Reckon One Enhancements (24 November 2016)

Rav

Administrator, Reckon Staff Posts: 14,235 Reckon Community Manager

Hi everyone!

Reckon One has received an update today which has brought in a new range of functionality, including a significant change to the email process.

Check out the details of the update below.

CHANGES TO EMAILING WITH RECKON ONE

Yahoo, Gmail and Microsoft are some of the larger email service provides to update their DMARC policy. DMARC (Domain Message Authentication Reporting and Conformance) is an email-validation system designed to detect and prevent email spoofing by verifying that an inbound email really does come from the domain it says it comes from.

What this means…

No one other than Yahoo (the entity itself) can send from “@yahoo.com”.

No one other than Gmail (the entity itself) can send from “@gmail.com”.

No one other than Microsoft (the entity itself) can send from “@hotmail.com”, “@outlook.com”, “@live.com” or “@msn.com”.

What does this mean for Reckon One?

Previously Reckon One allowed users to set a custom ‘from’ email address for emails sent via Reckon One. Moving forward, Reckon One will no longer be able to allow users to set custom ‘from’ email addresses.

Emails sent via Reckon One will use a Reckon email address: email-reckonone@reckon.com.

Reckon One will allow users to set a custom display name and a custom reply to email address for this Reckon email address.

To access these settings, select the Administration menu > Settings > Business settings

The Reply to email address option allows users to set a reply to email address for the Reckon email address.

The Show emails as being sent from option allows users to set a display name for the Reckon email address.

Example:

Ricks Golf Supplies Pty Ltd has configured their Reckon One book email settings as follows:

- Reply to email address ‘contactus@ricksgolf.com.au’

- Show emails as being sent from ‘Ricks Golf Supplies’

The Reckon One user (Ricks Golf Supplies Pty Ltd) emails an invoice via Reckon One to their customer, John Citizen.

John Citizen receives the email to his Gmail account.

The email is sent from email-reckonone@reckon.com and uses the custom display name (Ricks Golf Supplies) as set in Reckon One.

John Citizen replies to the email, the ‘reply to’ email address uses the custom ‘reply to’ email address (contactus@ricksgolf.com.au) as set in Reckon One.

SIMPLIFIED SETUP WIZARD

The Reckon One book setup wizard has been simplified into a single page to provide a quick and simple setup experience.

Australian example:

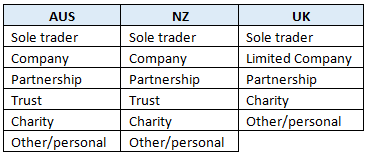

The entity types available for each region are:

SIMPLIFIED CHART OF ACCOUNTS

The book setup wizard now uses a simplified charts of accounts for new books.

Australian example:

New Zealand example:

United Kingdom example:

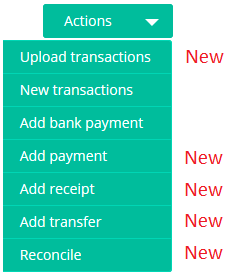

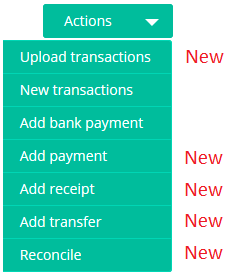

BANK ACCOUNT ACTIONS

Additional actions are now available to the bank account action button.

b) If the account hasn’t previously been reconciled then one month from the bank account start date.

c) If the account hasn’t previously been reconciled and the account doesn’t have a start date configured then one month from the book start date.

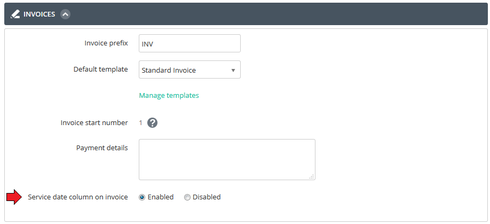

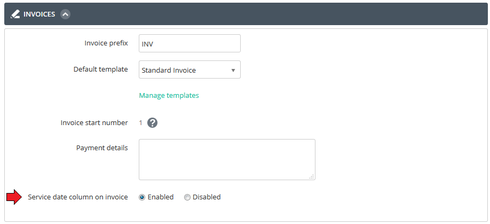

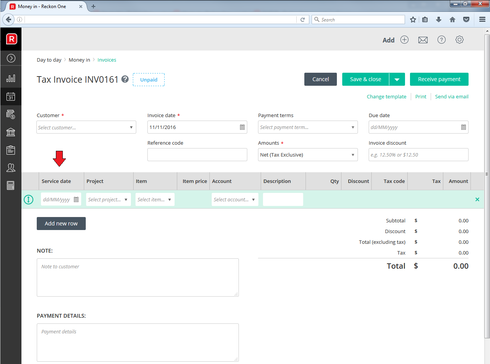

INVOICE SERVICE DATES

You can now set service dates to invoice lines in Reckon One!

