Replacement for ATO's Small Business Super Clearing House?

Hi all, I'm using ATO's SBSCH to process super contributions. It will be decommissioned on July 1st next year, so I started looking for alternatives.

I've noticed the Beam integration in R1, but while signing up I didn't like some of the T&Cs that I had to accept. So I'm looking for an alternative, but the only workable option I've found seems to be . Anybody's using them as a SuperStream provider? If so, I'd love to hear feedback.

Otherwise, are there other providers out there to consider for a small biz with just a couple of employees (4)?

Thank you.

Comments

-

Beam has been working well for one of my clients, has been easy to setup and use so far.

Out of curiosity, what is it that you didn't like about their terms?

0 -

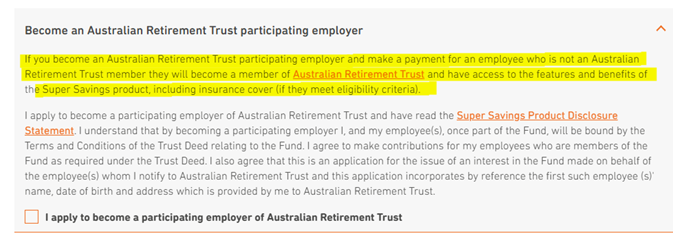

The last tickbox which wasn't optional, or at least I couldn't proceed unless I ticked it. The text starts with an "If …" which seemed to indicate this is an optional item, but if unticked I couldn't complete the application.

And I really don't want myself or any of the people I pay to somehow become members of another super fund. I wonder whether this is even legally valid.

I was wondering how Beam could offer the service for free… it became clear to me once I saw this 😁

0 -

Hi there @Mike_9755105

Thanks for raising this. Let me get in touch with the team at Beam to get some clarity around this and I'll come back to you.

0 -

Hi Rav,

I was wondering if there is any update on the above and what this actually mean when Beam for making contribution for employees who are not Australian Retirement Trust members?

Also, can you advise whether I can continue to use other clearing houses (such as ATO's SBSCH) to make super contributions while I have enabled and registered for Beam?

Thank you

0 -

Hi @erichung76 & all

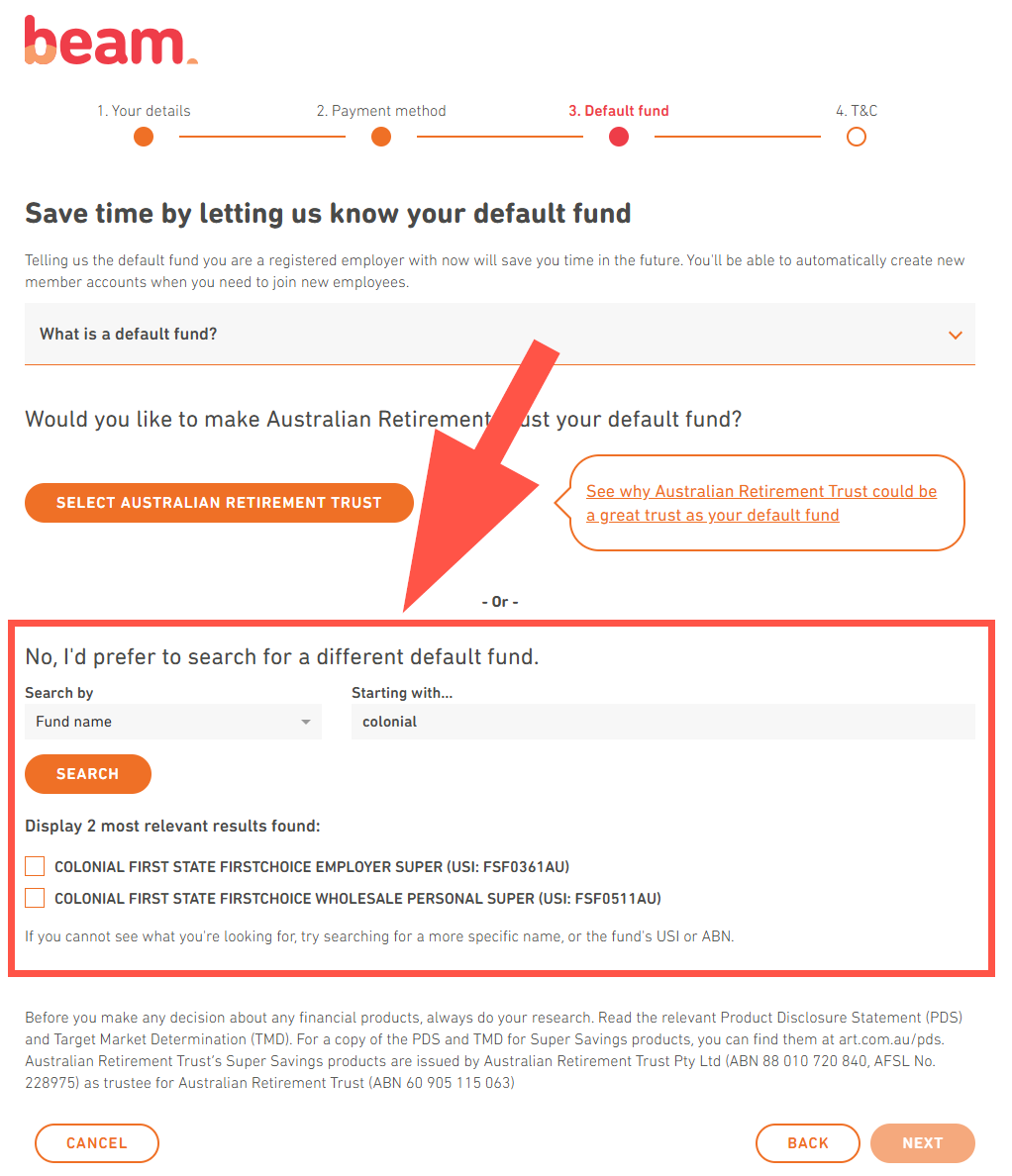

There is no requirement to make the Australian Retirement Trust the default fund during the Beam sign-up process.

Below is a screenshot of step 3 of the sign-up process where you can nominate any other super fund as the default fund. In my example below, you'll see that I can search and select another fund.

Also, can you advise whether I can continue to use other clearing houses (such as ATO's SBSCH) to make super contributions while I have enabled and registered for Beam?

Is there any specific reason you'd be looking to do the above as Beam will take care of it all end to end.

0 -

Hi Rav,

Thank you for the clarification. I have every intention to rely on BEAM as a permanent solution for super payment, but just wanted to have a fall back plan to be able to continue using the clearing house I'm currently using (ie. using ATO's SBSCH) in case there are any teething or intermitment issues with BEAM once enabled. Hence I want to know if enabling/registering with BEAM will prevent me from doing so.

Lastly, if I do agree to make Australian Retirement Trust (ART) my default fund, do I need to separately register with ART as a participating employer beforehand, or will step 3 of the sign up process help take care of the employer registration as well?

0