Will STP update events correct the EMPLOYER total pay figures (w1) with the ATO?

As we are considered by the ATO to be a large employer, the normal labels on the BAS for wages and withholding don't exist for us anymore.

As such the first two months pays sent to the ATO before the update late August to resolve the issue affecting the BAS W1 prefill are unable to be corrected on our BAS. Hence, we have two months of Gross Payments reported to the ATO via STP2 overstated.

We have been in touch with the ATO as there is nowhere on our portal to adjust these figures and I can see that the amounts reported agree with what was reported via STP2 which is incorrect for those 2 months and subsequent pay runs have not corrected this in anyway. There is no issue with the Employee data submitted.

The ATO have suggested the following to our accountant.

In relation to correcting the STP amounts, they have advised that as a large employer, there are two potential ways to correct.

1. If your software system allows it, the preference is that you amend the pay run in question and resubmit. However not all pay systems allow for this.

2. Alternatively, if you amend your next pay run to correct and submit, they are happy with this approach as well.

Option 2 obviously cannot be done as we cannot "amend" a pay run to reduce the Gross reported as this would also affect Employee information reported which has no issues.

My question is if I do update events for the affected pay runs from July and August (option 1) will this resolve the Gross reported on the Employer data side of things or will be making it worse increasing the Gross reported.

I was sure I read somewhere on this portal that while an update event corrects Employee data when required and YTD figures it actually creates an additional transaction of the Employer data to the ATO.

I do not want to increase the discrepancy reported of the Employer data (w1) to the ATO. Are there any other large employers here that have resolved this situation.

Best Answer

-

No, an update event won't make any changes to employer data. An update event-type submission doesn't contain any employer component within that submission type.

When you send an Update Event ie. to reflect changes to employee balances it adjusts employee data only. This is why it only shows that an entry has been received in the ATO Business Portal but doesn't show the detail ie. balances/figures.

To explain this a bit further, since the start of Single Touch Payroll (STP) in 2018, we have been sending Employer Data as well as Employee Data via STP submissions.

- Employer Data includes a total gross and total PAYG for the pay run itself and is not a YTD balance. This is the data that the ATO have started using to prefill the W1 and W2 fields in the BAS.

- Employee Data includes the Year to Date (YTD) breakdown of the employee’s pays which is used for completing their Income Statement.

Just something to note, employer data (total gross & PAYG) is not reported as YTD like employee data is, but instead is a total of that specific pay run itself which means it will impact prefill balances in the event that you send through the same submission multiple times, miss a submission, submission results in an error etc etc

If you find that your prefill balances for BAS are incorrect or not what you expect them to be, edit the W1 & W2 fields and correct as required.

1

Answers

-

Hi Janine

The ATO’s W1/W2 prefill feature is still relatively new & is often incorrect (even for small employers) Therefore, the recommendation has always been to edit these amounts if necessary anyway.

I’m a bit confused in that you’re saying the employee data submitted is correct but you still want to amend it 🤔

Check the current YTD totals for each employee. Are these balances correct or not ?

1 -

Thanks Rav

It is as I suspected - no way to update the EMPLOYER data via resubmitting via STP - it will in fact make it worse.

I have no idea why the ATO no longer give us an option to report W1 W2 on our BAS or anywhere else on our portal - if they did problem would be solved easily by updating the prefill amounts - I will reach out to ATO again via our accountant.

0 -

From what I understand, the W1 & W2 fields in the ATO Portal are editable and can be manually corrected if they're showing incorrect prefill balances.

3 -

Yes@Rav they definitely are editable, at least from what I’ve seen and done

2 -

Thanks

I will get my manager and accountant to double check the fields - they may not have realised they are editable in the ATO portal

appreciated

1 -

Hi @Rav and @Kris_Williams

What fields are you saying are editable in the ATO portal - is there somewhere besides the BAS prefilled options for W1 and W2 - because we no longer have these options on our BAS - these fields no longer exist for us.

We are submitting a further enquiry to the ATO but thought I'd check if you were only referring to editing in the BAS fields or if you knew of somewhere else in the portal.

thankyou

0 -

Normally, W1 & W2 are prefilled via STP now but should be reviewed & edited if incorrect (as they often are at the moment)

As a large withholder, you won't have the option to edit these labels. Large Withholders used to only report W1 but it sounds like the ATO have since updated this & are prefilling both (W1 AND W2) labels now, is that correct ?

0 -

Hi Shaz @Acctd4

Yes, what you said is all correct. We are now a large withholder and no option to edit these labels.

These labels are not even on our BAS anymore, but we have found a report (STP Reporting) on the ATO portal that shows the amounts reported so I can at least do a reconciliation. Just can't find anywhere to update the figures.

I am flying blind really with the ATO portal as I don't have access to search and look myself - it's all done by my manager or our external accountant.

0 -

Unfortunately, what it shows in the ATO portal’s “STP” section is significantly under-developed & is really just representative of a submission being lodged, but not the correct breakdown.

