill down on the actual cheque payment to see how it was allocated. My figures seem to have changed and now my cheque is for more than the liability components leaving a negative balance. Not sure how to manage this?

0 -

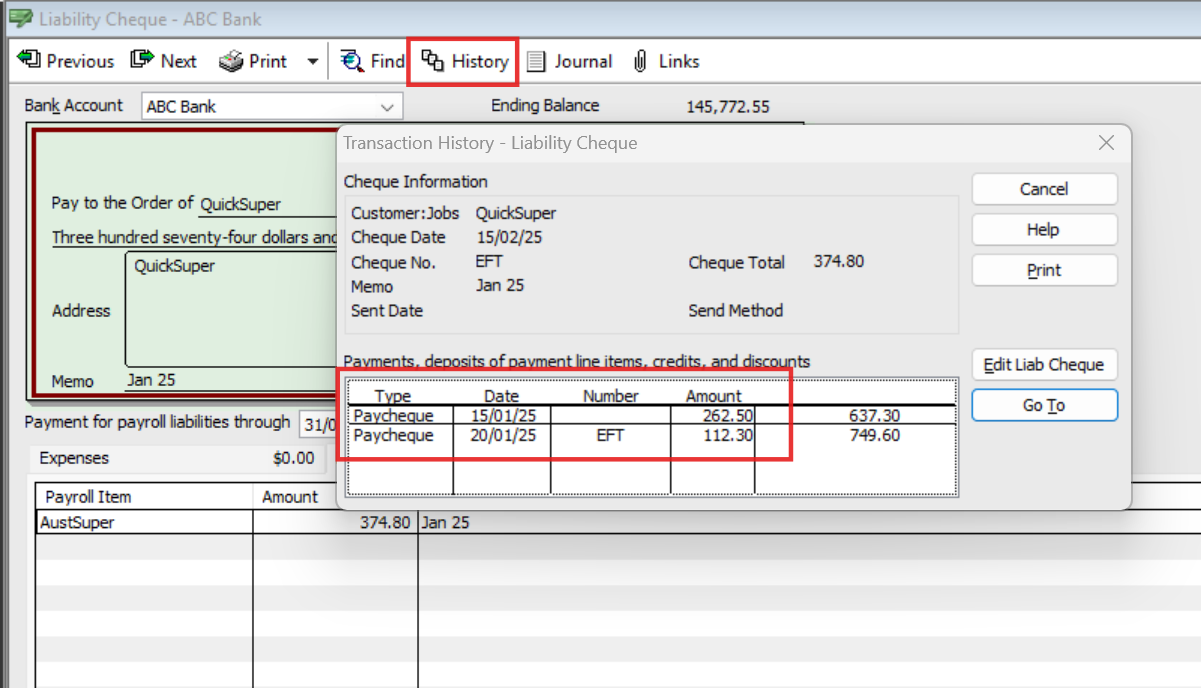

(If you use separate Super Fund Payroll Items) you can see the drilldown from the History button on a Super Liability payment:

However, because PAYG Tax is a default for all employees, the PAYG doesn't have this option.

The system accumulates liabilities (as per the PAYG Tax liability balance drilldown screenshot previously) & you pay against a selected "period", rather than per employee 😬

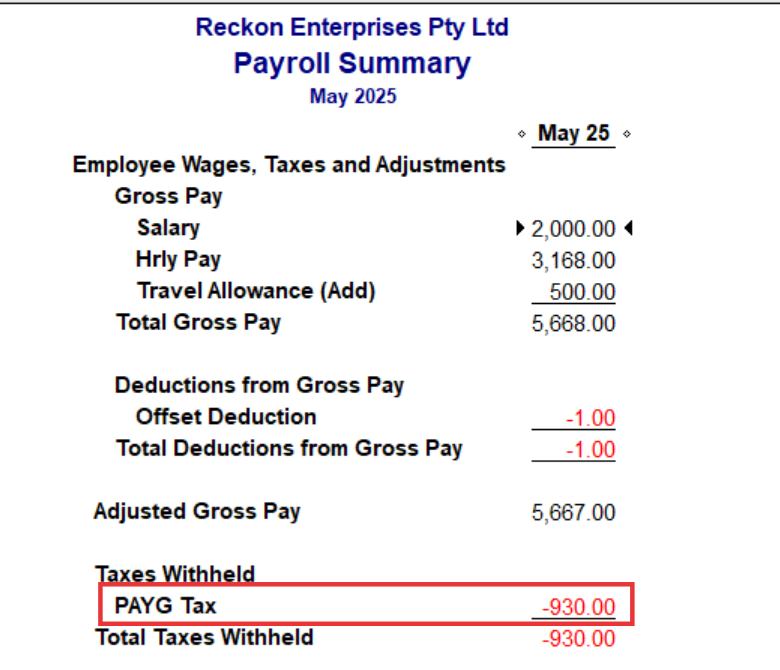

Run your Payroll Summary & modify it to just the relevant Month to see what the PAYG Tax is showing now:

Compare this with the amount you paid - It may be that a Paycheque was originally dated the 1st (or last) day of the month but upon reconciling the bank account, the cleared date was vice versa so the Paycheque Date was edited to match.

