Un-terminating an employee to process a backpay

Hi

Recently, we processed some redundancies and terminated employees. We now have a situation where we need to process additional gross and superannuation for a terminated employee.

Can someone send me the steps on how this can be achieved please?

Lucy

Answers

-

There are a couple of ways you could do this but what I'd recommend is the following -

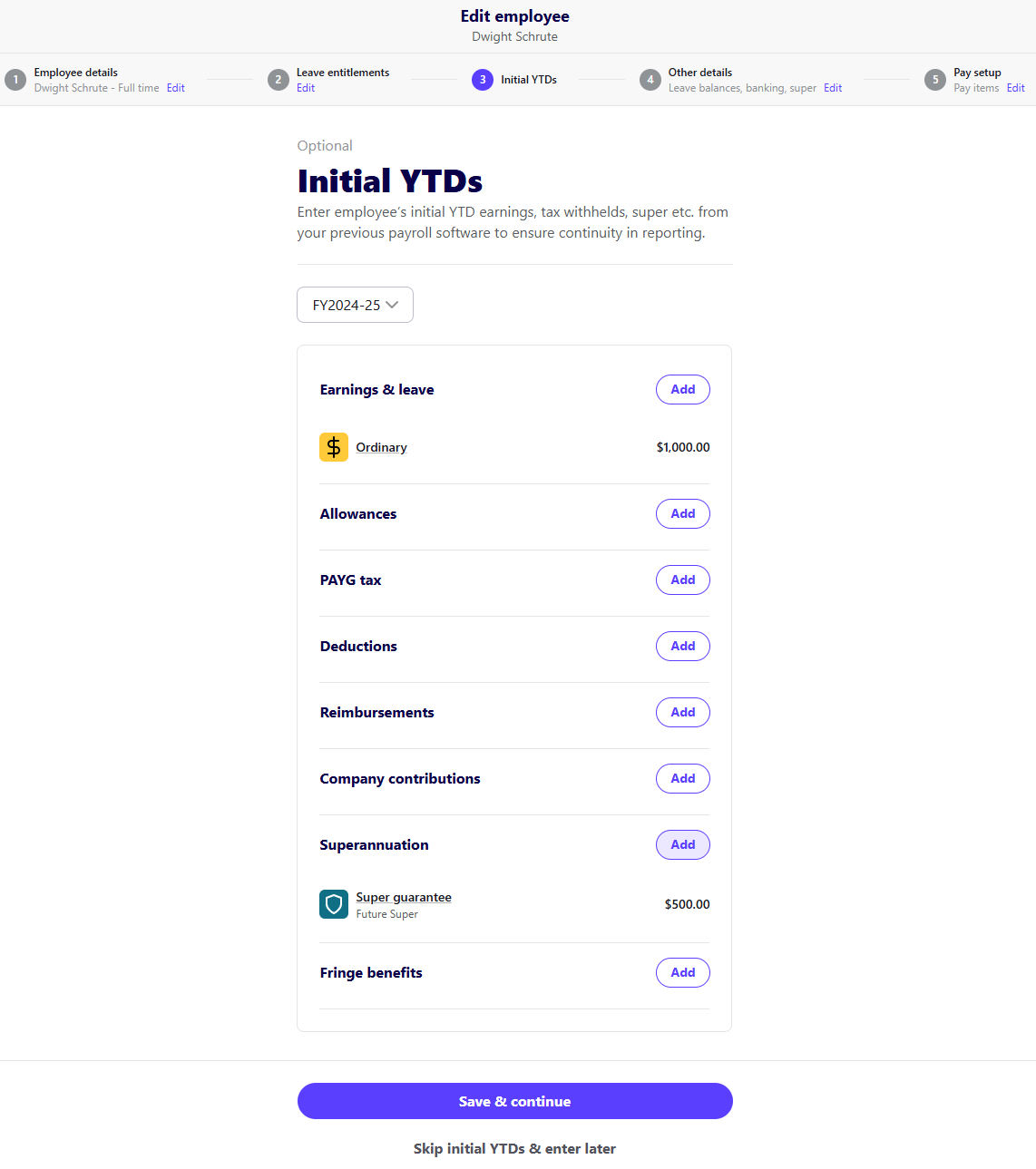

Simply add the additional gross/super etc into the initial YTD information in the employee profile for the respective financial year it belongs in.

See example below where I've added additional ordinary earnings and super guarantee for my employee for the previous 2024/25 financial year in their initial YTD.

Once that is done, send a new EOFY finalisation for the respective employees that you've edited so that the updated balances are sent to the ATO and also finalised for the appropriate financial year.

This is step is important and must be actioned in order to both update the balances on the ATO end but also ensure that previous financial year is finalised and balances set to Tax Ready for those employees.

0