Payruns already submitted to ATO need to be processed under a new ABN

I have some few questions though I believe might be a straightforward procedure but would like to double check as I have not done this in the past years.

I have pay runs for the December quarter already submitted to ATO under a partnership ABN.

The partnership ended and this December quarter pay runs need to be entered into the Reckon Payroll under the new ABN (sole trader). I got few questions that relate to this situation please if you could help.

- How do I convert to $0.00 all those Dec quarter pay runs that I already have submitted to ATO?

- Should I make an EOFY submission to ATO after I convert all the Dec quarter pay runs to zero?

- Do I need to create a new Reckon Payroll account to start entering the December quarter pay runs under the new ABN (sole trader)?

- What would happen then to the Reckon Payroll account with the ABN on partnership?

Thank you and hope to hear from your experiences or your intelligent thoughts on this.

Snowee

Comments

-

Hi @snowee

Here's a general outline of what I'd recommend.

1️⃣ How do I convert to $0.00 all those Dec quarter pay runs that I already have submitted to ATO?

Do you have a pay run that you've completed and sent an STP submission for prior to this December one? If so, you could could delete that December pay run and then send an update event on the prior pay run so that employee balances are updated back to the prior pay run balances.

To send an update event on an already completed pay run, open the pay run click on

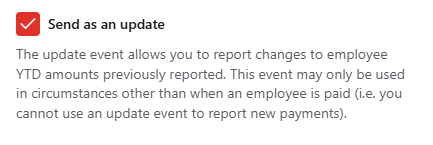

Resubmit to ATObutton, theSend as an Updateoption should already be ticked for you.Send the update event and it will update the employee YTD balances on the ATO end.

2️⃣ Should I make an EOFY submission to ATO after I convert all the Dec quarter pay runs to zero?

If there are no further pay runs to be completed this financial year for this ABN then yes, I'd strongly recommend finalising.

3️⃣ Do I need to create a new Reckon Payroll account to start entering the December quarter pay runs under the new ABN (sole trader)?

If you will be operating under a new, separate ABN then yes I would recommend creating a new Reckon Payroll book for this. You can create the book under your existing account so both of them are in one place if you'd like.

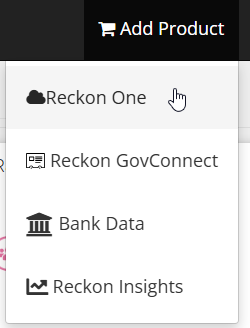

To create a new book in your existing account, click on Add Product ➡️ Reckon One ➡️ Follow the prompts to setup a new book and STP entity.

4️⃣ What would happen then to the Reckon Payroll account with the ABN on partnership?

You can deactivate the subscription for that specific book once you've finalised everything and downloaded/printed off any reports you'd like to retain if you'd like.

Let me know if you have any questions 🙂

0 -

Rav, thank you so much for your time and guidance. Very much appreciated.

Hope you don’t mind if I ask these following very specific questions to clear my apprehensions in making changes particularly numbers. Like what I said before, I haven’t done any update event in my working on STP.

The December quarter are pay runs for Oct-Nov-Dec.

- Rav, to delete all my Dec quarter pay runs, do I have to open every single pay run back as draft and change all entries to $0.00? Or is there another way of deleting pay runs?

- Should I retain the payment date and pay period on each pay run I am deleting?

- So after I edit a pay run changing the entries to $0.00 I understand I have to click on the Resubmit to ATO button. Am I right?

- And this is the process I have to do on every pay run for Oct, Nov and Dec?

Re sending an update event

I’m sorry but I am a bit confused on this part.

Going back to your query on my No 1 question yesterday if I have a pay run that I have completed and sent an STP submission prior to the Dec one — Yes is my answer. They are the September pay runs.

Because I am deleting all pay runs in Oct, Nov and Dec from the partnership ABN so the last pay run in this entity should be September.

Referring to your statement Rav, do I have to send an update event on the “prior pay run” after I have deleted/resubmitted to ATO the $0.00 pay runs for Oct, Nov and Dec?The “prior pay run” referred to in this case would be my last pay run in September. Is it correct?

