Best Of

Re: Super for owners

Morning @Kris_Williams

Yes, SMSF's are subject to Payday Super requirements, essentially any super guarantee contribution will fall under these obligations regardless of whether its a SMSF or a superfund.

Rav

Rav

Re: How to fix the position of items showing in reports?

Welcome to the Community @sk079 ! 👋🏻

Reports will usually generate lists in their current (real-time) order.

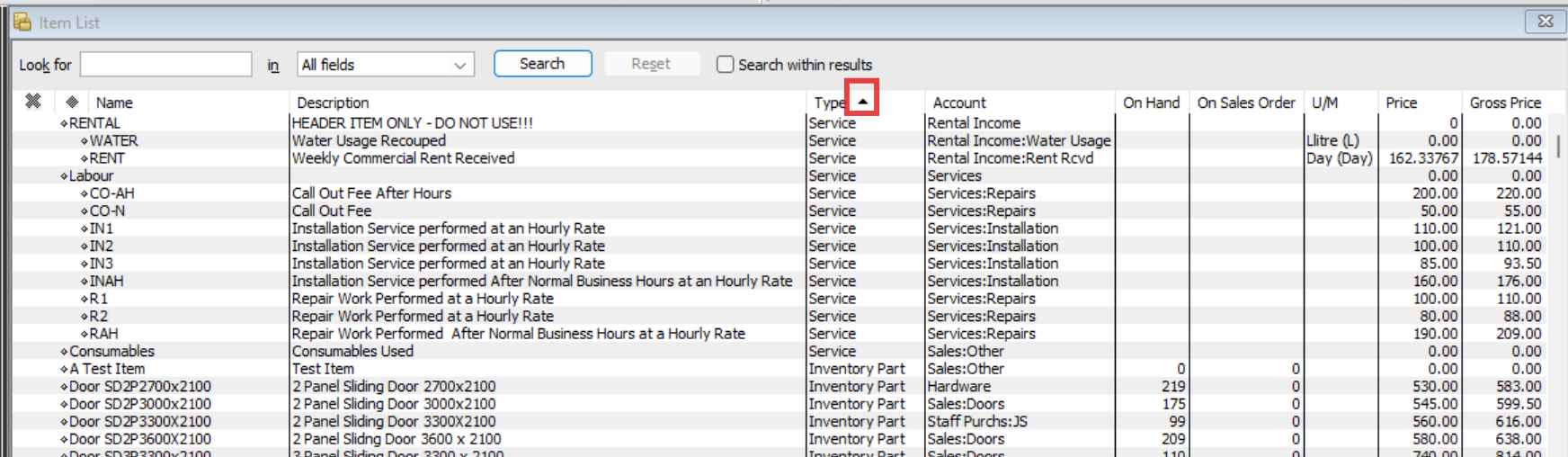

You can click on any column heading to quickly sort a list by that column. A little black triangle icon on a column header identifies a manual sort order (& the arrow direction indicates whether the list is ascending or descending) :

