Best Of

Creating a Note on Payslips

Would be good to have the ability to add a note to an individual employee's Payslip

Reckon One update! ✨ Your payruns have been upgraded!

The upgrades just keep coming and we're super excited about this one!

Payruns have received a major improvement in this latest Reckon One release! Check out the full details below.

✨ A new & improved payrun experience!

Creating a payrun has been given a major enhancement with the introduction of a full-page editing screen built directly from your feedback!

Full screen payrun editing experience

We've said goodbye to the editing panel which had limited space and created challenges when adding/editing multiple pay items, managing a large number of employees and the number of clicks needed.

The new full screen payrun editing experience is designed to improve efficiency, reduce the number of clicks and provide a much clearer view of payrun information.

In-line editing of pay items

You can now edit and add pay items directly on one screen without having to open multiple fields or pop-ups.

Faster input

You can now enter pay items and other information using your keyboard or mouse to make your workflow a lot faster.

Pay multiple pay periods in a single pay run

You can now pay employees for multiple periods in a single pay run with PAYG tax calculated automatically. This is perfect for holiday periods or advance payments - no more manual tax adjustments!

Simply select an employee in a draft pay run, adjust their total hours for the periods to be paid, and specify the number of pay periods to spread the tax across.

✨ Learn how to use the new pay run creation experience

All your existing pay items, categories, classifications and business rules remain the same. Check out our how-to video on creating a payrun which will give you a walkthrough on creating a pay run with the experience - Creating a pay run in Reckon One 🎥

✨ Try out the new pay run experience today!

The new payrun experience is available now and we're taking things slow along with closely listening to your feedback.

You can choose to opt-in and try out the new payrun editing features by clicking the message that appears when you next create a pay run. You can also switch back to the classic pay run experience at any time.

✨ Questions or feedback?

We'd love to hear your feedback! Click HERE to ask any questions or provide feedback on the new pay run experience.

Rav

Rav

Add Accounts on the fly.

When entering transactions and a relative income, expense, asset, liability or equity account is not already set up, why is that in some windows we can add an account on the fly and in other windows we cannot?

In the bank transactions, allocate payment & allocate receipt windows, if just using the contact and select account boxes, the option is there, but when using allocate detailed payment or detailed receipt the option to add an account is not there.

In fast coding, the option to add an account is not there.

In Create invoice and the recieve money window the option is there.

In the Bills and Make payment window the option is there.

It seems very strange to me that this feature that we have always been used to in RA desktop and hosted is only available in some areas and not all in R1. Can this be addressed please.

Reckon One update! ✨ Brand new STP report & more!

We're starting 2026 off with a bang with Reckon One's first release of the year and its a good one! 💥🚀

This update includes a brand new Single Touch Payroll (STP) report which will make your reconciliation a breeze plus bunch of other enhancements & fixes. Check out the full inclusions of this release below.