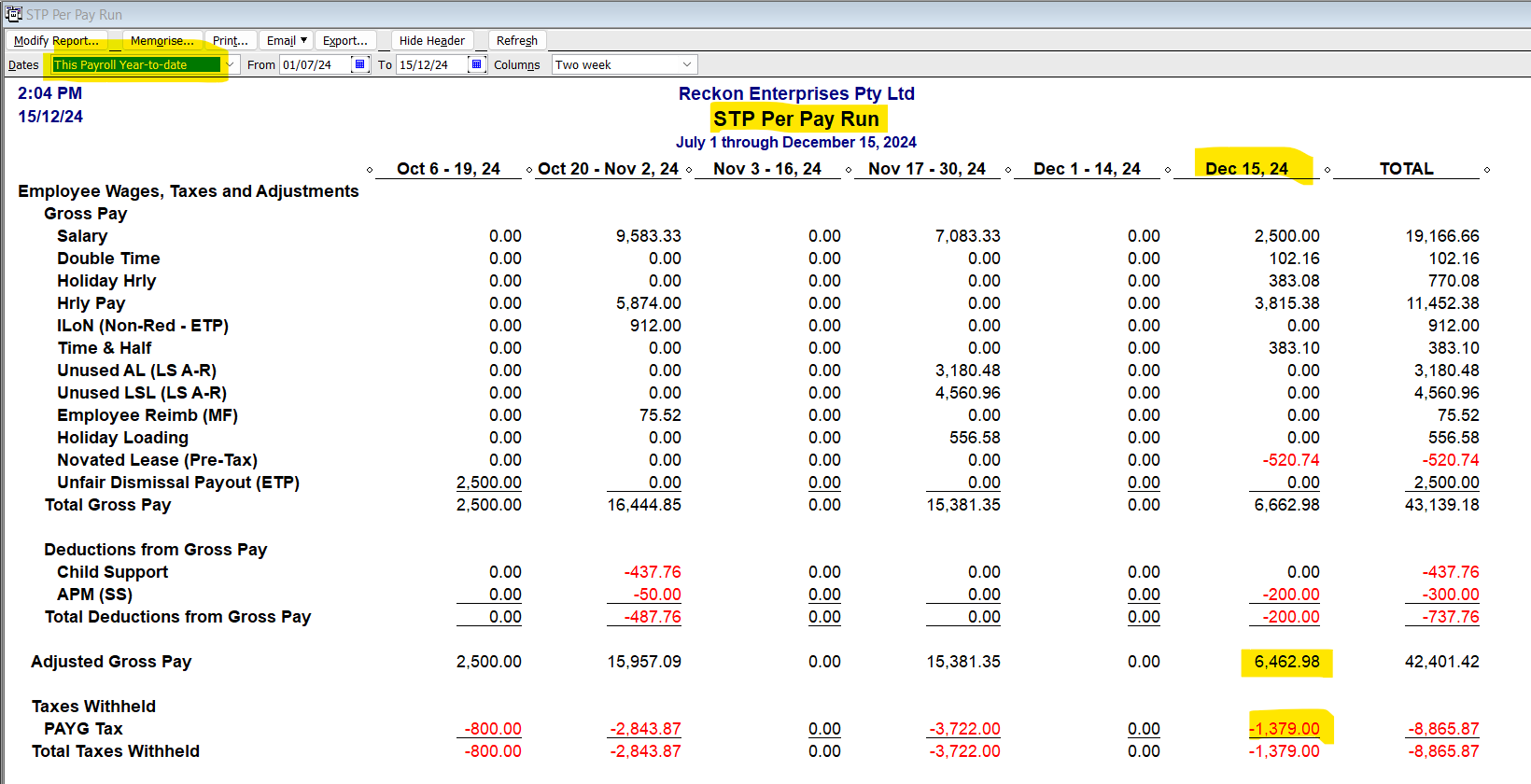

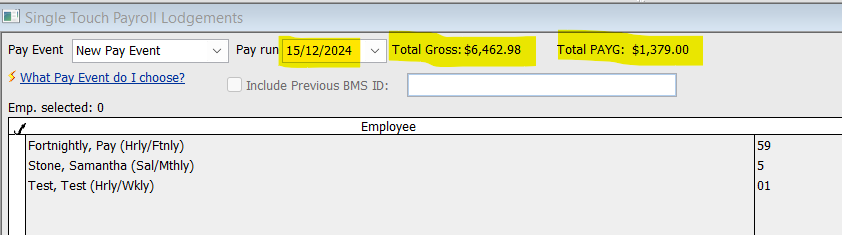

I never lodge a submission in Reckon's STP portal without cross-checking the figures first, using a modified version of the Payroll Summary. I create one to Display Columns by the pay runs (eg Week, Two weeks etc) :

v

... & one for the EOFY finalisation (to display by employee) (Note the above screenshots are from the sample file which is pre-the latest version released, which now references "Adjusted Gross (W1)" instead of "Total Gross")

I Memorise these reports - with the pay run one added to my Icon Bar for 1-click access - & run them accordingly, pre-submissions.

Open your most recent submission in your Reckon STP portal & click on the submission's Detail link to display each employee's YTD totals, then compare these with the modified EOFY ("finalisation") Payroll Summary.

This is the best way to check as what you have submitted here is what flows through to both the ATO & the employee's myGov 😊

0 -

Hi Shaz

Thank you for the advice - we always check prior to submitting to STP as you have indicated.

Unfortunately, it is the issues Reckon had prior to the end of August update that has caused our discrepancies with the ATO and we have been unable to find a way to correct these errors where Gross was reported rather than adjusted Gross now that we have no ability to update the prefilled figures on our BAS.

0 -

Hi Janine

Each submission just updates YTD though so it should be reporting correctly now, since the update ?

0 -

Hi Shaz

Each subsequent submission updates the employee data but NOT the employer data that is reported (normally) at W1 - please see Rav answer above.

thanks for your efforts however.

0 -

Yes, that’s right but it’s the employee data that flows through to the employee’s myGov for STP, not W1, so if W1 is incorrect - & as the ATO has made it un-editable - I wouldn’t worry about it.

As I said before, W1 is often incorrect anyway & there are a lot of people not even checking & just pressing “Submit”for this as is 😩

When you finalise & reconcile your payroll at EOFY, the annual totals for STP should still be correct & the tax return/financials will reflect this ☺️

1