Long Service Leave payment

Good afternoon all,

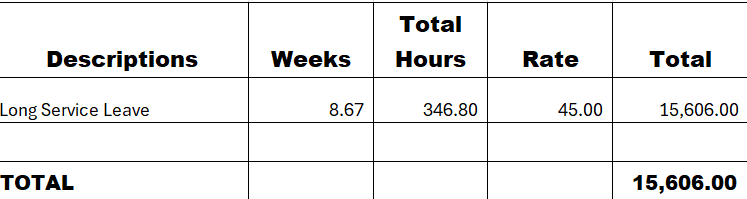

I would like to request for your assistance in paying out the Long service leave to an employee resigned. I got the following, and the employee has not availed any LSL during his time with the company. I have calculated the LSL using the WA LSL calculated and go the amount as follows:

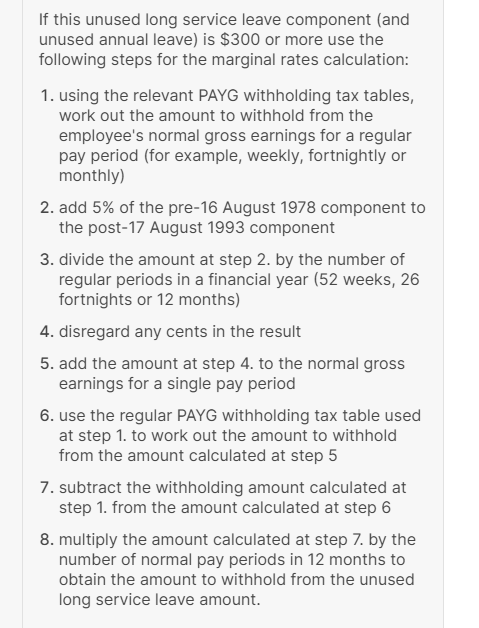

I was following the below calculation steps from ATO website but I am not getting the amount

I don't know if I am doing right. Please help me with this. Thank you very much for your support.

Answers

-

@Miks88 Your ATO screenshot is just on how to calculate the PAYG Tax amount to be withheld from it, not for the LSL calculation itself.

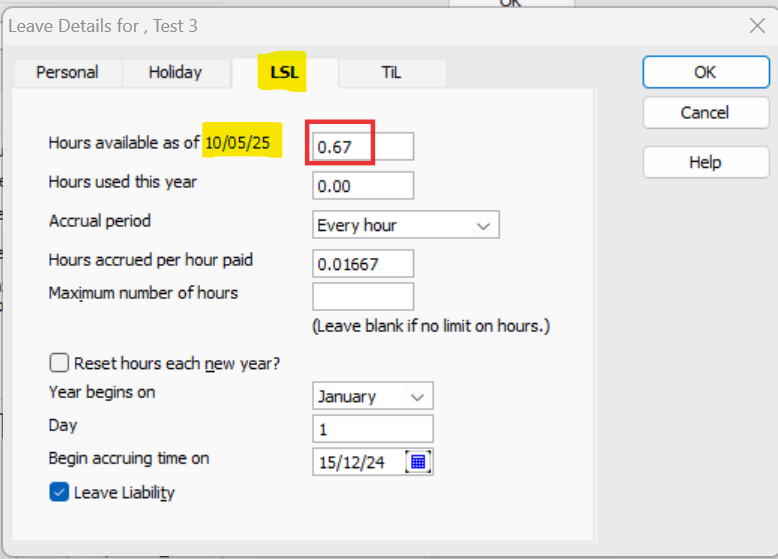

Is LSL already set up & being tracked in the program ?

If not, you will need to use one of your Other Leave tabs, rename it to LSL & manually add the 346.8 hours to the Available Hours as of … box:

You also need additional Payroll Items set up for both AL Paid out on Termination & LSL Paid out on Termination. This is because there are separate STP Tax Tracking Types for when leave is paid out (eg on Terminations v Cash outs v Redundancy/Invalidity/Early Retirement Scheme)

You also need to determine how it's categorised based on the employee age & length of service. Most ordinary scenarios will just be part of standard unused Leave however if the LSL is accrued from an extensive length of service, it may be a Lump Sum A (pre-17/08/93) or Lump Sum B (pre-15/08/78)

If you are unfamiliar with many aspects of the program/payroll etc, I would strongly recommend reaching out to me direct, to arrange 1-on-1 customised training/assistance, as these are important areas that need to be configured correctly.

0 -

Thank you very much Shaz.

0 -

Hi Shaz,

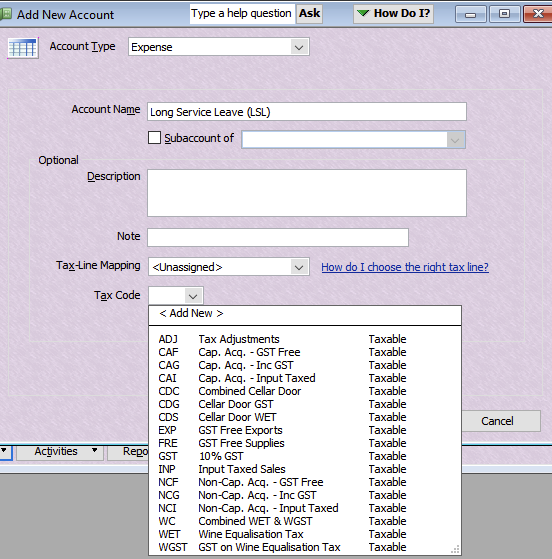

Could you please advice me of the tax code for the Long Service Leave? I need to pay this tomorrow. This will be separate payment, and I need to process in Reckon and not with the wages. We are based in Perth. And the employee resigning LSL calculated from the year 2015 to 2025, and he has not taken any leave. Your guidance in this regards will be very much appreciated. Thank you.

0 -

Are you processing this via payroll, no tax code, not entered as a cheque

1 -

No Kris. I am not processing via payroll. I need to pay him tomorrow. Trying to set up the account head to book his LSL. Please guide me of the process. Thank you.

0 -

you need to do it in payroll, I guess if you’re positive of the amount you could use a cheque but you will have to go back and do it in payroll and then delete the cheque. Not advisable though

1 -

Have you been using payroll up till now? All you have to do is setup the LSL payroll item in his details as per Shaz’s advice above and enter the amount outstanding - check everything with your calculations and if you’re sure of the tax component you can override what payroll says.

Take Shaz’s advice and follow her instructions

1