This functionality is available as part of the medium level invoice module.

To enable the service date functionality, select the Administration menu > Settings > Day to day > Money in > Invoices > Set ‘Service date column on invoice’ to Enabled and save changes.

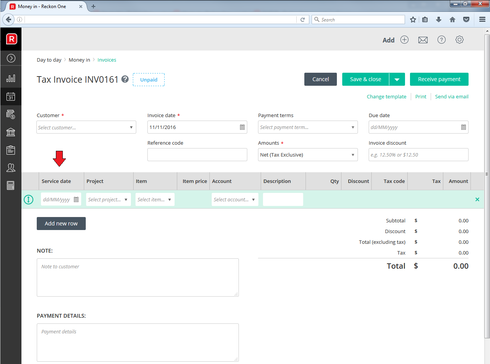

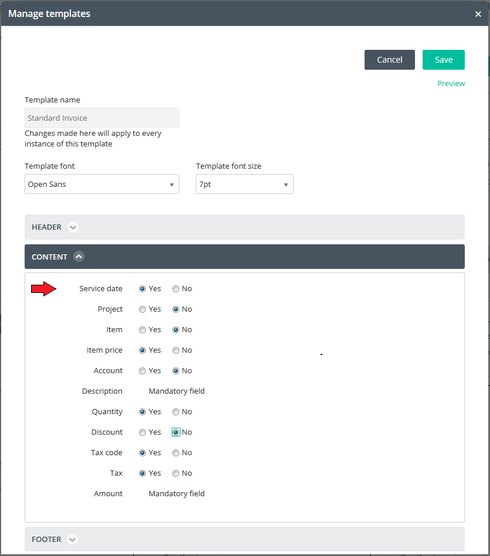

What happens when the service date feature is enabled?

The service date column is added to the invoice page. The invoice template configuration is updated to show the service date column.

What happens when the service date feature is disabled?

The service date column is removed from the invoice page. The invoice template configuration is updated to hide the service date column.

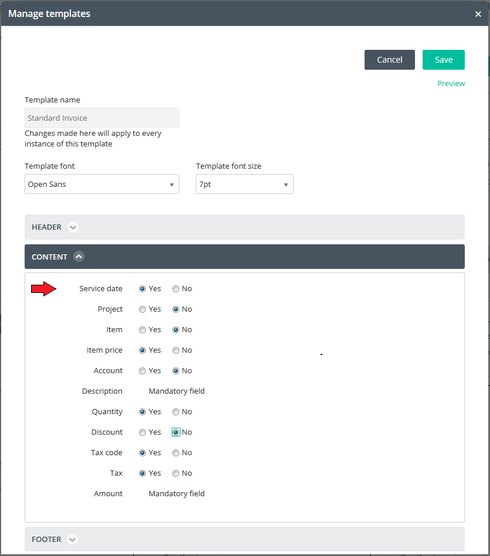

If you want to use the service date feature for internal use only (display the service date column on the invoice form and hide the service date column on the invoice template), you can update the invoice templates and hide the service date column. To update an invoice template, select Administration menu > Settings > Day to day > Money in > Invoices > Manage templates > Select the template > Expand the ‘Content’ option and set ‘Service date’ to ‘No’.

TAX LIABILITY ACCOUNTS AVAILABLE IN PAYMENTS AND RECEIPTS

Tax liability accounts are now available for use in payment and receipt transactions!

See the information below for a list of the system tax liability accounts for each region.

NEW TAX LIABILITY ACCOUNT

An additional tax liability account has been added to Reckon One.

This account can be used to track your tax liability payments and refunds.

Australian books have a new system tax account ‘ATO - Integrated Client Account’.

The system tax liability accounts for Australian books are:

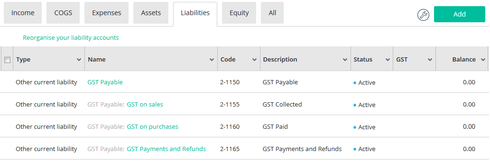

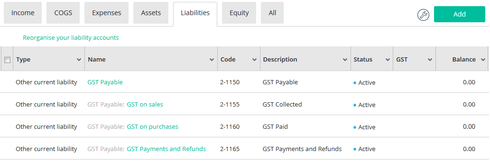

New Zealand books have a new system GST account ‘GST Payments & Refunds’.

