Reckon One UPDATE (6 July 2017)

Rav

Administrator, Reckon Staff Posts: 14,235 Reckon Community Manager

Hi everyone,

Hope you're all having a productive EOFY, just a heads up to let you know Reckon One has received an update this morning which includes Simpler BAS, classification reporting, enhancements to the Payroll Annual Summary Report (EMPDUPE) and more.

SIMPLER BAS

Reckon One now has the option to use Simpler BAS!

Simpler BAS applies to Australian books only.

Refer to the ATO website for more information regarding Simpler BAS HERE

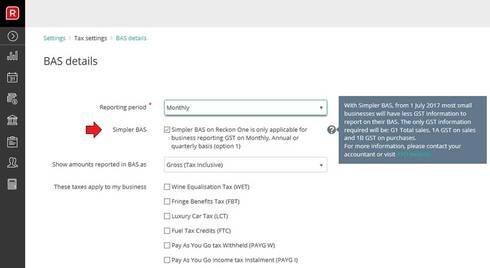

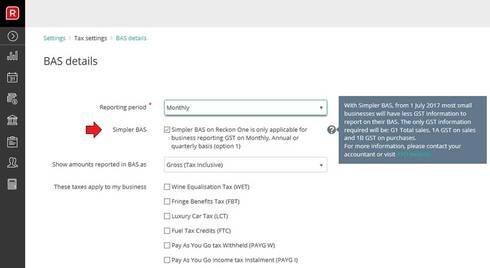

To access the BAS settings in Reckon One, click the Administration menu > Settings > Tax settings > BAS details.

The Simpler BAS option is available when reporting: Monthly, Quarterly Option 1 or Annually.

It is not available when reporting Quarterly Option 2 or Quarterly Option 3.

The Simpler BAS option is not enabled by default.

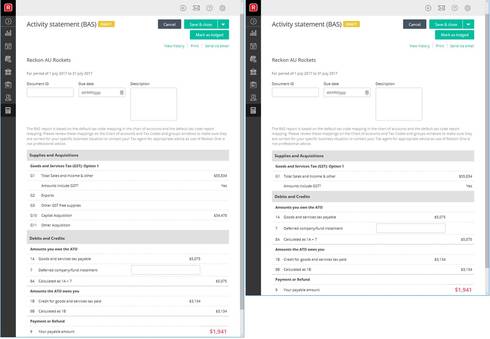

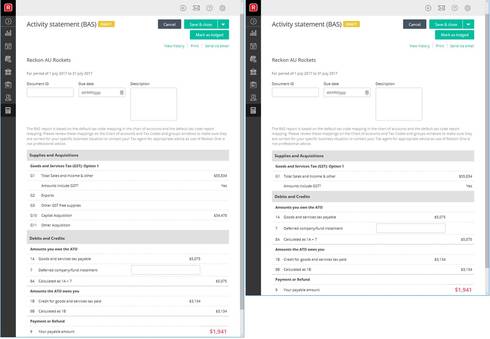

The left example below is not using the Simpler BAS. The right example is using the Simpler BAS.

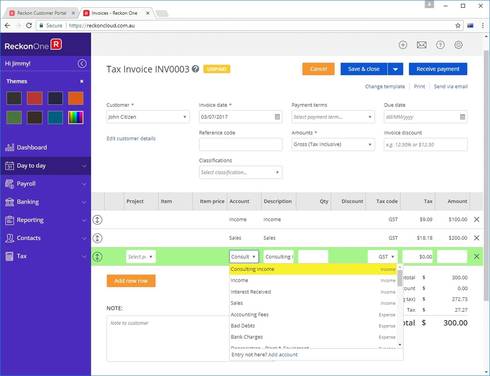

CLASSIFICATION REPORTING

The customer transaction report and supplier transaction report are the first reports to include classifications.

The Classification feature for Reckon One is a progressive release. Additional classification reporting will be available in a subsequent update.

For more information on classifications please visit the earlier posts on the Community here -

Reckon One UPDATE (19 December 2016)

Reckon One UPDATE (25 May 2017)

Reckon One UPDATE (28 June 2017)

The customer transaction report is accessible via the Customers category in the Report Centre.

The supplier transaction report is accessible via the Suppliers category in the Report Centre.

Classifications are not enabled by default for these two reports. To enable classifications in the reports please do the following steps.

When using a classification on a receipt, the classification is only applicable to the entries on the ‘New’ tab within the receipt.

