EOFY Superannuation amounts do not match the payslips

HELP please!

I have generated a EOFY Report for 2024/2025 and have noticed that the Superannuation amounts do not match the amounts that have been paid according to the employees' payslips. All other payroll amounts are correct, except for the Superannuation. All employees (3 in total) have been paid the guaranteed 11.5% super. The amounts differ by up to 50% less of what has actually been paid. Can I have some help as to why this would be the case please?

Answers

-

Hi @TwidaleInv

Are the super balances for these 3 employees in the over or under what you expect them to be?

Were any changes made to these employees super in their pay runs at some point throughout the financial year?

1 -

The amounts in the EOFY report are much lower than the actual amounts paid - one employee shows an amount that is only half of the amount paid. I do recall that I was prompted to update something to do with Super details at some point a few months ago as I was not able to process that particular pay until I did. I honestly don't remember what I had to do but it took hours to work it out at the time!

0 -

Thanks for that @TwidaleInv

Would it have been something to do with creating the employee's super fund, removing the default system-generated super fund and then assigning that fund to them by any chance?

Or have the employees changed their super funds at some point in the year and you had to change their super fund information for them?

If you click on Payroll Settings ➡️ Superannuation Funds ➡️ Then click on the Inactive tab, are there any inactive super funds listed here?

1 -

No employees have changed super funds, however, removing the default system-generated super fund and assigning the employee's super fund does sound familiar. Perhaps this could be the cause of the discrepancy? How do I go about rectifying this please?

There are no inactive super funds listed.

0 -

Great thanks @TwidaleInv

If its the same issue as what I think it is, then we've got the team looking into the situation where changing an employee's super fund, whether that be from the old system-generated default fund or a custom one, is impacting the display of super and salary sacrifice in the EOFY finalisation and a fix isn't too far away.

I'm not 100% sure this is going to work when it comes to the system-generated fund, but can I get you to go into one of the profile of one of the employee's and try to re-add that previous fund to them in conjunction with the one they have now.

If you're able to add it, save the profile then create a new EOFY finalisation and just confirm whether the balance now shows correctly.

0 -

Thanks for the suggestion. I am not sure how to go about this as there is no previous fund to add?? When I look at the Default super fund tab, the details are the same as the custom Super fund that I have added to the system. The fund details have not actually changed for any of the employees. How do I find out what the system-generated fund was?

0 -

Hi @TwidaleInv

I'm going to shoot through an access request to your book as I'd like to take a closer look and just make sure its the same thing that I believe it may be.

The access request will come through separately to the email address registered to the book, when you have a chance can you please grant access.

Also, let me know the name of an employee this relates to and what their expected super balance should be.

1 -

Thanks Rav, I have accepted the access request. I am an employee, so my details are Natalie Twidale, super balance should be $5313 for 2024/2025 EOFY. I use the Reckon Payroll app, rather than desktop - not sure if that makes a difference.

0 -

Thanks for that Natalie

I've just jumped in and taken a look at your specific records and I can see from the Payroll Detail report that the super balance from your pay runs is indeed $5313 but appears as $2656 in the EOFY finalisation. The same sort of disparity applies to the other 2 employees.

In taking a look at the setup of your super funds, I can see there are two listed as Australian Retirement Trust (ART) however one of them looks to be the old system-generated default super fund which has been reused for the ART fund. My gut feeling is there might be something related to this causing the disparity but I can't quite see how, and also, none of the employees are currently assigned to that fund.

Do you know if you, and the other employees for that matter, were previously assigned to that other ART/default super fund?

What I'm going to do is put the details of this together into a case and get it over to our dev team to take a closer look.

0 -

Hi @TwidaleInv

Just a quick update to this one. I've heard back from the dev team and this is indeed related to the old system-generated default super fund and its a bit of a complicated issue.

The team are going to work on addressing a fix for it, however this might take a bit of time so in the interim there's a workaround I'll outline below that'll help you get your EOFY finalisation moving along.