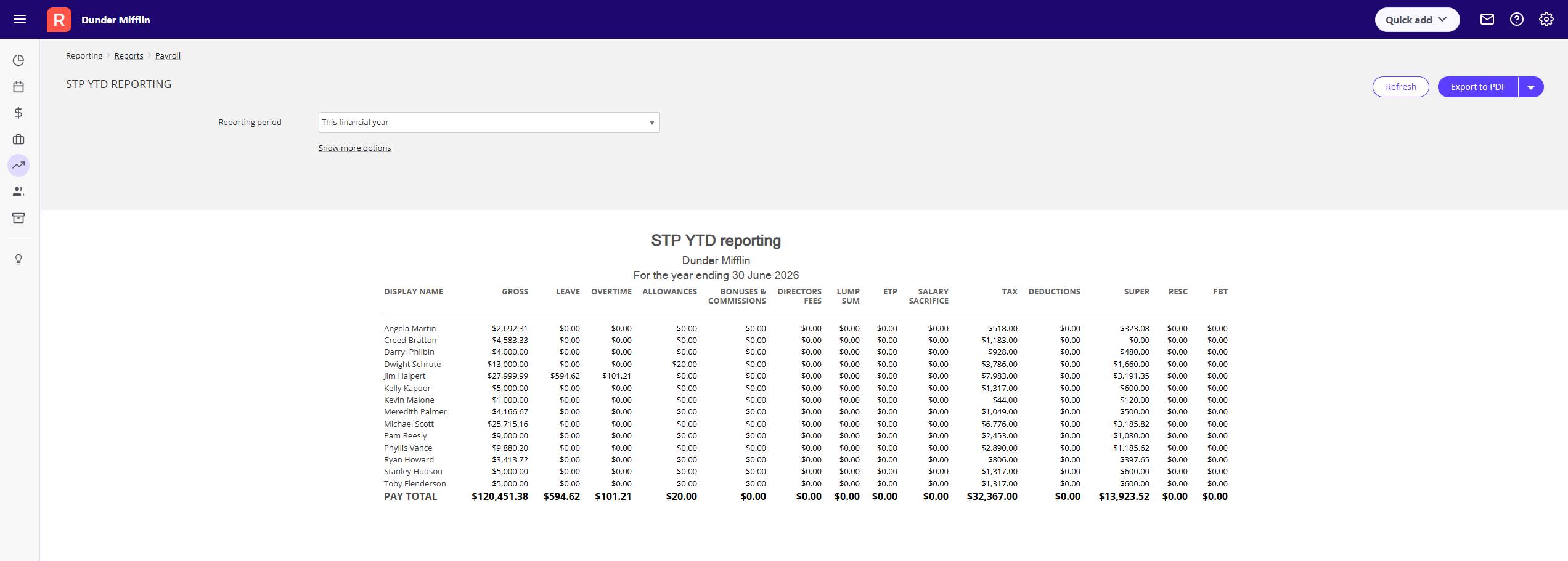

✨ STP Year to Date Report

A brand new Single Touch Payroll Year-to-Date report is now available in Reckon One and I'm pretty sure its going to become your favourite payroll report! 🙂

The STP report allows you to easily view employee STP balances that will be submitted to the ATO.

The report shows STP-reportable YTD values from Paid or Posted pay runs, including Initial YTDs, for a selected financial year (draft pay runs are excluded). Balances are always calculated from the start of the financial year however you can set an end date if required.

The STP report makes it much easier to reconcile payroll throughout the year, compare figures with the Employee Earnings Summary Report, identify discrepancies earlier, and eliminate any stress not just at EOFY time but throughout the year.

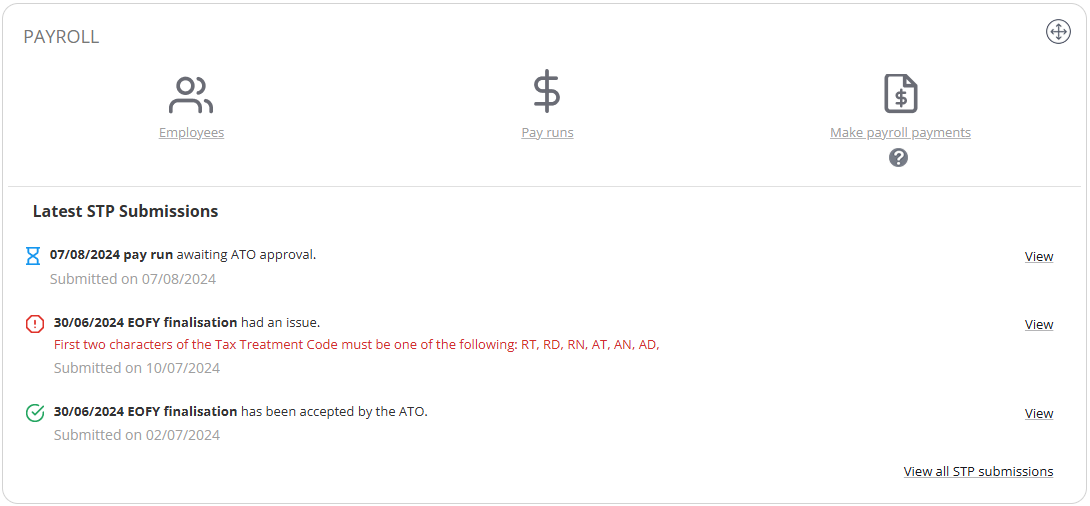

✨ Improvements to the STP Widget

We've made visual improvements to the STP Widget on your dashboard. Icons have been refreshed, messaging has been made clearer and more visually distinct.

If you haven't already added the STP Widget to your Reckon One dashboard, check out more info on it here.

✨ Invoice & Journal history now includes a date filter

When viewing the audit history of an invoice or journal entry, you'll now find a date range filter which allows you to easily filter entries to specific date ranges.

