Reckon One Enhancements (26 September 2016)

Hi everyone!

Our Reckon One team have introduced a series of new enhancements to our cloud solution Reckon One which are now live!

Here are some details of what is included in this update;

YTD column on Payslips

Based on user feedback we have added the YTD (Year to Date) column back to payslips. When choosing to print a payslip, or viewing a payslip PDF that is generated when sending the pay slip via email, the YTD column will be visible with the current values since the start of the financial year.

If you would rather not show the YTDcolumn, the same setting that controls the display of the YTD column in a payrun also controls this function.

Customise invoice font size and font type

You can now change the font size and the font type for invoice templates.

There are 3 font sizes (7pt, 9pt or 11pt) and 8 font types available.

Fonts: Arial, Georgia, Lucida Grande, Open Sans, Palatino, Tahoma, Times New Roman and Verdana.

This setting is found by navigating to the following menu: Administration menu > Settings > Manage Invoice Templates

Please note: The invoice template column header labels use font size 7pt regardless of the font size specified for the template and the following invoice template labels have been renamed:

- ‘Invoice address’ has been renamed to ‘Invoice to’

- ‘Shipping address’ has been renamed to ‘Ship to’

- ‘Invoice number’ Has been renamed to ‘Invoice #’

- ‘Reference’ has been renamed to ‘Ref #’

- ‘Payment terms’ has been renamed to ‘Terms’

- ‘Quantity’ has been renamed to ‘Qty’

Standard invoice template EXAMPLE

A more advanced invoice designer with more functionality is coming soon.

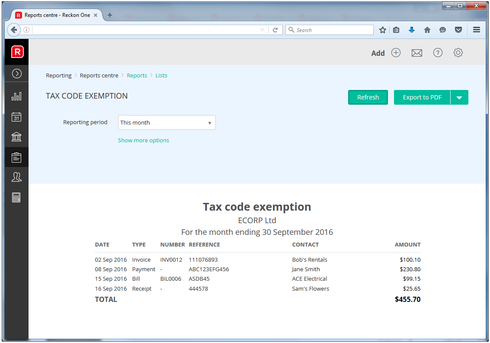

Tax code exemption report

A tax code exemption report is now available. This report shows transactions without a tax code for a given period.

Reporting menu > Report Centre > Category: Lists > Tax code exemption report

Note: NZ users will have a GST code exemption report. UK users will have a VAT code exemption report.

The report allows you to drill down into a transaction when clicking the data in the transaction type column.

The report allows you to drill down on a contact when clicking the data in the contact column.

Tip: When drilling down on reports, we recommend right clicking the drill down entry and select the option ‘Open in a new tab’. This way you won’t override the current report.

Bank Account action button

The bank account list page now shows an Action button for each bank account. The Action button groups the existing action options. More actions will be introduced in future updates and these actions will be made available via the Action button.

Please note: The ‘Add bank payment’ action is currently available in Australian books. This option is used to create bank payment (ABA) files. Bank payment functionality for NZ and UK users will be added in a future update.

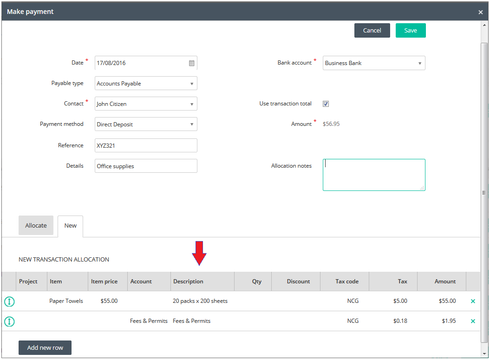

Description column in Payments and Receipts

The description column is now shown in the ‘New’ tab within payments and receipts.

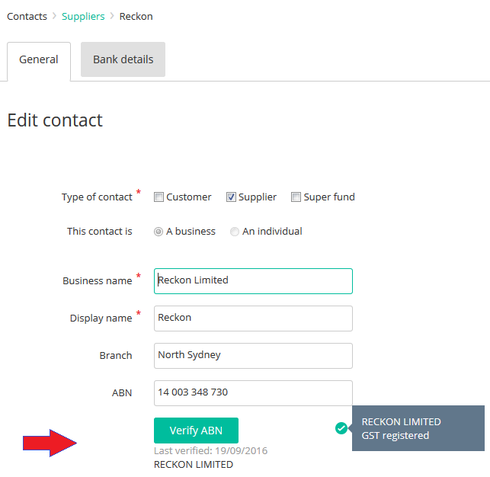

Verifying a Supplier ABN now displays the entity name

When you verify a supplier ABN, Reckon One will now display the entity name for the respective ABN

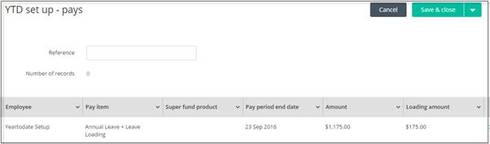

Add Loading column to YTD setup pays

You can now setup Year to Date balances to affect leave loading balances. The YTD set up pays page now includes a new column called Loading Amount. The adding of the loading amount column caters for the previous change of splitting out the leave loading component from annual leave items and showing the loading portion as a separate value.

The Loading amount field works in the following way:

- When the pay item field contains an Annual Leave type item the field becomes editable

- When the Pay item field contains Non Annual leave type items the field is NOT editable

- The entered value against the Amount column field should contain the combined total for Annual Leave and Leave loading components.

- The loading column will perform an automatic calculation to show the loading portion based on the value entered in the Amount field.

Example

The value entered in the Amount field is $1175. This is the total for Annual leave and Leave Loading. The loading amount auto calculates $175.

The Loading column performs the following calculation

Amount field value $1175 divide by 1.175 = $1000.

Amount field value $1175 minus $1000 = $175

Add Option for rounding to Settings

The Payment defaultssection within the general payroll settings has received some minor enhancements.You will now see in the dropdown list for Round to nearest* include a ‘No rounding’ option. In New Books thiswill set as default.