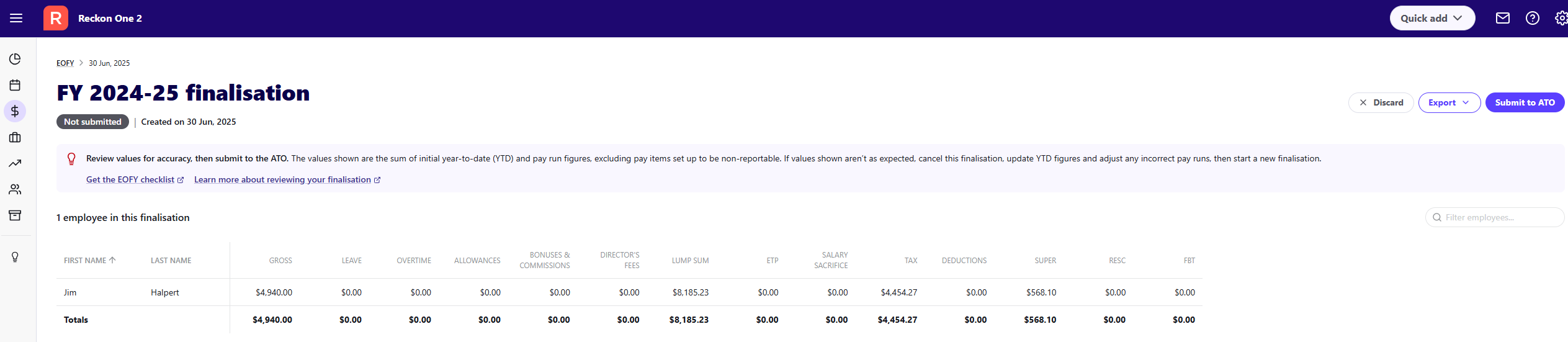

Redundancy Payments Missing from EOFY Finalisation Report

Hi there,

I’m currently reconciling our payroll year-end summary against the general ledger and the EOFY Finalisation report before submitting to the ATO.

This year, we processed a couple of redundancies, which included both redundancy payments and pay in lieu of notice. However, I’ve noticed that these components are not appearing in the Finalisation report, resulting in understated gross earnings.

Has anyone else come across this issue? If so, I’d appreciate any advice or a possible fix you could share.

Lucy

Answers

-

Hi @Lucy R

Can I get a little bit more info on the specific termination pay runs themselves.

How were the termination pays created and more specifically, what were the Lump Sum codes used in the final pay run?

Also, just to clarify, are you looking at the EOFY finalisations screen that generates in the EOFY menu?

0 -

Hello @Rav

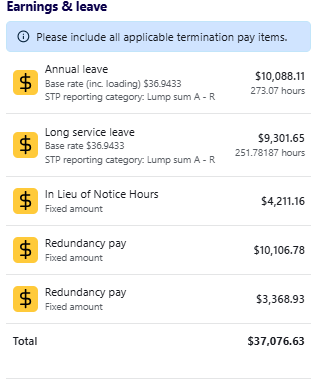

Yes, I’m using the EOFY Finalisation screen in the EOFY menu.Below is a snip from the payroll

