Reckon One Enhancements (9 November 2016)

Rav

Administrator, Reckon Staff Posts: 14,235 Reckon Community Manager

Hi everyone,

Our cloud solution Reckon One has received a seamless update this morning.

This update includes the following changes;

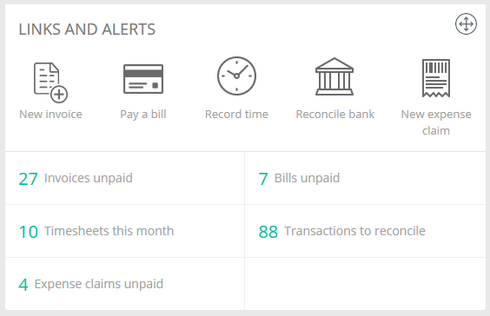

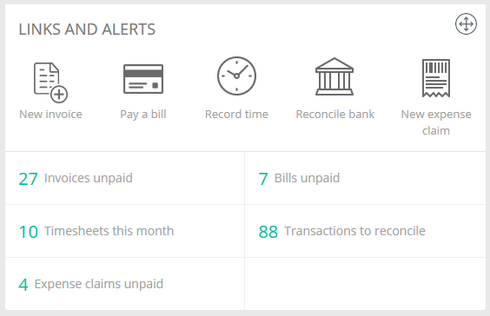

Links & Alerts Widget enhancement

The links and alerts widget now has Timesheet and Expense claim options available. These options are available in books with the time and expense module enabled.

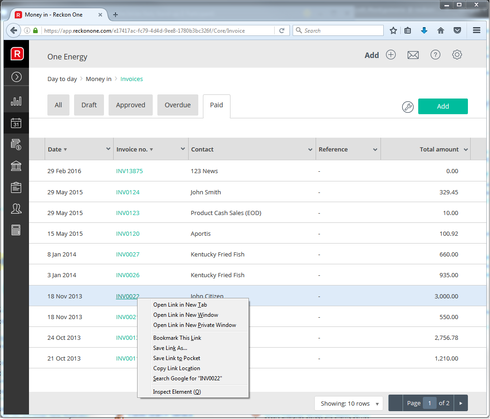

List page enhancement

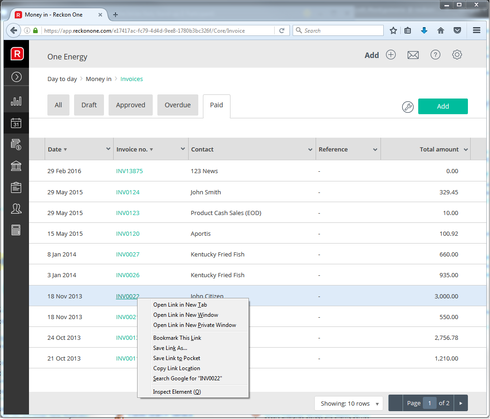

List pages in Reckon One now show a green link for each list entry. Right click functionality is available for these links.

For example, you may want to view an invoice without exiting the invoice list. You can now right click an invoice link and open that invoice in a new browser tab or browser window.

Invoice list page enhancements

These enhancements currently apply to the invoice list and will be added to other list pages in a future update.

The scroll bar position for the invoice list is now retained.

Example: You have configured the invoice list to show 50 rows per page. You are viewing the invoice list and scroll down the list to a specific invoice on row 42. You view this invoice. You then close this invoice. Upon returning back to the invoice list, the scroll position is retained.

The column filter in the invoice list is now retained.

Example: You have configured the date column filter for the ‘All’ tab in the invoice list to only show invoices dated in July 2016 which displays multiple results. After opening then closing the invoice and returning back to the invoice list, the column filter is retained.

The column sort setting in the invoice list is now retained.

Example: You have configured the ‘All’ tab in the invoice list to show entries in date ascending order. You have configured the ‘Paid’ tab in the invoice list to show entries in date descending order. If you navigate away from the invoice list and later return back the sort order is retained.

Remove Super items from Super item inclusions

Previously we included super salary sacrifice items to be a selectable option in the Pay items included section of a Super item. This was to allow employees who salary sacrifice a large chunk of their pay to also receive super on the reduced gross amount beyond the statutory calculated rate of 9.5%.

This change did not have the desired effect and as such we have removed Super salary sacrifice items from the super items inclusions table.

In the future, we will be adding functionality to enable Super to be calculated on the reduced gross amount.

Update Termination Tax YTD calculation

The tax section of a pay run shows tax related information of the current pay run as well as cumulative year to date figures.

When a Termination line appears under the Tax section, the YTD amount displayed did not take into account any values entered via a YTD setup – tax balance transaction that were linked to the ETP tax types.

This has been updated to now include YTD tax balance transactions linked to any of the ETP tax types

EXAMPLE:

YTD Setup - Tax Balance

Navigate to Payroll settings area click on YTD Set Up > Select 'Add Tax Balances' > From the 'Tax Type' column choose either of the ETP options available.

In this example ETP – O has been added with an amount of $5000

Pay run – Termination tax YTD

Create a pay run and the employee setup with YTD tax balance linked to the ETP tax type. In the Employee pay run detail page, add a pay item in the earnings grid that is linked the Termination earnings type.

Navigate down the page to the Tax section. You will notice a termination line has been added. The YTD column reflects the amount entered in the YTD tax balance transaction.

Update Super pay items to have editable rate and display error on delete (if relevant)

The employee pay run detail page now gives you the ability to change the rate for super related items on the fly.

This update applies to super items added to the ‘Deductions & Employee super contributions’ and ‘Company summary’ area of the pay run. When super items are loaded into a pay run you can click into the Rate field and the Rate field becomes editable. The Rate field becomes active as the soon as Super item is added to a pay.