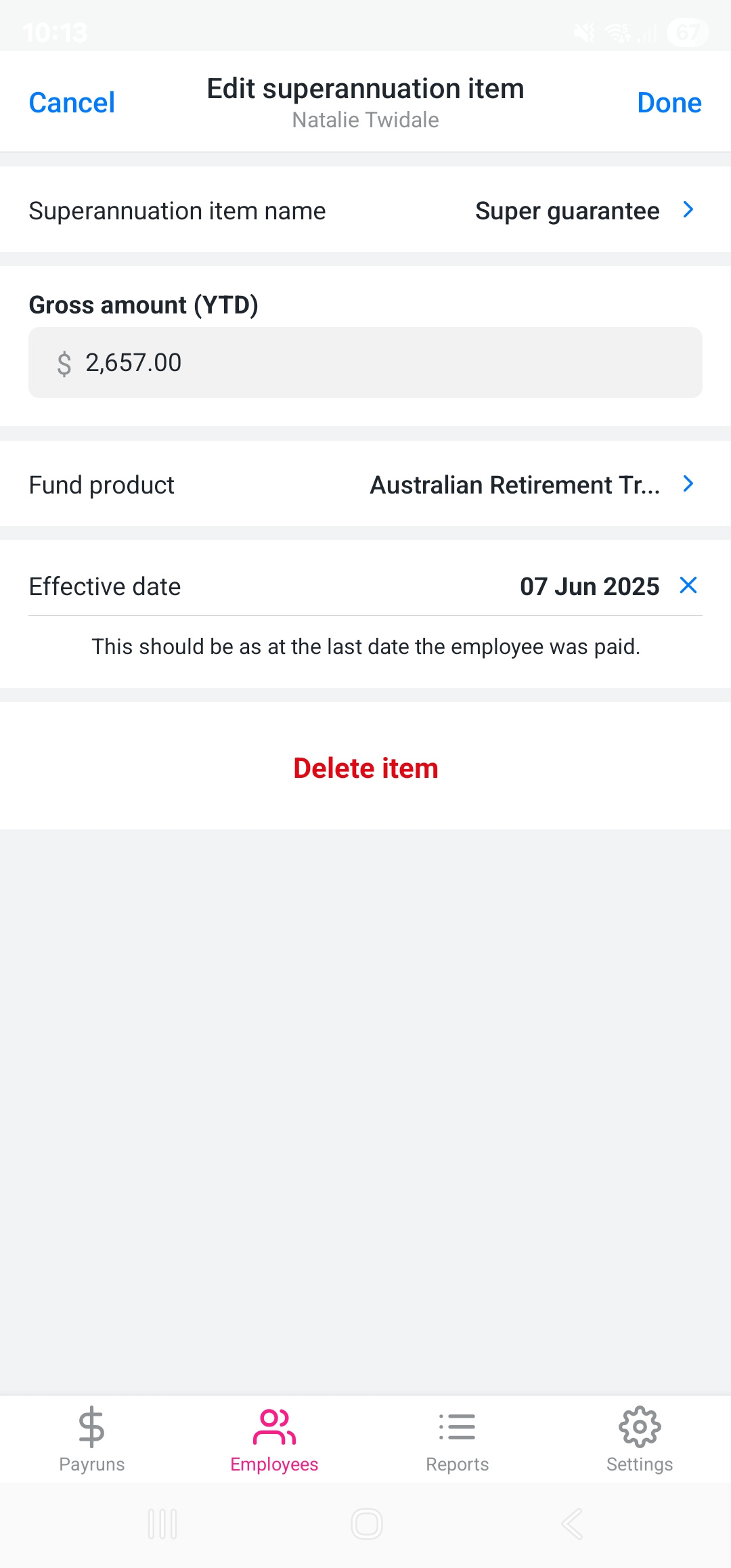

1️⃣ Go to an employee's profile and take note of their current super fund details. Then click Edit Details.

2️⃣ Click on Edit Initial YTD at the top.

3️⃣ Set the Financial Year toggle to FY2024-25.

4️⃣ This is probably the most important step. Add a Super Guarantee item for the difference in the super balance for the respective employee. So for example in your case that is $5313 - $2656 = $2657.

Type in the name of the employee's fund product and select the correct one from the list.

Ensure that you set an Effective Date that falls in the 2024/25 financial year eg. 1 June 2025.

5️⃣ Save the profile and do the same for the other two employees. Below is a quick little example I've put together.

6️⃣ Generate a new 2024/25 EOFY finalisation. The super balances for each employee should now be at their correct totals.

7️⃣ Once your EOFY finalisation has been sent, go back into each employee profile and remove those super items you've added from the employee profiles.

I know that's a fair bit of information so if you have any questions, please let me know.

