STP File Upload Error

Hi all,

I processed our holiday pay for pay date 31/12/2024 and did the STP upload successfully.

With everyone's pay processed, I processed one employee's final pay for its unused annual leave because he is finishing up before Christmas. The pay date for his final pay is also 31/12/2024. What I didn't realise before hand was that Reckon would pick up his regular pay and his final pay on the same pay run event when exporting STP file. I thought never mind. I would just do an update event for 31/12/2024 and uploaded the new STP file.

An hour after the submission, I logged back in to find "error" for its status. The details as per below screenshot. Has anyone experienced this before? How do I resolve this?

Best Answers

-

From what I understand that error response will appear on an update event that is sent with a future date. A regular/normal pay run submission is able to be sent with a future date, however an update event cannot.

I believe an update event can only be dated with a current, or historic date. If you need to send through that update event submission again, date it with today's date and it should be processed successfully.

1 -

There's no need to separate the holiday v final payout pays into 2 submissions. As long as your Payroll Items are correctly mapped, everything will still report accordingly, whether it's in a single or combined lodgment 😊

1

Answers

-

@Rav @Acctd4

Thank you both so much for your tips. The problem is resolved. 😀

0 -

-

Hi all,

Thank you for the help earlier. More questions now that I am preparing for Dec quarter BAS.

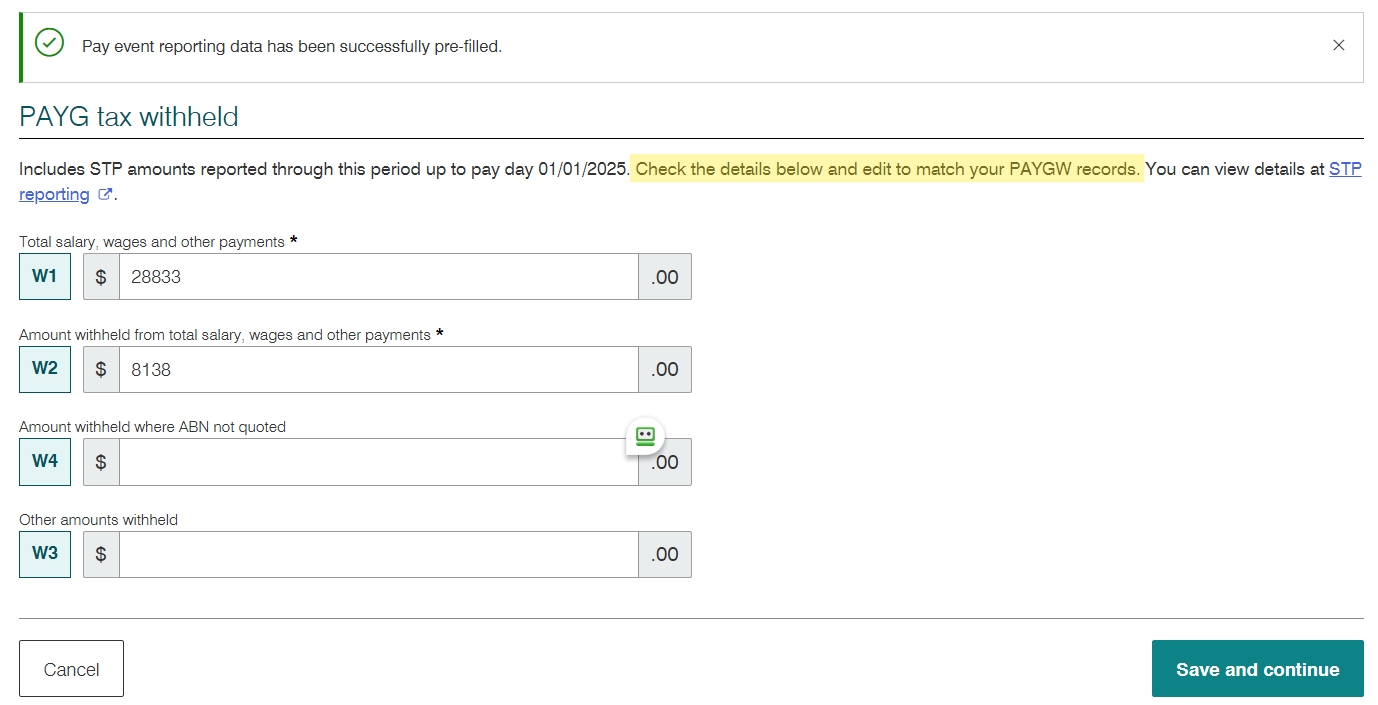

With the above update event being successful, now when I log in at ATO's portal, the PAYG tax withheld (STP pre-fill) figure doesn't agree with the PAYG Tax amount on my Reckon Payroll Totals for December. The difference was that staff's final payout. Does this mean that the above discussed update event was not successful after all? What shall I do?

0 -

if you are certain your figures are correct override the prefill figures when you lodge the BAS

2 -

@SarahFinance Unlike Reckon's STP submissions, the ATO's prefill feature is NOT in real time & also doesn't backdate so - as Kris advised - you should manually override the prefill amounts if they are not correct hence why the ATO actually includes a note advising this at W1/W2:

Also, do NOT follow the suggestion there to " view details at STP reporting" ! That section in the ATO portal has never been developed any further since it was initially introduced & is pretty useless as it can basically only confirm a submission has been made. It doesn't reflect any updates/file replacements/corrections or even breakdowns, so I never look at that.