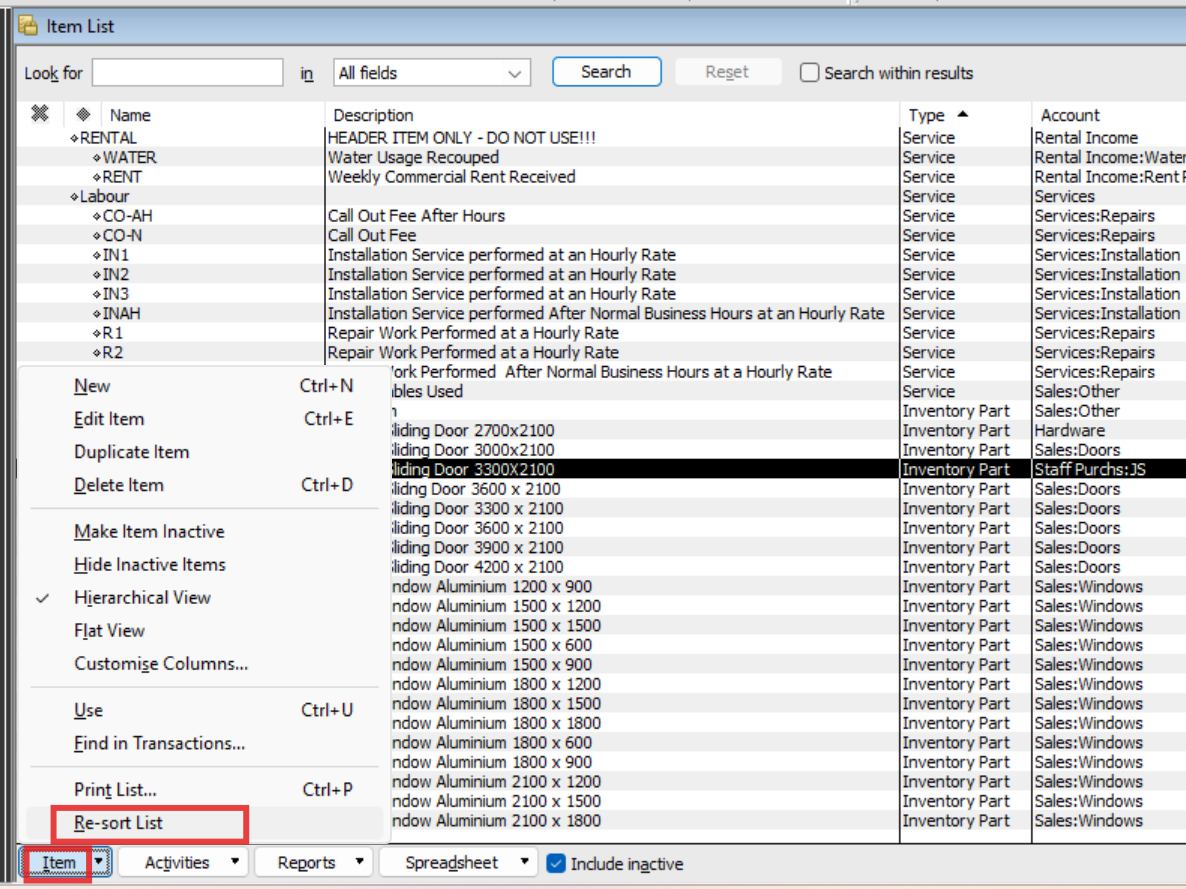

There is also a "Re-sort List" option in most Lists that will return it to its default (by type, then alphabetised) order 😁 :

Sort the list beforehand & when you generate a relevant report, it will show it in that order.

NOTE: A memorised report is memorised EXACTLY how you originally set it. Therefore, if you have memorised reports that are out of order, Re-sort - then re-Memorise them - to retain that view 😊

Acctd4

Acctd4

Vote in our poll - What default date should apply when creating consecutive transactions?

When creating multiple transactions in one go in Reckon One, for example, when creating several invoices or bills and then selecting Save & New to create the next one - what date would you like the new transaction to use?

We'd love to get your input! Please vote in our poll below 🙂

Rav

Rav

Re: Vote in our poll - What default date should apply when creating consecutive transactions?

Sort-a depends...😃

Invoices: use the previous transaction date

Bills: either same as previous or blank

Journals: blank OR same date next month (possibly by an option to create a series of journals to spread costs across the financial year)

Budgets: as journals

Re: Reckon Desktop Automatic Backups

Using the built-in backup function allows for the inclusion of a file verification to be performed to the company data file (QBW) just prior to the backup itself being created.

- This allows the software to check the file for any detectable issues which really should be addressed before a backup is made.

- If there are issues, have them investigated and addressed by putting the file through the built-in file rebuild function.

- Then once more attempt to create a backup (QBB) using the built-in backup function.

- If no further issues, then great.

- You now have a compressed backup copy of the company file that has been tested and found to be error-free at that time.

- If the initial issue is resolved but additional problems surface then addressing those is vital.

Simply making a copy of a company data file (QBW) is a reasonably good alternative to making use of the built-in backup function under ideal conditions.

- It is certainly a faster process than the built-in backup function, but it does not include that very important file verification.

- Therefore, if one chooses to simply copy a file, it is a very good idea to periodically make use of the built-in file integrity checking functions of the software (Verify Data / Rebuild Data).

- How often you perform that manual file verification with respect to how often you make a copy of the file to serve as a secondary/backup copy is highly dependent on your appetite for risk.