1 -

Hi Rav

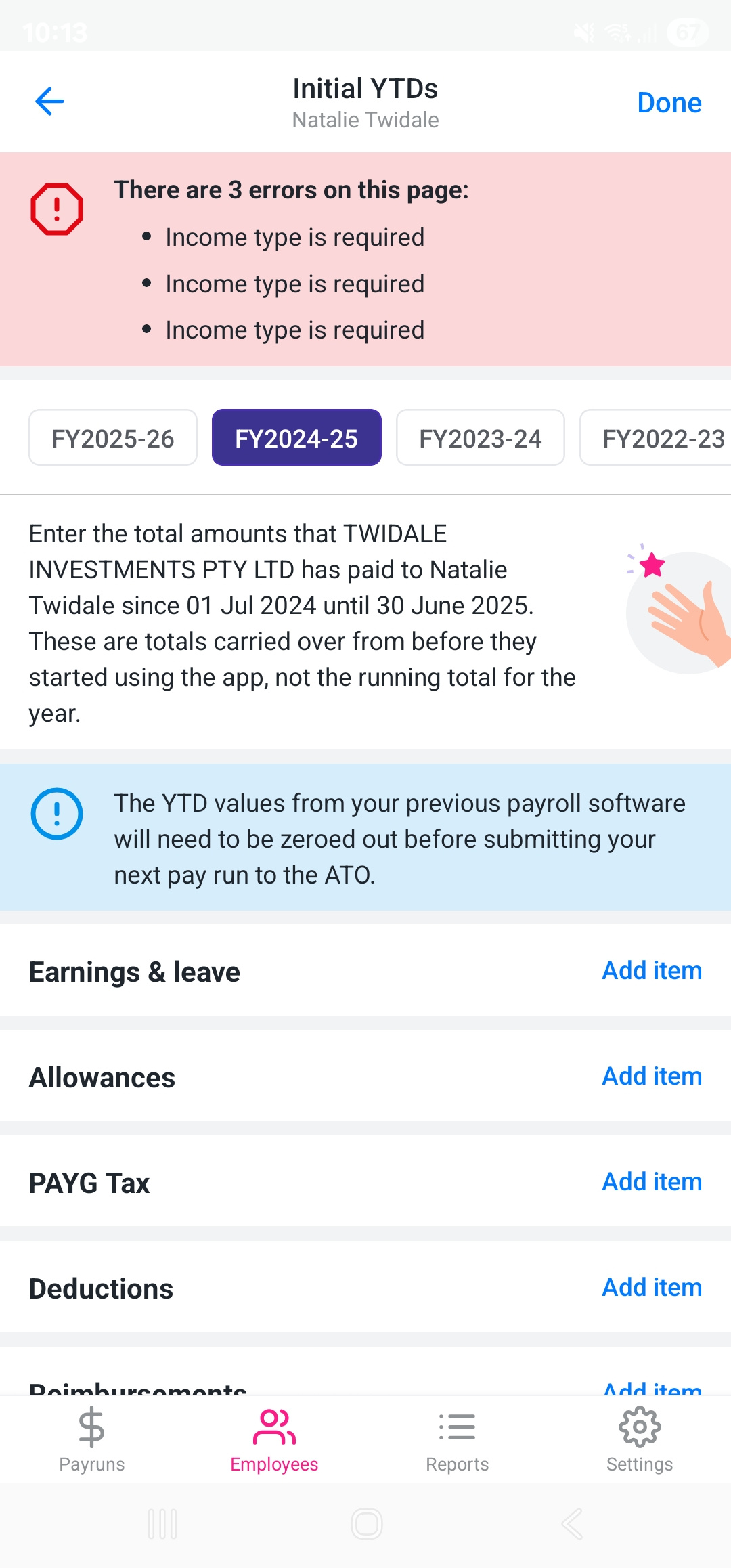

Thank you for looking into this for me. I have followed the instructions provided, however I am getting an error message and it will not allow me to save the changes. I have included a screen shot of what I have done and the errors. What do I need to do here to rectify the errors please?