The system tax liability accounts for New Zealand books are:

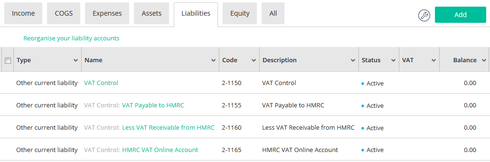

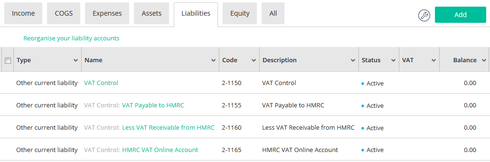

United Kingdom books have a new system VAT account ‘HMRC VAT Online Account’.

The system tax liability accounts for United Kingdom books are:

ENHANCED PAGE HEADERS

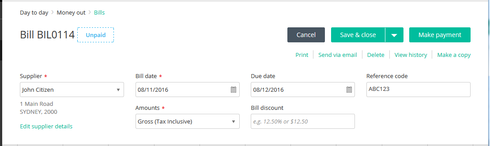

The new page header layout introduced in a recent release has now been applied to estimates, customer adjustment notes, bills, supplier adjustment notes, expense claims, journals and chart of account accounts pages.

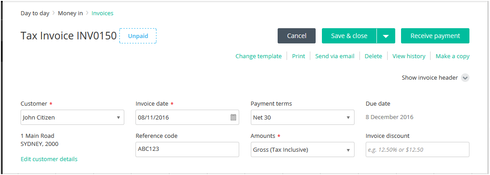

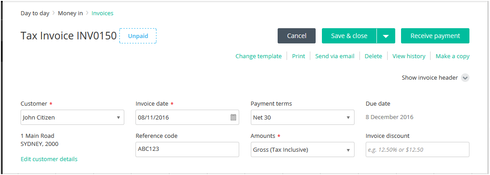

Here is an example of the invoice page header layout

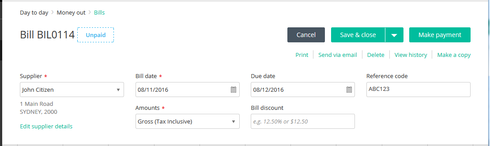

Here is an example of the bill page header layout

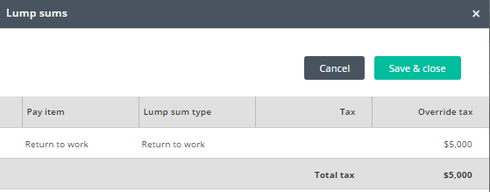

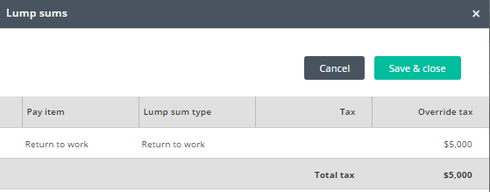

UPDATE TAX AND PAYMENT SUMMARY TRANSACTIONS FOR LUMP SUM & TERMINATION PAY ITEMS

Tax Applicable - Return to Work

Return to work payments is used to entice an employee to resume work with a company. These are generally in the form of a lump sum amount.

In Reckon One payroll, Earnings pay items linked to Tax applicable – Return to work will show as a line entry in the Lump sum tax light box when added to a pay run. You can enter the Lump sum tax light box and enter a tax value against the Return to work line

Amounts entered in the earnings grid for Return to Work linked pay items will also populate in the INB Payment summary Lump sum E field.

Tax Applicable – Additional payment method A, B(i) & B(ii)

Amounts entered against items linked to tax applicable options - Additional payment method A, Additional payment method B(i) and Additional payment method B(ii) will now automatically populate on the INB payment summary. Currently the user needs to enter an YTD transaction to display the data on the INB payment summary.

Termination type – Annual leave & Long service leave not accumulated in the system

During a termination pay run when termination items are added that have a termination type of ‘Annual leave not accumulated in the system’ or ‘long service leave not accumulated in the system’, the Termination tax line will no longer appear under the tax section. The Tax engine within the pay run already handles the tax for these types of termination items.