If a receipt is linked to a transaction (invoice, journal or supplier adjustment note) via the ‘Allocated’ tab within the receipt. The classification should be set within the linked transaction (invoice, journal or supplier adjustment note).

When using a classification on a payment, the classification is only applicable to the entries on the ‘New’ tab within the payment.

If a payment is linked to a transaction (bill, journal or customer adjustment note) via the ‘Allocated’ tab within the payment. The classification should be set within the linked transaction (bill, journal or customer adjustment note).

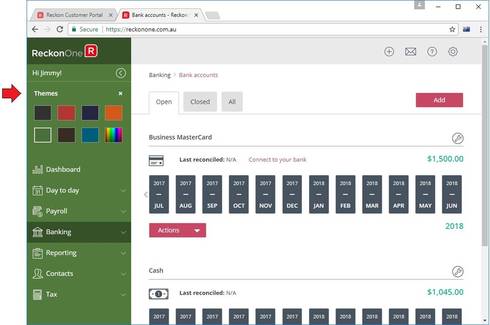

COLOUR THEMES

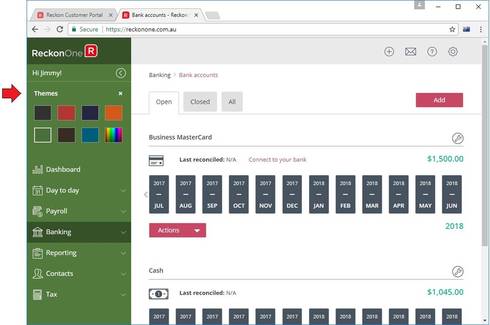

Reckon One now allows you to set a colour theme for your book. Themes are located within the left navigation menu. Expand the navigation menu, then click your name to access themes. There are seven default themes and a custom theme (via the rainbow icon).

Themes are saved on a per user, per book, basis.

In the scenario where multiple users have access to the same book. Each user will configure their own theme for the book.

In the scenario where your account has multiple books, each book theme will be configured separately.

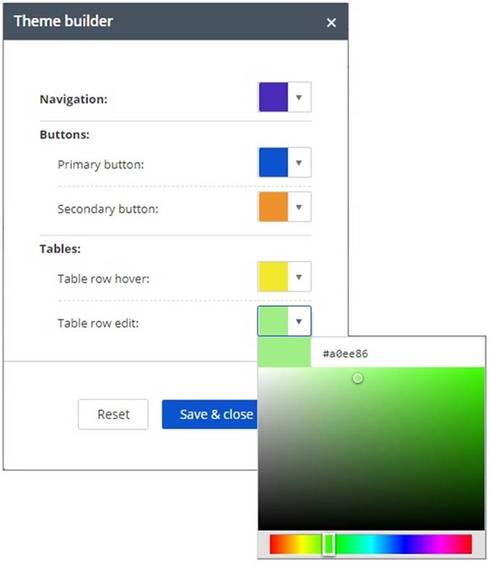

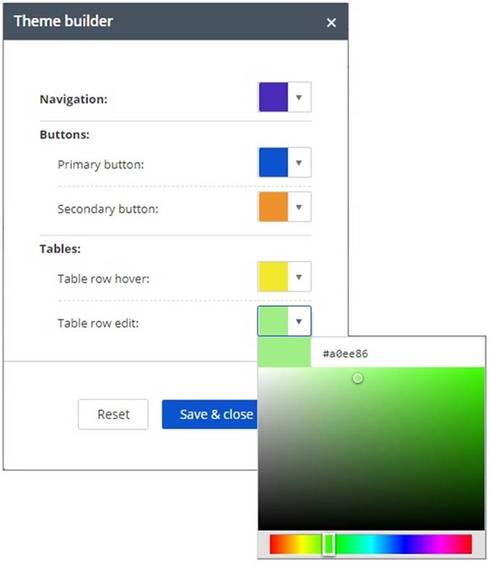

When setting a custom theme, a theme builder window will appear. Here you can set your custom colour selections using the colour picker or by entering a colour code.

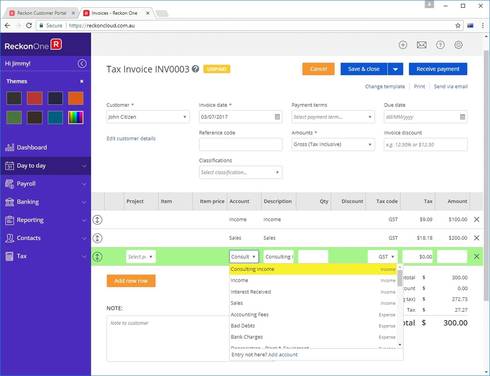

The example below is usingthe custom theme settings shown above.

