STP Submission Still Pending?

Hi guys,

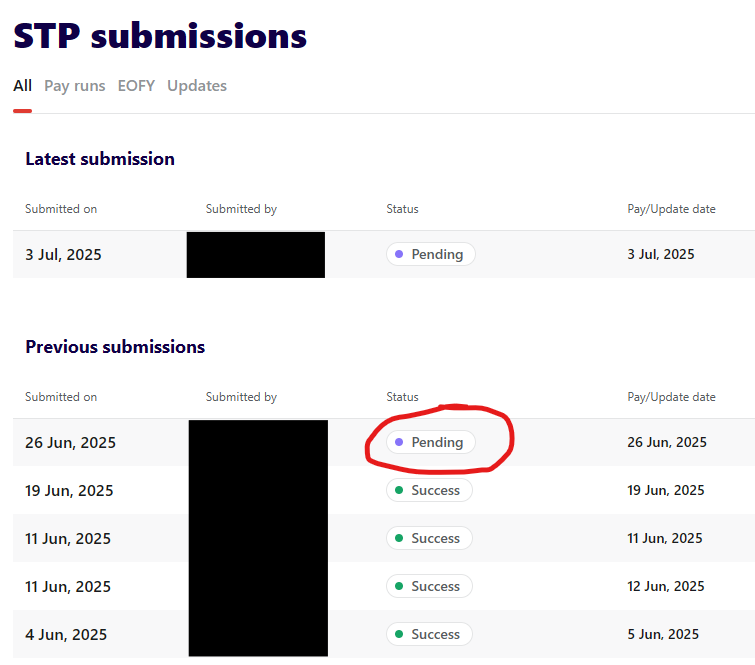

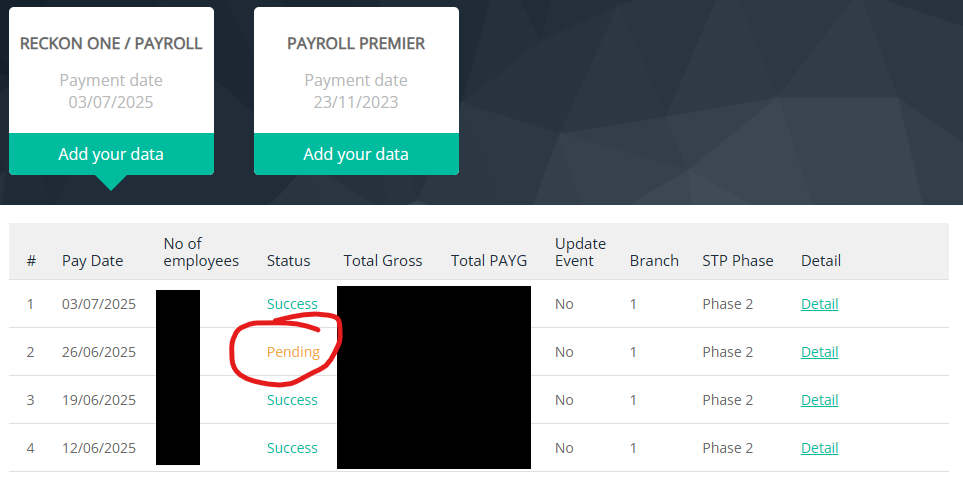

We just lodged our first pay-run for the 2025-2026 financial year and noticed that last weeks' pay-run (dated 26 June 25) is still shown as pending with the ATO.

Is there any reason for this? Is it dependant on us lodging our EOFY for 2025 which we haven't done just yet? Or should we just resubmit this payrun to the ATO?

Answers

-

Dear @Mark_9171963 ,

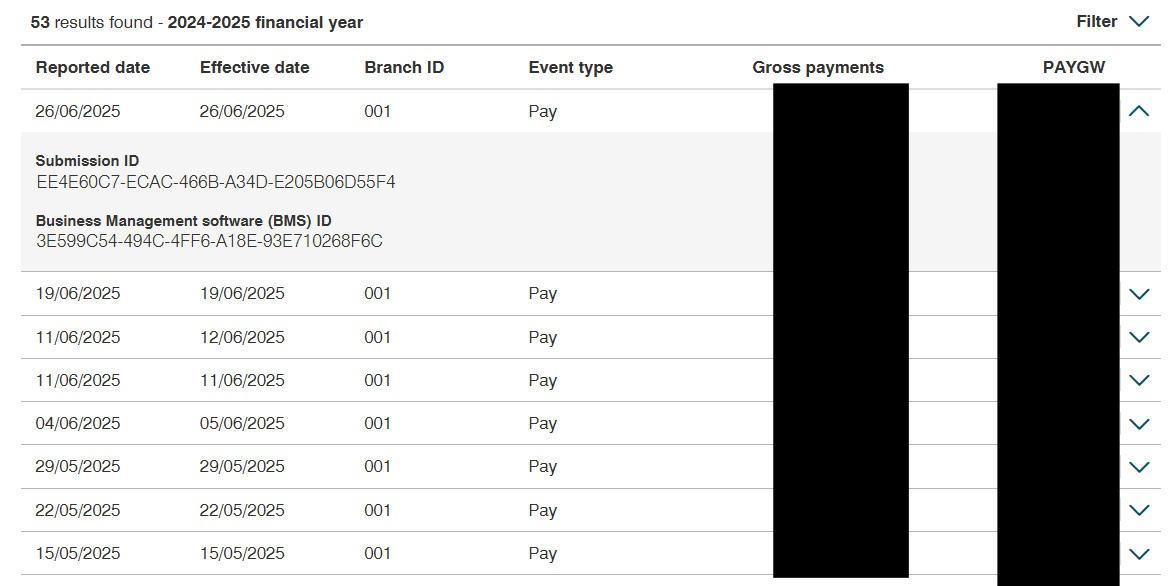

If you go into Reckon GovConnect and check the details of this submission, does it appear pending in there as well?