NOTE: The Termination line under the tax grid will still appear for all other Termination types

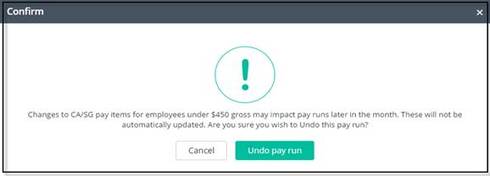

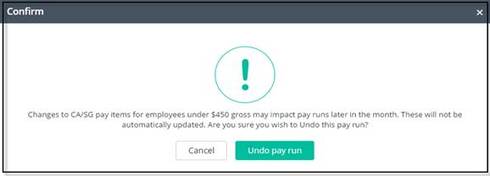

Warning message for Collective agreement super items

When undoing a pay run, if payroll detects that a pay run includes pays for employees who earn less than $450 gross and have super added in a subsequent pay run when they pass the $450 monthly threshold a warning message will display. The Warning message text has been updated and extended to look at super items set to collective agreements.

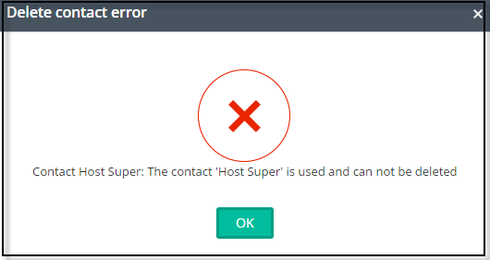

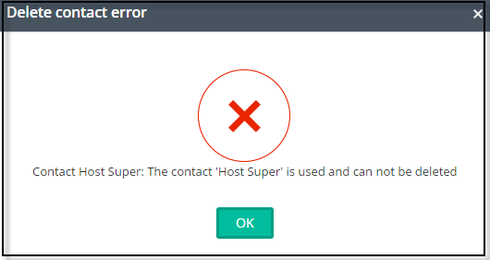

VIEW CHECK IF SUPER FUND IS IN USE

Additional validation checks have been included around the deleting of a super fund contact. If a user attempts to delete a super fund contact the following will occur:

Reckon One has received an update today which has brought in a new range of functionality, including a significant change to the email process.

Check out the details of the update below.

CHANGES TO EMAILING WITH RECKON ONE

Yahoo, Gmail and Microsoft are some of the larger email service provides to update their DMARC policy. DMARC (Domain Message Authentication Reporting and Conformance) is an email-validation system designed to detect and prevent email spoofing by verifying that an inbound email really does come from the domain it says it comes from.

What this means…

No one other than Yahoo (the entity itself) can send from “@yahoo.com”.

No one other than Gmail (the entity itself) can send from “@gmail.com”.

No one other than Microsoft (the entity itself) can send from “@hotmail.com”, “@outlook.com”, “@live.com” or “@msn.com”.

What does this mean for Reckon One?

Previously Reckon One allowed users to set a custom ‘from’ email address for emails sent via Reckon One. Moving forward, Reckon One will no longer be able to allow users to set custom ‘from’ email addresses.

Emails sent via Reckon One will use a Reckon email address: email-reckonone@reckon.com.

Reckon One will allow users to set a custom display name and a custom reply to email address for this Reckon email address.

To access these settings, select the Administration menu > Settings > Business settings

The Reply to email address option allows users to set a reply to email address for the Reckon email address.

The Show emails as being sent from option allows users to set a display name for the Reckon email address.

Example:

Ricks Golf Supplies Pty Ltd has configured their Reckon One book email settings as follows:

- Reply to email address ‘contactus@ricksgolf.com.au’

- Show emails as being sent from ‘Ricks Golf Supplies’

The Reckon One user (Ricks Golf Supplies Pty Ltd) emails an invoice via Reckon One to their customer, John Citizen.

John Citizen receives the email to his Gmail account.

The email is sent from email-reckonone@reckon.com and uses the custom display name (Ricks Golf Supplies) as set in Reckon One.

John Citizen replies to the email, the ‘reply to’ email address uses the custom ‘reply to’ email address (contactus@ricksgolf.com.au) as set in Reckon One.

SIMPLIFIED SETUP WIZARD

The Reckon One book setup wizard has been simplified into a single page to provide a quick and simple setup experience.

Australian example:

The entity types available for each region are:

SIMPLIFIED CHART OF ACCOUNTS

The book setup wizard now uses a simplified charts of accounts for new books.

Australian example:

New Zealand example:

United Kingdom example:

BANK ACCOUNT ACTIONS

Additional actions are now available to the bank account action button.