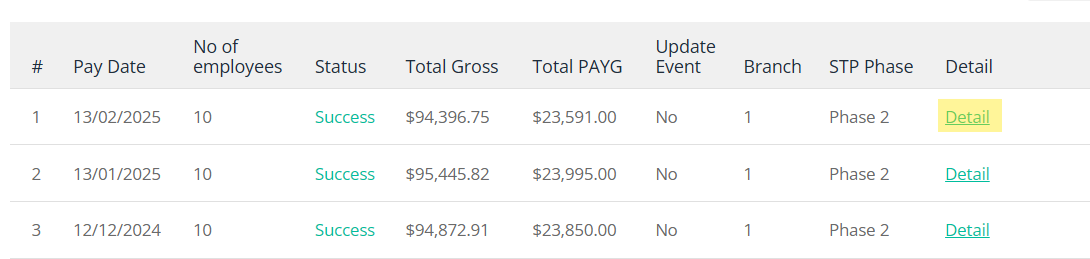

The most reliable & current information is via the most recent Successful-status submission in your Reckon portal. Under the Detail link at the end of the submission line,:

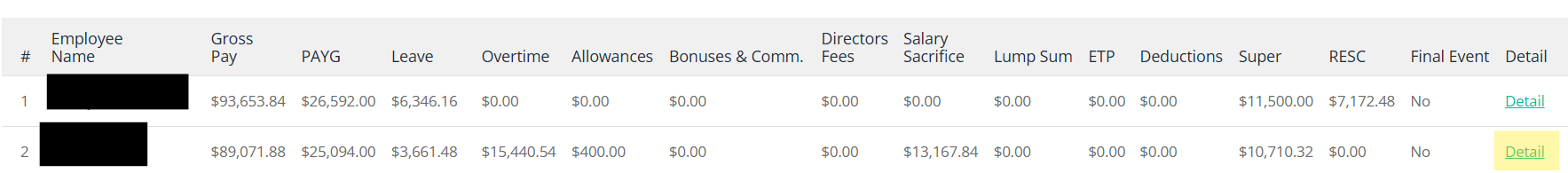

you will be able to see each employee's YTD breakdown:

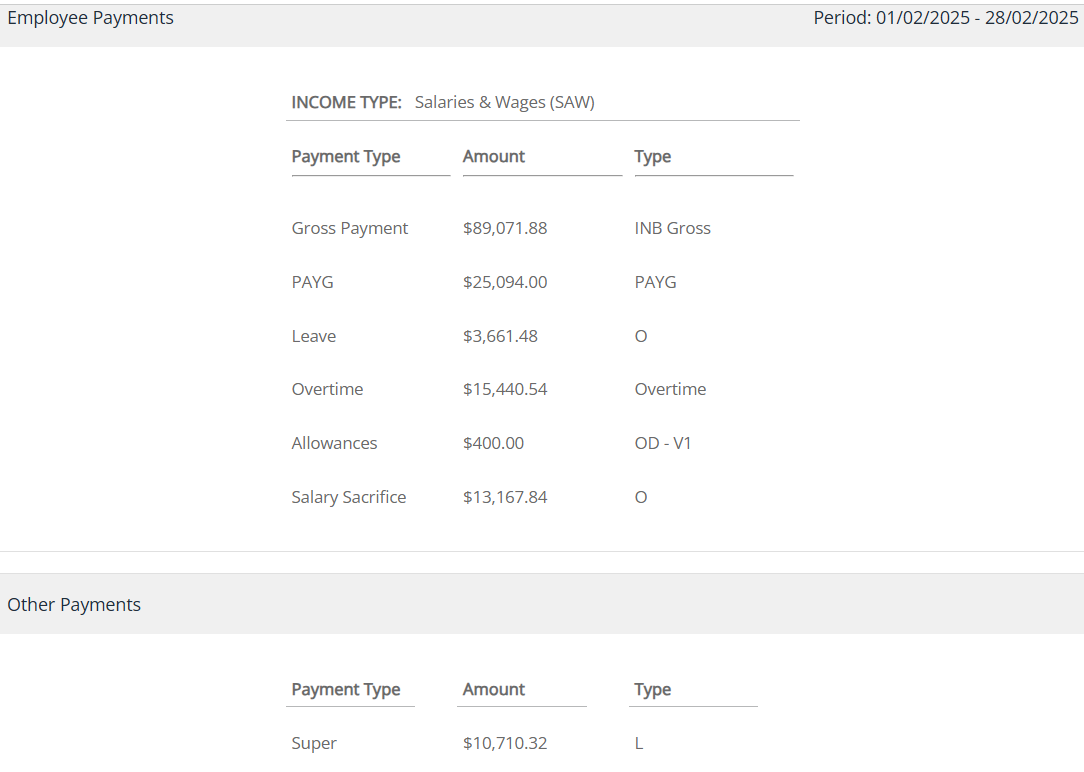

If you click on an individual employee's Detail link (as highlighted above), you can see what they see (eg how it reports) in their myGov :

2 -

@Acctd4 Thank you very much for your detailed explanation. I figured out I could overide the prefills. It was after following the link "view details at STP reporting" that worried me. Now knowing that the prefills are not real time and that the ATO's STP reporting doesn't reflect updates or corrections has restored the peace of mind that the update event was indeed successful.

@ Kris_Williams Thank you. The report to the employee's myGov is correct. Will override the prefills.

Appreciate this Reckon community support very much!

2 -

Glad you’re all sorted now

1 -