PAYMENT SUMMARY ANNUAL REPORT

'Make Draft' option

The annual payment summary report now contains a ‘Make Draft’ button. This functionality allows any Lodged Annual report to be set back to a draft state, allowing the user to delete the Annual report batch. You can then recreate the EMPDUPE file which is generated when creating the Payment summary annual report batch.

Updates to EMPDUPE

The EMPDUPE file that is created and sent/lodged to the ATO has been updated to include the latest government changes.

The EMPDUPE now record the following:

Hope you're all having a productive EOFY, just a heads up to let you know Reckon One has received an update this morning which includes Simpler BAS, classification reporting, enhancements to the Payroll Annual Summary Report (EMPDUPE) and more.

SIMPLER BAS

Reckon One now has the option to use Simpler BAS!

Simpler BAS applies to Australian books only.

Refer to the ATO website for more information regarding Simpler BAS HERE

To access the BAS settings in Reckon One, click the Administration menu > Settings > Tax settings > BAS details.

The Simpler BAS option is available when reporting: Monthly, Quarterly Option 1 or Annually.

It is not available when reporting Quarterly Option 2 or Quarterly Option 3.

The Simpler BAS option is not enabled by default.

The left example below is not using the Simpler BAS. The right example is using the Simpler BAS.

CLASSIFICATION REPORTING

The customer transaction report and supplier transaction report are the first reports to include classifications.

The Classification feature for Reckon One is a progressive release. Additional classification reporting will be available in a subsequent update.

For more information on classifications please visit the earlier posts on the Community here -

Reckon One UPDATE (19 December 2016)

Reckon One UPDATE (25 May 2017)

Reckon One UPDATE (28 June 2017)

The customer transaction report is accessible via the Customers category in the Report Centre.

The supplier transaction report is accessible via the Suppliers category in the Report Centre.

Classifications are not enabled by default for these two reports. To enable classifications in the reports please do the following steps.

- Open the report

- Reporting > Reports centre > Customers (category) > Customer transaction report

- Reporting > Reports centre > Suppliers (category) > Supplier transaction report

- Click ‘Show more options’

- Enable the classifications tick box

- Choose whether you want to show all classifications or selected classifications

- Set the reporting period and click refresh to update the report

When using a classification on a receipt, the classification is only applicable to the entries on the ‘New’ tab within the receipt.

If a receipt is linked to a transaction (invoice, journal or supplier adjustment note) via the ‘Allocated’ tab within the receipt. The classification should be set within the linked transaction (invoice, journal or supplier adjustment note).

When using a classification on a payment, the classification is only applicable to the entries on the ‘New’ tab within the payment.

If a payment is linked to a transaction (bill, journal or customer adjustment note) via the ‘Allocated’ tab within the payment. The classification should be set within the linked transaction (bill, journal or customer adjustment note).

COLOUR THEMES

Reckon One now allows you to set a colour theme for your book. Themes are located within the left navigation menu. Expand the navigation menu, then click your name to access themes. There are seven default themes and a custom theme (via the rainbow icon).

Themes are saved on a per user, per book, basis.

In the scenario where multiple users have access to the same book. Each user will configure their own theme for the book.

In the scenario where your account has multiple books, each book theme will be configured separately.

When setting a custom theme, a theme builder window will appear. Here you can set your custom colour selections using the colour picker or by entering a colour code.

The example below is usingthe custom theme settings shown above.

PAYMENT SUMMARY ANNUAL REPORT

'Make Draft' option

The annual payment summary report now contains a ‘Make Draft’ button. This functionality allows any Lodged Annual report to be set back to a draft state, allowing the user to delete the Annual report batch. You can then recreate the EMPDUPE file which is generated when creating the Payment summary annual report batch.

Updates to EMPDUPE

The EMPDUPE file that is created and sent/lodged to the ATO has been updated to include the latest government changes.

The EMPDUPE now record the following:

- A new income Type code of H – The income type field will now record Code H for employees who are set to ‘Working Holiday Maker’ tax scale.

- A new FBT Exempt Status field – The FBT exempt status field will record

- N – For when ‘Reportable Fringe Benefit amount (non-exempt) category has been used

- Y - For when ‘Reportable Fringe Benefit amount (exceeding exempt) category has been used

- Blank – When neither of the Reportable fringe benefits categories have been used.

0

Comments

-

1

This discussion has been closed.