Datarec

Datarec

Re: Account Codes for Chart of Accounts

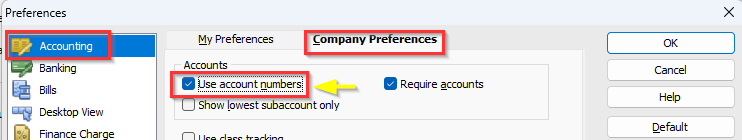

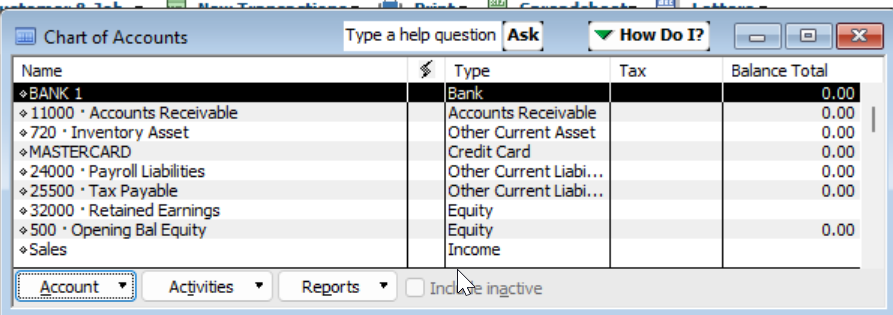

In a test file, with the Preference setting enabled, the Chart of Accounts displays the account numbers.

If you are still encountering an issue, please contact the Technical Support Team for additional troubleshooting.

Datarec

Datarec

Re: Account Codes for Chart of Accounts

Hi @P Piercey

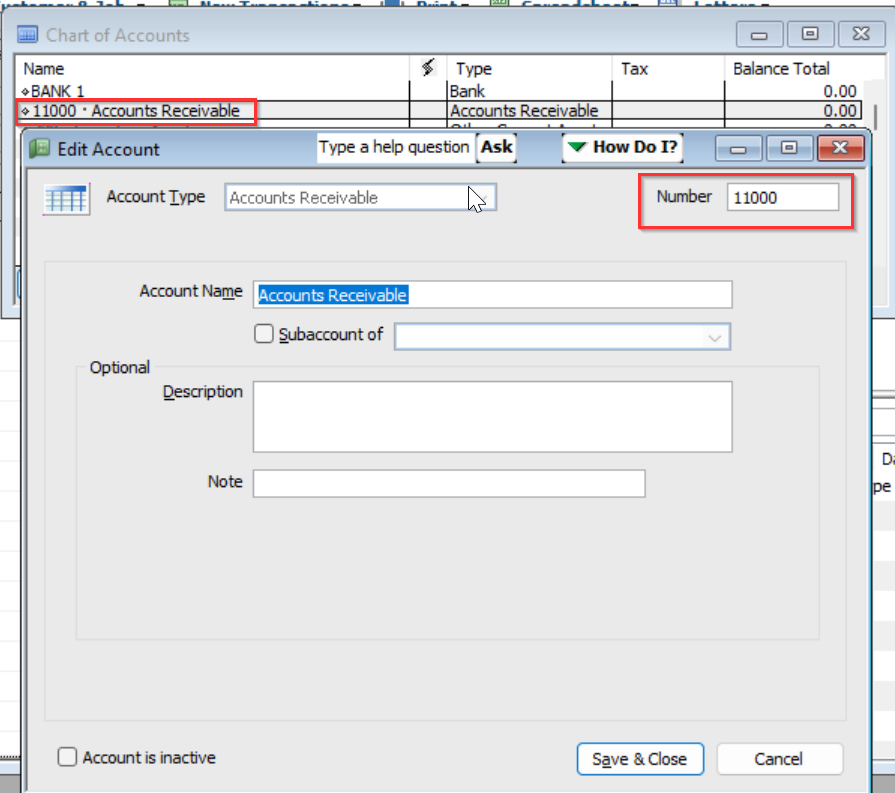

Only the default accounts (eg the system-created) ones already have a designated number. Any accounts that you've created yourself, you'll need to add the number in the Number box as shown above 😬 The Show account numbers preference just specifically displays this Number field for you.

Acctd4

Acctd4

Re: Does RAH automatically calculate pro-rata holidays and sick leave when the employee is part time?

Check out the full breakdown I explain here:

😊

Acctd4

Acctd4

Re: Why does my Other1 (Leave Accural) deduct from a payroll item?

Hi @Redline

It’s been incorrectly linked to leave 😬

Unfortunately, that selection is only shown at initial setup so you’ll need to create a new Payroll Item

Acctd4

Acctd4

Re: Can I change employee numbers?

Hey @SydneyFlow

I would strongly advise that you don't change employee numbers for any existing employees that you've reported for.

Doing so will certainly impact STP as you've asked and more specifically, it will create an additional entry in your ATO Portal and the employee's MyGov; one for any reported balances under the old employee number and another for the new employee number.

If you're looking to introduce a new employee number format, then I'd recommend doing so from the next new employee that comes onboard moving forward.

Rav

Rav