I am afraid submitting an update event on my last pay run in September might duplicate the computation of the ATO.

Please enlighten.

Thanking you kindly.

Snowee

0 -

Oh sorry, I thought you had a singular December pay run rather than multiple. Regardless though, the advice is still the same it'll just take a tad longer to action with multiple pay runs.

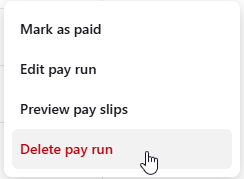

To delete a pay run, you'll need to switch it to draft then select the Delete Pay Run option.

I'm not quite sure I'm following your 2nd and 3rd questions as once the pay runs from the relevant time period are deleted, they are removed ie. so you won't change any balances to $0.00 since they're deleted.

Referring to your statement Rav, do I have to send an update event on the “prior pay run” after I have deleted/resubmitted to ATO the $0.00 pay runs for Oct, Nov and Dec?

The “prior pay run” referred to in this case would be my last pay run in September. Is it correct?

I am afraid submitting an update event on my last pay run in September might duplicate the computation of the ATO.

Yes that is correct. I'm referring to the last 'legitimate' pay run created for this ABN prior to those December quarter pay runs.

STP is reported on a YTD basis only when it comes to employee information so there aren't going to be any duplications when it comes to employee balances. Moreover, once you send the EOFY finalisation, that in itself will also overwrite any and all balances that have come before it.

0 -

Hi Rav

Thank you very much for your enlightening response. Very much appreciated. I can start moving forward following your very informative advice.

snowee

1 -

Hi and thank you again Rav as I have successfully deleted my Oct Nov and Dec pay runs.

I am at the stage of wanting to create a new Reckon Payroll book for my new ABN as sole trader in my existing software/Plan.