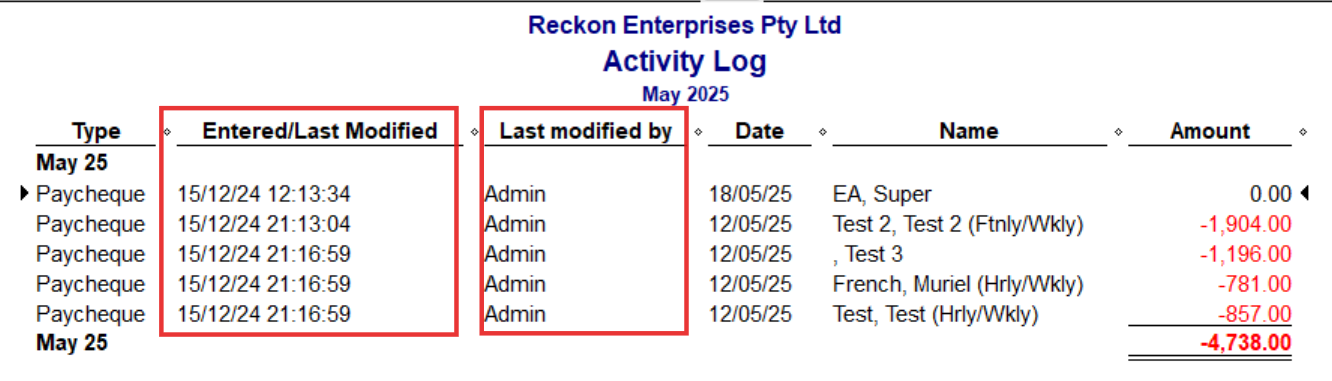

If you run a Find report for the relevant month, filter for Transaction Type > Paycheque & add the Entered/Last Modified column, set to the timeframe since, you may be able to see which Paycheque(s) were edited (You can also add the Last modified by column if you have multiple users):

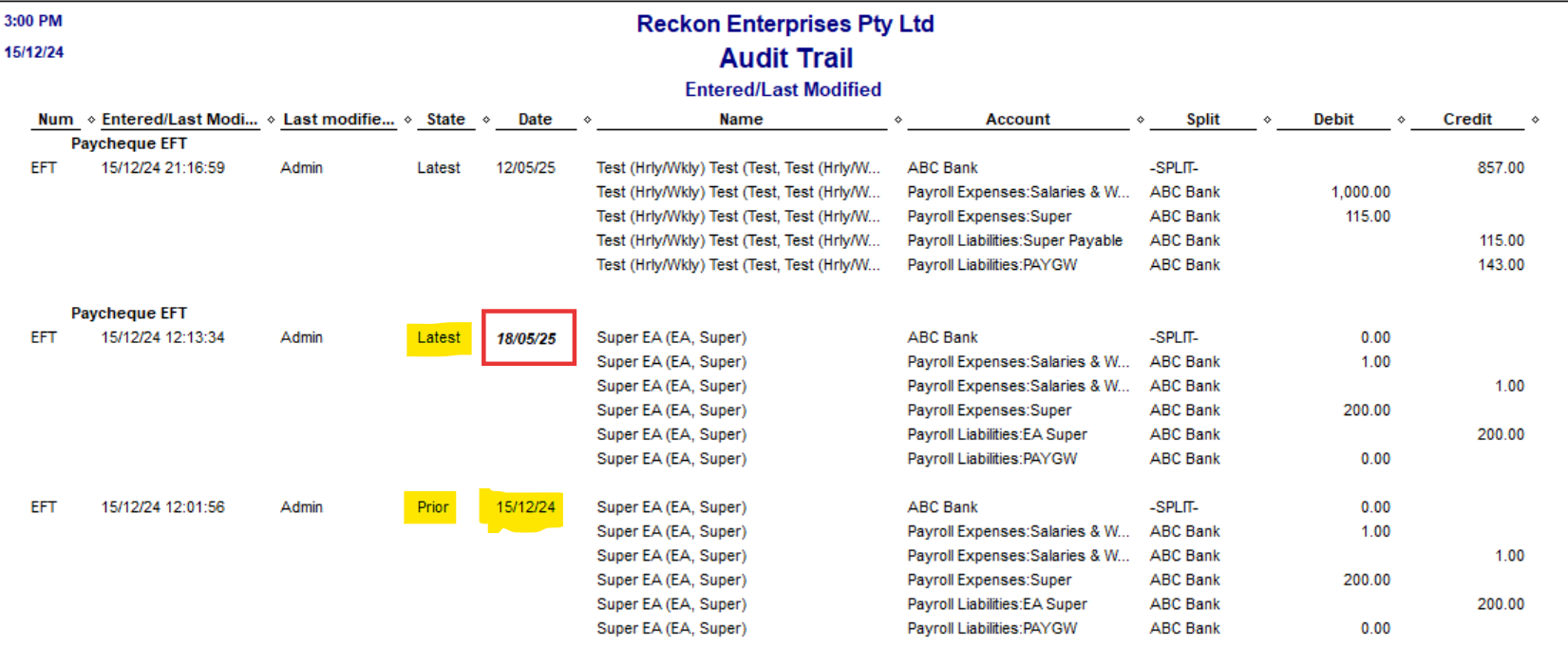

Alternatively, you can filter the Audit Trail (however that one's a bit more complicated to analyse !) This will show in bold text, specifically what was edited/deleted … & when:

1