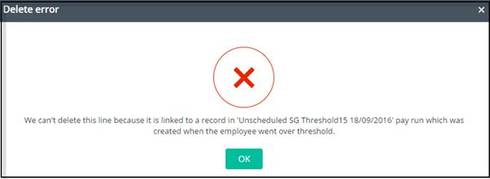

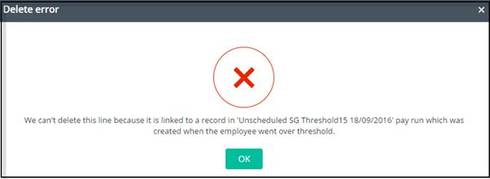

Also, the following warning dialog has been added when attempting to delete either a Super SG/CA pay item from a pay run.

The warning will appear if the Super SG/CA line contains a $0.00 amount due to the employee gross pay being less than the $450 monthly threshold, and if super is calculated in a subsequent pay run where the employee monthly gross earnings is above the $450 threshold.

In order to delete the Super SG/CA from the pay run, pays created after the pay in question within the same month need to be deleted first.

Add related super pay items when new pay items added.

To ensure payroll users do not overlook not paying an employee’s super, we have enhanced the pay run functionality to include super when an item has been added to the Earnings & Leave area.

When an Earnings type or leave type item is added, if the current pay run does not contain super, it will check the employees pay setup for the relevant super item.

If the employees pay set up contains super, then this will be automatically added to the pay run. If the employees pay setup does not contain super, then super is not added to the pay run.

Our cloud solution Reckon One has received a seamless update this morning.

This update includes the following changes;

Links & Alerts Widget enhancement

The links and alerts widget now has Timesheet and Expense claim options available. These options are available in books with the time and expense module enabled.

- Clicking the Time icon opens a new timesheet.

- Clicking the timesheet counter opens the timesheet list.

- Clicking the expense claim icon opens a new expense claim.

- Clicking the expense claim counter opens the expense claim list.

List page enhancement

List pages in Reckon One now show a green link for each list entry. Right click functionality is available for these links.

For example, you may want to view an invoice without exiting the invoice list. You can now right click an invoice link and open that invoice in a new browser tab or browser window.

Invoice list page enhancements

These enhancements currently apply to the invoice list and will be added to other list pages in a future update.

The scroll bar position for the invoice list is now retained.

Example: You have configured the invoice list to show 50 rows per page. You are viewing the invoice list and scroll down the list to a specific invoice on row 42. You view this invoice. You then close this invoice. Upon returning back to the invoice list, the scroll position is retained.

The column filter in the invoice list is now retained.

Example: You have configured the date column filter for the ‘All’ tab in the invoice list to only show invoices dated in July 2016 which displays multiple results. After opening then closing the invoice and returning back to the invoice list, the column filter is retained.

The column sort setting in the invoice list is now retained.

Example: You have configured the ‘All’ tab in the invoice list to show entries in date ascending order. You have configured the ‘Paid’ tab in the invoice list to show entries in date descending order. If you navigate away from the invoice list and later return back the sort order is retained.

Remove Super items from Super item inclusions

Previously we included super salary sacrifice items to be a selectable option in the Pay items included section of a Super item. This was to allow employees who salary sacrifice a large chunk of their pay to also receive super on the reduced gross amount beyond the statutory calculated rate of 9.5%.

This change did not have the desired effect and as such we have removed Super salary sacrifice items from the super items inclusions table.

In the future, we will be adding functionality to enable Super to be calculated on the reduced gross amount.

Update Termination Tax YTD calculation

The tax section of a pay run shows tax related information of the current pay run as well as cumulative year to date figures.

When a Termination line appears under the Tax section, the YTD amount displayed did not take into account any values entered via a YTD setup – tax balance transaction that were linked to the ETP tax types.

This has been updated to now include YTD tax balance transactions linked to any of the ETP tax types

EXAMPLE:

YTD Setup - Tax Balance

Navigate to Payroll settings area click on YTD Set Up > Select 'Add Tax Balances' > From the 'Tax Type' column choose either of the ETP options available.

In this example ETP – O has been added with an amount of $5000

Pay run – Termination tax YTD

Create a pay run and the employee setup with YTD tax balance linked to the ETP tax type. In the Employee pay run detail page, add a pay item in the earnings grid that is linked the Termination earnings type.

Navigate down the page to the Tax section. You will notice a termination line has been added. The YTD column reflects the amount entered in the YTD tax balance transaction.

Update Super pay items to have editable rate and display error on delete (if relevant)

The employee pay run detail page now gives you the ability to change the rate for super related items on the fly.

This update applies to super items added to the ‘Deductions & Employee super contributions’ and ‘Company summary’ area of the pay run. When super items are loaded into a pay run you can click into the Rate field and the Rate field becomes editable. The Rate field becomes active as the soon as Super item is added to a pay.

Also, the following warning dialog has been added when attempting to delete either a Super SG/CA pay item from a pay run.

The warning will appear if the Super SG/CA line contains a $0.00 amount due to the employee gross pay being less than the $450 monthly threshold, and if super is calculated in a subsequent pay run where the employee monthly gross earnings is above the $450 threshold.

In order to delete the Super SG/CA from the pay run, pays created after the pay in question within the same month need to be deleted first.

Add related super pay items when new pay items added.

To ensure payroll users do not overlook not paying an employee’s super, we have enhanced the pay run functionality to include super when an item has been added to the Earnings & Leave area.

When an Earnings type or leave type item is added, if the current pay run does not contain super, it will check the employees pay setup for the relevant super item.

If the employees pay set up contains super, then this will be automatically added to the pay run. If the employees pay setup does not contain super, then super is not added to the pay run.

0

This discussion has been closed.