- Select Upload transactions to upload a bank statement (CSV, TXT or QIF) file for the account.

- Select New transactions to access an existing upload for the account.

- Select Add bank payment to create a new bank payment (ABA) file for the account.

- Select Add payment to create a new payment for the account.

- Select Add receipt to create a new receipt for the account.

- Select Add transfer to create a new transfer for the account.

- Select Reconcile to reconcile the account.

- The Add bank payment option is available to Australian books.

- The Reconcile option will display the reconciliation page for the account. The default reconciliation period is as follows:

b) If the account hasn’t previously been reconciled then one month from the bank account start date.

c) If the account hasn’t previously been reconciled and the account doesn’t have a start date configured then one month from the book start date.

INVOICE SERVICE DATES

You can now set service dates to invoice lines in Reckon One!

This functionality is available as part of the medium level invoice module.

To enable the service date functionality, select the Administration menu > Settings > Day to day > Money in > Invoices > Set ‘Service date column on invoice’ to Enabled and save changes.

What happens when the service date feature is enabled?

The service date column is added to the invoice page. The invoice template configuration is updated to show the service date column.

What happens when the service date feature is disabled?

The service date column is removed from the invoice page. The invoice template configuration is updated to hide the service date column.

If you want to use the service date feature for internal use only (display the service date column on the invoice form and hide the service date column on the invoice template), you can update the invoice templates and hide the service date column. To update an invoice template, select Administration menu > Settings > Day to day > Money in > Invoices > Manage templates > Select the template > Expand the ‘Content’ option and set ‘Service date’ to ‘No’.

TAX LIABILITY ACCOUNTS AVAILABLE IN PAYMENTS AND RECEIPTS

Tax liability accounts are now available for use in payment and receipt transactions!

See the information below for a list of the system tax liability accounts for each region.

NEW TAX LIABILITY ACCOUNT

An additional tax liability account has been added to Reckon One.

This account can be used to track your tax liability payments and refunds.

Australian books have a new system tax account ‘ATO - Integrated Client Account’.

The system tax liability accounts for Australian books are:

New Zealand books have a new system GST account ‘GST Payments & Refunds’.

The system tax liability accounts for New Zealand books are:

United Kingdom books have a new system VAT account ‘HMRC VAT Online Account’.

The system tax liability accounts for United Kingdom books are:

ENHANCED PAGE HEADERS

The new page header layout introduced in a recent release has now been applied to estimates, customer adjustment notes, bills, supplier adjustment notes, expense claims, journals and chart of account accounts pages.

Here is an example of the invoice page header layout

Here is an example of the bill page header layout

UPDATE TAX AND PAYMENT SUMMARY TRANSACTIONS FOR LUMP SUM & TERMINATION PAY ITEMS

Tax Applicable - Return to Work

Return to work payments is used to entice an employee to resume work with a company. These are generally in the form of a lump sum amount.

In Reckon One payroll, Earnings pay items linked to Tax applicable – Return to work will show as a line entry in the Lump sum tax light box when added to a pay run. You can enter the Lump sum tax light box and enter a tax value against the Return to work line

Amounts entered in the earnings grid for Return to Work linked pay items will also populate in the INB Payment summary Lump sum E field.

Tax Applicable – Additional payment method A, B(i) & B(ii)

Amounts entered against items linked to tax applicable options - Additional payment method A, Additional payment method B(i) and Additional payment method B(ii) will now automatically populate on the INB payment summary. Currently the user needs to enter an YTD transaction to display the data on the INB payment summary.

Termination type – Annual leave & Long service leave not accumulated in the system

During a termination pay run when termination items are added that have a termination type of ‘Annual leave not accumulated in the system’ or ‘long service leave not accumulated in the system’, the Termination tax line will no longer appear under the tax section. The Tax engine within the pay run already handles the tax for these types of termination items.

NOTE: The Termination line under the tax grid will still appear for all other Termination types

Warning message for Collective agreement super items

When undoing a pay run, if payroll detects that a pay run includes pays for employees who earn less than $450 gross and have super added in a subsequent pay run when they pass the $450 monthly threshold a warning message will display. The Warning message text has been updated and extended to look at super items set to collective agreements.

VIEW CHECK IF SUPER FUND IS IN USE

Additional validation checks have been included around the deleting of a super fund contact. If a user attempts to delete a super fund contact the following will occur:

- If super fund has not been assigned to an employee or exist in a pay run the deletion will be successful

- If super fund has been assigned to an employee, used in a pay run the following message will appear

0

This discussion has been closed.