In what cases and how to exactly use Petty Cash...? Please confirm or Explain.

Hi Everyone…

In my Company, sometime company's employee pay to some supplier such as Bunnings by personal Credit Card or via Cash and don't use a business debit card because they don't have one - Only I have one as a owner. Which is actually a 100% company's expense and not a personal at all. So, what is the correct way to record that expense in reckon?

So, Here how i do it…

Day to Day - Money Out - Make a Payment - Add Payment - Select 'Petty Cash' as a Bank account - scroll down - select 'NEW' - select 'Expense account' select 'GST' and write the 'amount paid' - Done.

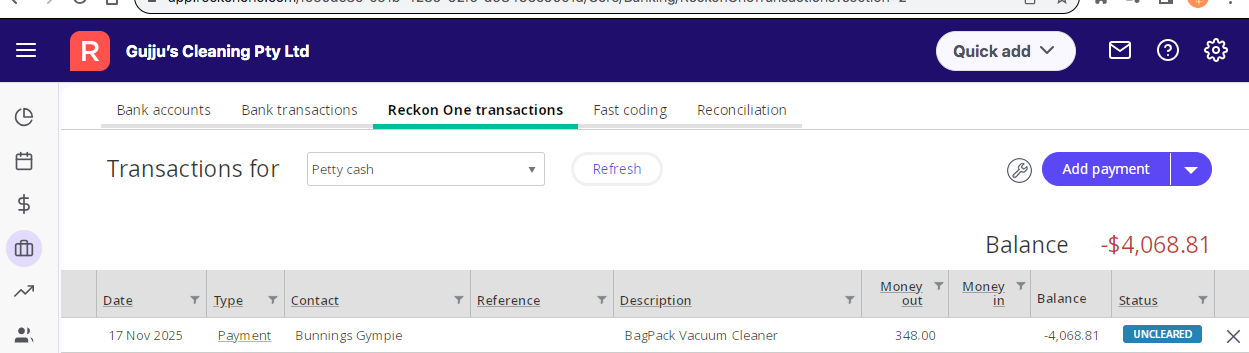

Then Go to 'Banking' - Select 'Reckon One Transaction' - Select 'Petty Cash' - Done. It shows the total of all petty cash transactions amounts in Negative and red.

is this correct way…? If Yes, How we can get those 'uncleared' Transactions into 'Cleared' status? and how to reconcile those?

Also, If this is the way it should be recorded then, as a company, How I should reimburse my employee? Because If I record that expense in petty cash and reimburse my employee along with payroll salary then it will double the same expense. once as a expense and again as a reimbursement. Can somebody please clarify for me.

I have attached screenshot if required.

Answers

-

We've got some really good info on petty cash along with how to handle it here -

1 -

When you reimburse your employees, the payment should be allocated against the petty cash account, not to the expense account.

This will fix two of the issues you mentioned: double counting of the expense and the red entries on the petty cash account.

2