0 -

Ah apologies @TwidaleInv, I wasn't aware you were using the mobile app so I created my screen recording above using Reckon Payroll on the PC. If its easier for you, you can access the full Reckon Payroll service on your PC browser by logging in here - https://id.reckon.com/login

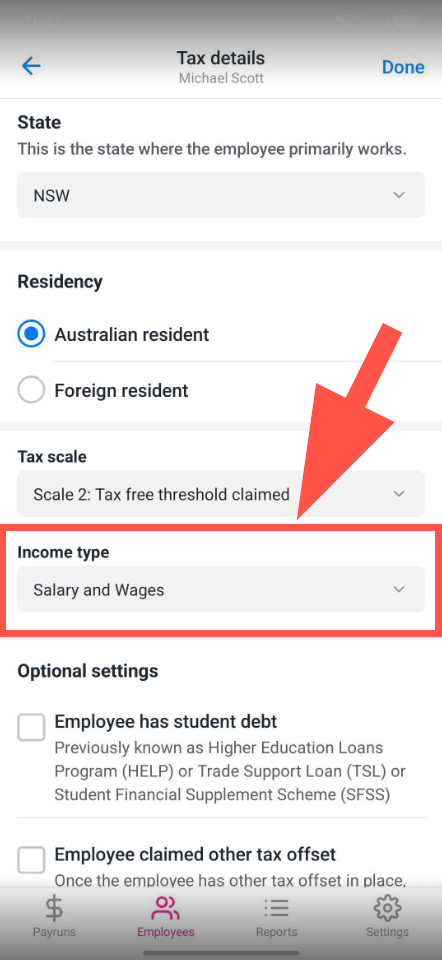

In regard to that error message you're encountering though, the Income Type is an STP Phase 2 requirement. Can I just clarify whether you have, or haven't updated to STP Phase 2 yet?

If you tap on the Tax tab in the employee profile, you'll find the Income Type field listed there (example below). Select the appropriate income type for the employee from the dropdown menu.

0 -

Hi Rav, thanks. I have managed to make the corrections through the PC rather than the mobile app. This seems to have worked and I have been able to submit the EOFY report and then delete the amendments made to super for each employee. I am not sure why I am getting the error message on the mobile app as the income type is already added for each employee. I do believe that I have updated to Phase 2 but cannot see where to confirm this.

0 -

Nice work, glad you got it sorted 👏

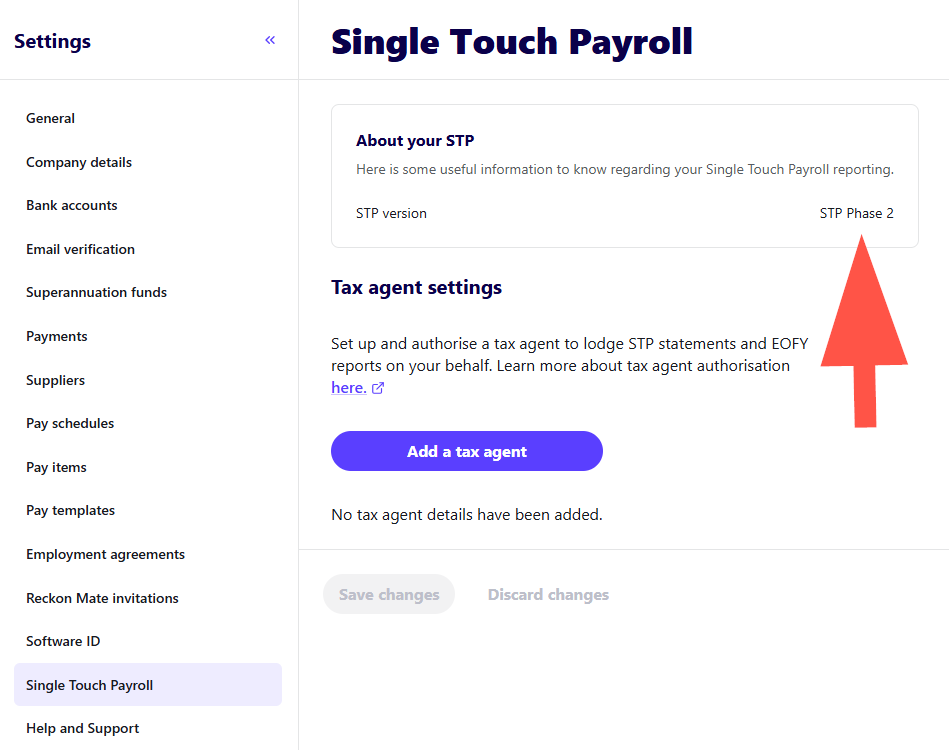

In regard to STP Phase 2, if you're still logged into Reckon Payroll on your PC, click on Payroll Settings from the menu on the left then Single Touch Payroll. You'll see a listing which shows the STP version you're currently using.

0