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

There could be a few reasons for it such as issues with the ATO's SBR2 service at the time of submission, system maintenance or backlogs which haven't been processed yet.

No, your EOFY finalisation is not dependant on that submission being processed, the finalisation will overwrite any and all balances sent before it so you can go ahead and send it if you're ready to do so.

0 -

Hi Alexis. What is the URL of Reckon GovConnect? Haven't been there in ages.

We just looked at the ATO portal and the payrun is showing as lodged.

0 -

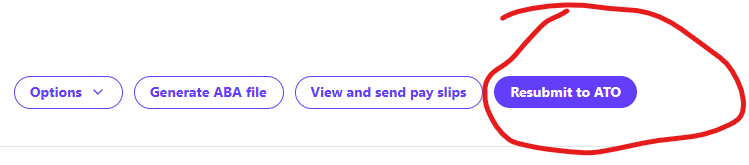

Thanks Rav. Is it worth re-submitting the payrun to the ATO prior to doing the EOFY submission?

0 -

Dear @Mark_9171963 ,

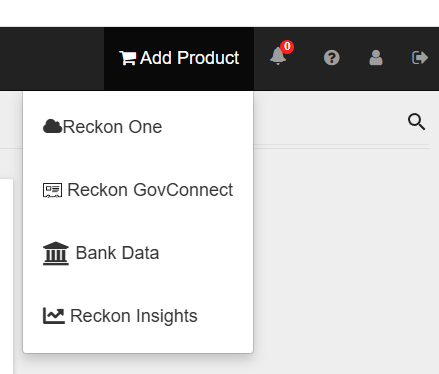

It would be on your Customer Portal ( ) under Reckon GovConnect (found on the left-hand side of the screen).

As for resubmitting payruns to the ATO, you should not need to do this - only resubmit if a payrun itself has an error, not the submission. This is to prevent STP duplication.

If your payrun is appearing as lodged with the ATO, it's a safe assumption it did not return an error, and you can safely submit your EOFY submission through.

Kind regards,

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20181 -

Thansk Alexis,

We won't re-submit then. We will just do the EOFY submission and leave it at that.

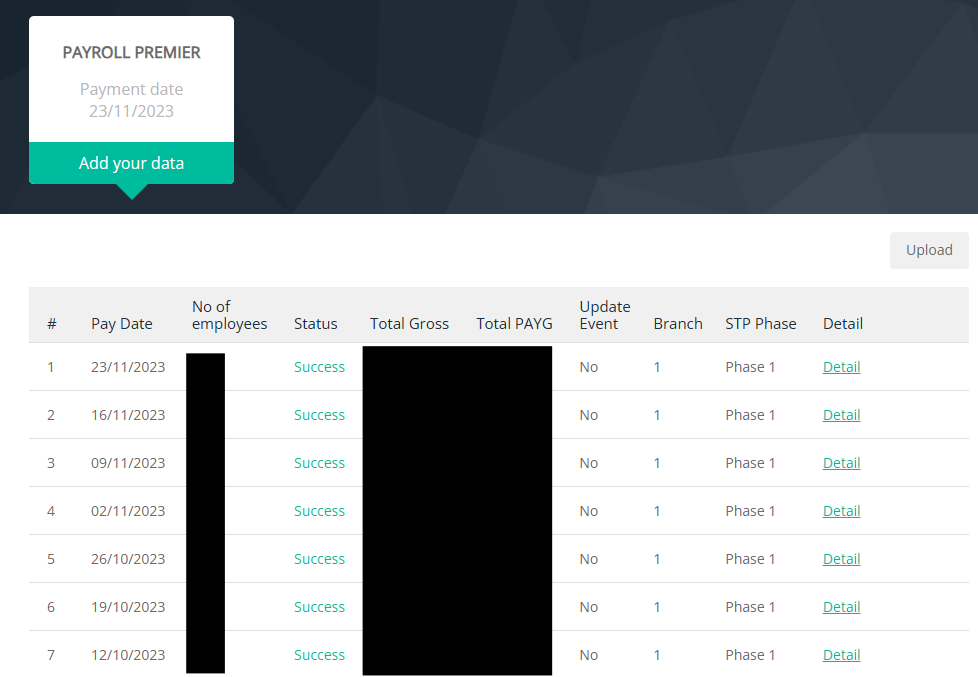

By the way, Reckon GovConnect only shows Phase 1 submissions up to 23/11/23 which was the last payrun completed with Payroll Premier prior to the migration to Phase 2 using Reckon Payroll. Refer below…

2 -

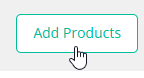

@Mark_9171963 Click on the green Add Products button in the top right corner then tick Reckon One/Payroll and click Save.

That will add the Reckon One product within your existing STP entity and it will show you a list of all the submissions you've sent since upgrading to Reckon One.

0 -

Thanks Rav. Not sure it shows ReckonOne/Payroll?

0 -

Sorry I should have been a little clearer, I was meaning the Add Products button when you're within the STP entity itself. This one in particular 👇

1 -

Roger that, thanks. Entry still shows as pending.

0 -

I wouldn't worry too much about it @Mark_9171963, provided the balances in your EOFY finalisation are correct it'll supersede that submission.

0