GST reconciliation

When my consultant set me up I've used the spreadsheet to reconcile the GST from the reports in Reckon Hosted.

It rarely balances, so it drives me mad. Entering the amounts from the B/Sheet into excel recon, i.e., GST control, Debtors, Creditors & GST 101, last month the difference between this was only $12 (great)!

After entering Sept figures the difference is $182.

I don't know what would cause this. All transactions are set to S (std) on the reports.

Best Answer

-

You shouldn't be needing to reconcile against a manual spreadsheet as the detail is already entered in Hosted 🤔

Be mindful of the report basis selected in Hosted - Is it Cash or Accrual ?

- Cash = PAYMENTS made/received whereas

- Accrual = INVOICES/BILLS (regardless of payment status!)

NOTE: If on a cash basis, the Tax Detail reports in Hosted will have some discrepancies for part payments with mixed tax code transactions (This is because it tries to apportion the payments for 10% GST, line-by-line) Therefore, I review these but rely on the Tax Summary report(s) as those are unaffected by this issue. Also, always check the Tax Code Exception Report to ensure you've not missed any tax code allocations!

0

Answers

-

Totally agree with Shaz that there shouldn't be a need to reconcile against a spreadsheet. My experience has been, provided the data is entered correctly, that the Reckon reports reconcile within cents (and this is only because data is entered in cents but the BAS uses whole dollars)

As well as Shaz's a couple of other suggestions which might help:

- Once I have completed my BAS, I always set the closing date at the end of the quarter. (Doing this means that you can still post entries dated the previous quarter but you are forced to actively think about the wisdom of doing this and you can make explicit notes for your next BAS.)

- In my preferences I have set my "edit tax amounts" to NO. This means for transactions where GST is not equal to 1/11 of the total amount (eg, some insurance premiums) I have to enter the transaction via two lines. One line with GST and the other without any GST

3 -

Thanks Shaz, I didnt know about the Tax code exception report.

I picked up a couple of errors there when entering in a billable expense through to invoice it has not come through with the 'S' for tax and no tax was added to those items…bit of a can of worms.

As I've also now corrected an 'item' code that was wrong but dont know who for.

1 -

Since the beginning of GST I have customised a detailed Profit & Loss to show the tax code, memorised it as Tax Code Check, and study it each quarter or whenever required. It doesn’t include balance sheet items but they are easily checked. Another report for Cost of goods if tracking inventory, but that isn’t something I have to deal with so not so familiar. But I will say the tax code cheque report is my bible, it also helps to make sure the correct categories have been selected

1 -

@Bruce Personally, I always have mine enabled for editing GST (but ONLY for rounding/matching purposes eg when it’s just a cent or 2)

When entering transactions with mixed tax codes, these should always be via split lines. This is because of the way the system calculates & displays GST in detail reports.

@Chris_7677427 Like Kris, I create & memorise my own set of BAS reports but I modify the tax ones for this purpose, including removing cents.

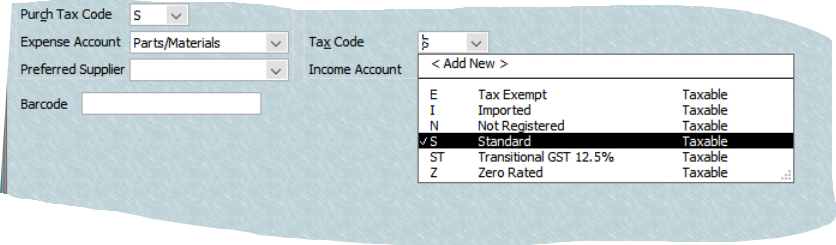

“-S” is not a standard tax code. Have you created a custom one ? The system will add this - &/or “-P” (hyphenated) on the tax report, to indicate a sales tax code has been incorrectly used on a purchase/expense entry or vice versa, so I’m wondering if that is also occurring ?

Are you able to post a screenshot example(s) of your reports ? (You can block out any sensitive/identifying data)

0 -

S is our standard tax rate - 15%.

I find using the spreadsheet a way of me knowing something is not right. However hopefully like you said Shaz it could be something to do with outstanding amounts.

Thanks everyone for your assistance, it has given me more info re reports to check out :)

2 -

Aha @Chris_7677427 !

Looks like yours is NZ (rather than AU) hence the different tax codes then 😊

0