Good afternoon all,

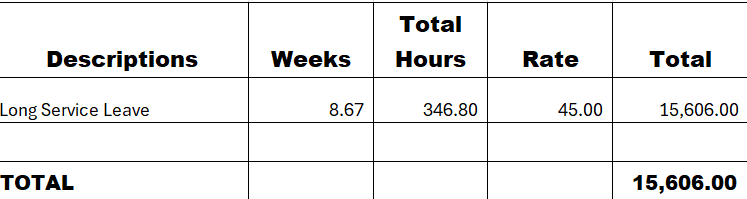

I would like to request for your assistance in paying out the Long service leave to an employee resigned. I got the following, and the employee has not availed any LSL during his time with the company. I have calculated the LSL using the WA LSL calculated and go the amount as follows:

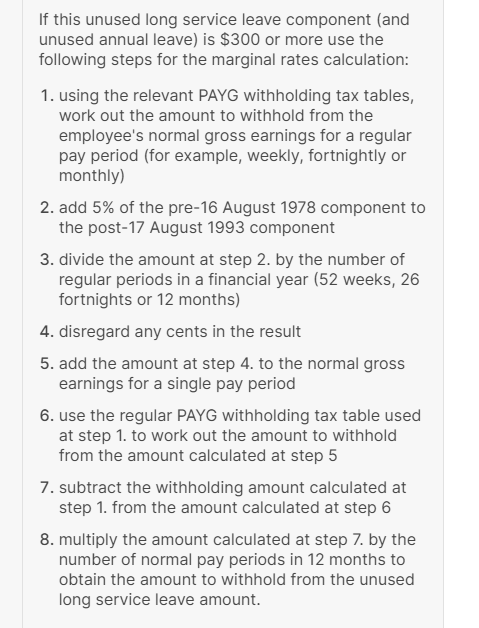

I was following the below calculation steps from ATO website but I am not getting the amount

I don't know if I am doing right. Please help me with this. Thank you very much for your support.