Just changed from Sole Trader to a trust. Can we change details is STP Payroll or pay for new one?

Wondering if anyone has suggestions

Answers

-

Is the ABN also changing as part of this as well?

0 -

Yes ABN has changed.

0 -

Thanks for that. My recommendation would be to create a new book for the new entity. That way everything remains separate and reporting remains consistent.

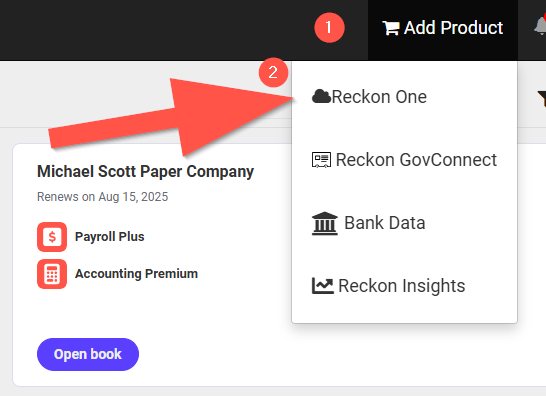

You can create a new book in your existing account by clicking Add Product in the top right corner then selecting Reckon One. Follow the prompts to set up your new book for the new entity.

As its a new book, you will need to recreate certain data such as employees, items, etc.

When setting up a new book, a new STP entity will be created automatically for the new ABN. All you'll need to do is register the new Software ID with the ATO so they'll accept submission sent from the new ABN.

0 -

Thank you.

Is there a way to transfer old account labels and payroll to new account without having to re-enter all details?

0 -

I had a similar question a while back but unfortunately there isn't a way to merge books or transfer data between them ☹️

0