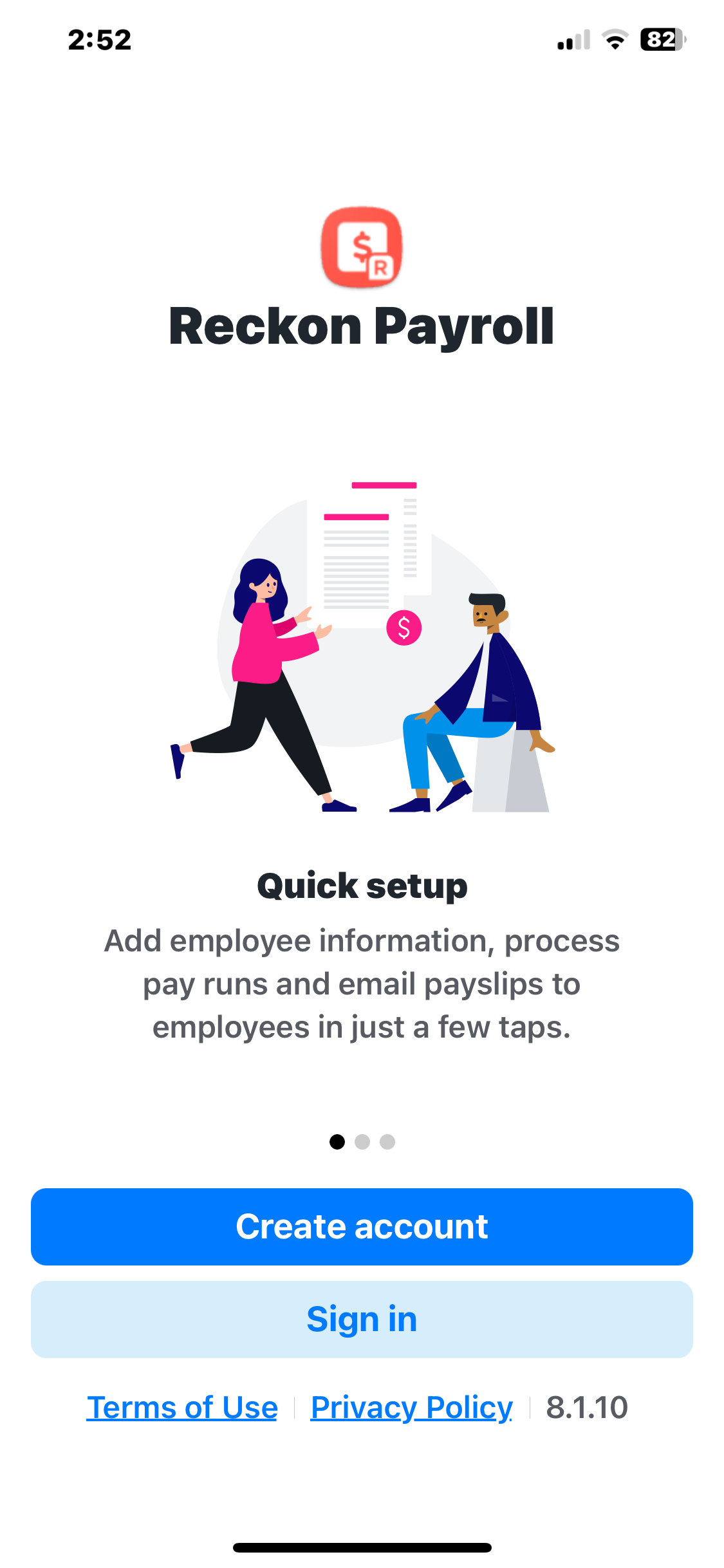

Following your procedure to create a new book I couldn’t find where I have to click on Add Product. Would it be because I am using only my phone to do my pay runs?

When I click on the Reckon Payroll icon on my phone I could see highlighted Create account and below it I see the Sign in prompt.Does it mean I only have these 2 choices? Do I need to subscribe to another plan? I really wanted to start entering my Dec quarter pay runs under my new ABN the soonest I can.

Please …. and thank you.

Snowee

0 -

Rav, I have attached the photo of what comes up when I click on the icon Reckon Payroll.

Thanks again

0 -

Hi @snowee

You're correct, the mobile app is a little limited in the options it will present you. Instead, head over to https://portal.reckon.com/ on a PC and login with your existing Reckon Payroll App sign-in credentials.

Once you've logged in you'll see the option to Add Product that I pictured above. Select Reckon One and then follow the prompts to setup a new book and subscription. You'll need to add in the new ABN details along with setting up the employees again and registering the new Software ID for this new ABN with the ATO.

If you have any questions let me know.

0 -

Thank you Rav. I will do it. I truly appreciate your reply.

snowee

0 -

Hi Rav,

Yes … I found the option where to Add product. Thanks for that. I did not click on it yet. I got curious to see how my reckon payroll looks like in PC as I am always just on my mobile app.

The STP submissions page on the screen actually surprised me because I see all the pay runs in Oct, Nov and Dec I deleted last night/early this morning through the pay runs screen.Rav, is there anything I need to do with that STP submissions page?

Will those Oct-Nov-Dec pay runs that I still see on the STP submissions page affect my EOFY reporting to ATO?

I am so sorry Rav that I have to ask so many questions. I am really happy I am learning a lot from your responses. I’m getting there slowly but surely. Appreciate your kind help.

Snowee

0 -

No worries at all @snowee you're more than welcome to ask as many questions as you need, that's what the Community is here for 🙂

To answer your question, no there's nothing you need to do with the previous STP submissions. Any submissions that you've already sent are retained and we're required to keep as mandated by the ATO. They won't impact your EOFY reporting as when you send through a new EOFY finalisation for the former ABN, it'll overwrite any and all balances that you've sent previously from those submissions that you see on-screen right now.

0 -

I thank you so very much Rav for your time answering my questions and clarifying my doubts.

You have helped me a lot to move forward on this STP Reckon thing.

May I reiterate my sincerest thanks.

Kind regards,

snowee

1 -

Hi Rav,

Hope you are well. I am stuck in completing Superannuation details in my 2nd Reckon book for my 1st employee as shown on the screen shot. I choose 1, 2, all 3 but still getting the same message. I can't move on to my work. Please enlighten. Thank you Rav

0