Employee resignation notice period

Will_10588422

Member Posts: 15 Reckoner

Does anyone know how to setup a payroll deduction from final pay for an employee that did not work the notice period? There is insufficient sick and annual leave to cover the notice period.

0

Best Answer

-

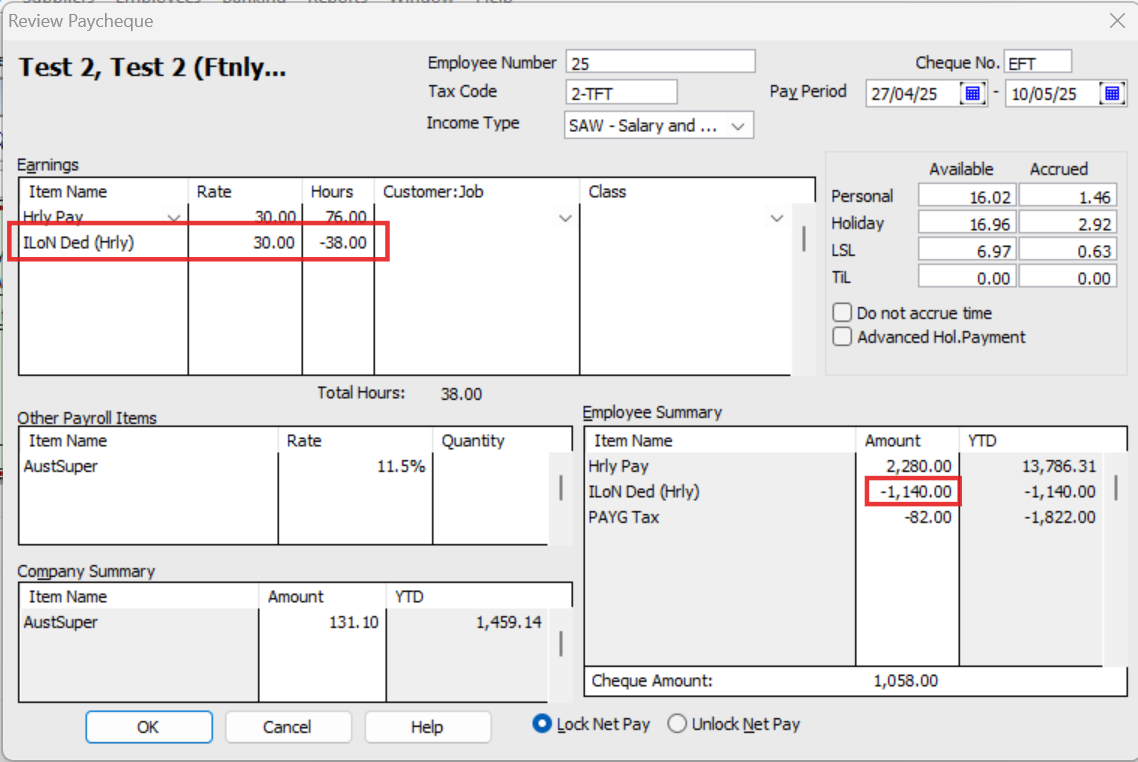

There are a couple of ways to do this - You can either use a net Deduction or a (negative Gross) Hourly Payroll Item.

Both should have the same overall result however, if your pay period is different to the notice period being deducted, the net deduction option is unable to automate that combination. Therefore, that option will require manual entry of the (net pay deduction) amount as well as editing of both the PAYG & Super auto-calcs.

By comparison, the negative gross option is automated & should calculate accordingly:

1