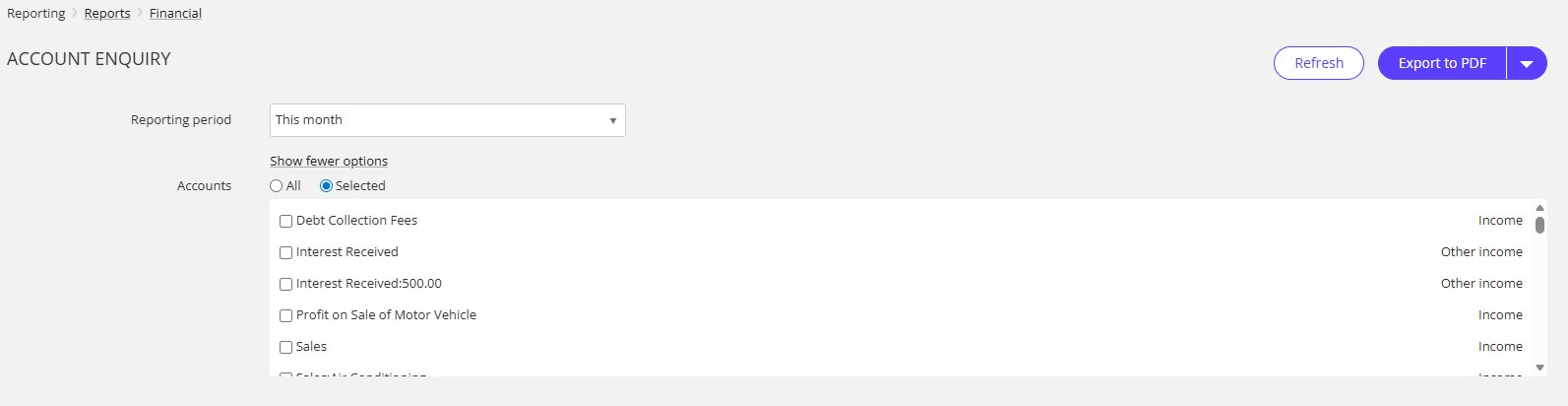

✨ Account Enquiry Report - improved performance

We've put a bit of work into improving the performance of the Account Enquiry Report particularly when generating a large amount of account data.

✅ Fixes

- The Leave Taken by Employee report is now ordered by payrun pay date.

- We've fixed the filter on the SuperStream screen to ensure a page refresh is not required after invalid entries.

- Ensured an employee's superannuation membership number populates in the SAFF export and relevant reports.

- Updated the limit on the display of suppliers in the dropdown when adding a deduction payee.

- For the following super item pay types:

- Member Voluntary – Deduct from gross before calculating tax is now correctly enabled

- Spouse Deduction – Deduct from gross before calculating tax is now correctly enabled

- Previously amounts for YTD Reimbursement and Tax-Free Allowance pay items were reducing the Net Pay on the Payroll Summary report. This has now been fixed. When these items are used in a pay run, the amounts are correctly added to Net Pay in this report.

- Fixed an issue where an unexpected error message would appear when attempting to delete a custom field for an item when its currently in use.

- We've ensured that changing an item type does not impact item purchase information

- Fixed an issue in the Profit and Loss by Classification report where amounts recorded against 3rd level sub-accounts were not included in report totals when an item classification was applied.

Rav

Rav

#TipTuesday - Reckon Accounts Hosted/Desktop - re-import a bank statement file

🌟 Tip Tuesday – Welcome to 2026! 🌟

Good morning everyone, and welcome to my first Tip Tuesday of 2026.

I hope you all had a great New Year and are feeling well-rested and refreshed.

For this week’s tip, I want to remind everyone how to re-import a bank statement file (QIF) that didn’t import successfully the first time. You might see a message that there are no new transactions to import, or nothing happens at all when you try again. Following this tip can help you re-import these bank statements.

Why does this happen?

When Reckon Accounts Business imports a QIF, it remembers the first transaction in the file. If the same transaction appears again, it’s flagged as already imported, and the import won’t continue.

Renaming the file won’t help, because Reckon recognises the transaction data itself, not the file name.

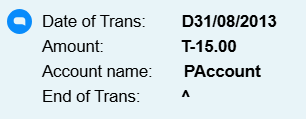

Bank QIF file format (example)

Header:

The transaction block:

The ^ symbol marks the end of a transaction.

How to fix it

To work around this, we simply need to move the first transaction to the bottom of the file.

This makes Reckon treat it as a “new” QIF file and allows the import to proceed.

Summarised steps

- Make a backup copy of the QIF file.

- Open the duplicate file in Notepad.

- Cut the first transaction block.

- Paste it at the very bottom of the file.

- Remove the blank line left behind.

- Save the file and re-import.

For more information check out our full help article here:

Jason_Z

Jason_Z

Thank you

I am new to this community and Reckon One in general and I'd just like to say thank you to all the Reckon staff and members who have helped me since joining.

As a small business owner it's been a learning curve but I've received fast help from this site which I'm very grateful for.

I have another question so will make another post soon if I can't figure it out myself

Geekzone

Geekzone

Passing Stripe fees on to customer

In relation to the new product, Stripe, it seems we still have to bear the cost of the card fee. We currently are with a system where those fees are automatically added to what the customer pays.

We would not consider changing unless Reckon offers the same.

To have the receipts apply to our customer accounts is not particularly appealing as most of our customers pay by bank transfer from their bank direct to our bank with no fees. Works well. If the customer chooses to pay by card, then he/she should pay for that.

Search function by keywords

Re: Merry Christmas & Happy New Year, Reckon Community! 🎅🎆

Belated Merry Christmas everyone, and thankyou to everyone for your hard work and great input & to Rav for being such a great support, knowledge base and sounding board.

I just saw that custom reports are on the horizon, this news is almost better than Christmas 😂🍾🍾

Add 'Search Panes' and 'Account Codes' in Reckon One

Search Panes save time and mitigate choosing an incorrect account. For example:

Add a search pane to the Account Enquiry Report to enable the user to enter a partial account name for the selected accounts option - currently the accounts appear in a drop-down box (account name only - please add account codes). This report also requires an option to exclude Archived Accounts.

A search pane is also required in the Chart of Accounts.