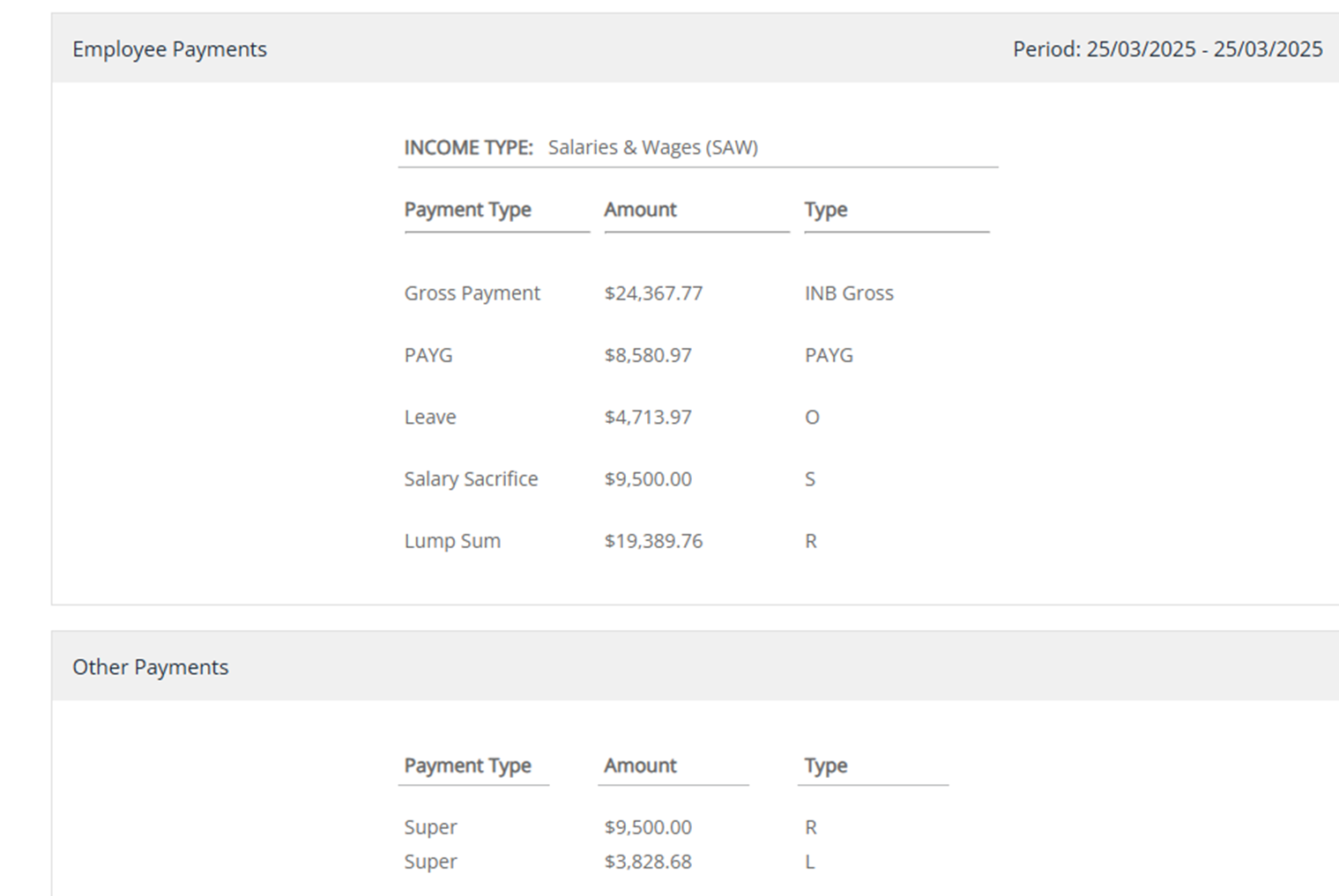

This is a snip of the STP for this pay

You can see that Lump Sum has only picked up Annual Leave and Long Service Leave.

Let me know what further info you require.

Thank you

Lucy0 -

Hi @Lucy R

I've been speaking with the Reckon One payroll team about your post today and we've had a look at a couple of things.

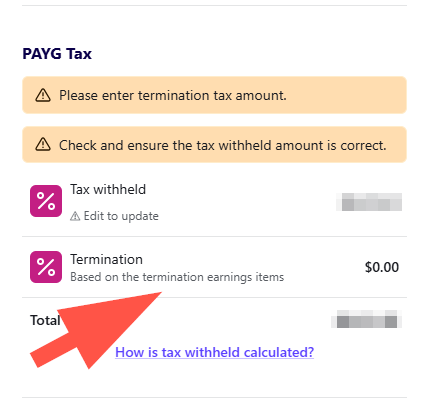

Firstly, you've done everything right but there's just one part missing which is the termination tax component and more specifically the ETP code within it. Right now, there is no code added to the termination tax component (see example below).

What you'll need to do is, switch the termination pay back to draft status and add the relevant ETP code to the termination tax item within the pay run.

We've just published a detailed article on processing an ETP which I think will be really helpful for you -

Once you've done that, re-mark the pay run as paid and then generate a new EOFY finalisation. You'll notice the balances will recalculate and any amount attributed to ETP will appear in the ETP column based on the code selected.

1 -

Great work! Glad to hear it sorted 🙂

0