Reversing Salary Sacrifice & paying e'ee, since it was returned from super fund

Hi, I saw this question from 2016, and I have the same problem.

John Graetz Member Posts: 1,658 ✭✭✭ January 2016 edited July 2020

This matter has been resolved. The item in question was for salary sacrifice super. A slightly different approach was needed to effect a reversal, but it has worked. John L G

Mine too is salary sacrifice and I can't get rid of the minus sign. I use Reckon Desktop Accounts Plus 2020. Unfortunately the "slightly different answer" was not explained. Could this be explained please?

Comments

-

Dear Jean,

This would require you to journal the reverse payments and ensure they can be pushed via a holding account, as you cannot have a negative figure inside a payslip if it is not a tax item or deduction.

Regards,

Alexander.

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

Dear Alexander, I don't follow how this remedy would correct the situation in the payroll. It effects what is reported via STP, the reportable super total, and the tax will need to be calculated. It relates to payroll in October, and subsequently when the super was paid to the super fund it was rejected in January. The returned super deposit is currently in a "clearing account", awaiting how to fix it in the payroll.

0 -

Dear Jean,

At this stage, it might be wisest to seek out an accountant or book keeper to manage the transactions in the clearing account for you, as I initially believed this to be a software issue. I do apologise for any confusion.

Alexis McKeown

Reckon Senior Technical Support

Working hard since 20180 -

I am an accountant. I don't need to know how to manage the clearing account. I just need how in Reckon to do the entry to reflect in the payroll records please and allow Reckon to send the STP after the rebank is entered.

0 -

The only other way I can see to do this, is to go back and amend the October payroll, by removing the salary sacrifice, and paying the employee's bank account now.

Then doing an adjustment run for the STP for October.

Not a very elegant solution as it will put bank rec out from October to February by this entry., resolving only when I pay out to the employee's bank account.

Isn't there any way to just do an adjustment? Like minus out in Salary Sacrifice which will make a positive final payment less pro rata tax, to be paid to the employee?

0 -

At least the bank adjustment would fall into the financial year, I agree with your choice and see no problem with it

0 -

Thank you for your reply. I agree it will work. It is just that it isn't a good way to present the chain of transactions. We did not know back in October that it would be rejected. It wasn't rejected until January. A much better reflection of when things happened is if a negative salary sacrifice could be entered now, in February. That is how I would like it to appear. There will be no future salary sacrifice allowed due to ATO rules,ever, for this employee from October.

0 -

No a negative entry is not possible, and I would just enter notes in the deposit to explain to anyone looking back down the track. Should be a simple fix, you will have to manually change the tax to what was taken out if it was a salary sacrifice before tax

0 -

@Jean, @Alexander McKeown & @Kris_Williams

The correct way to record this is via Deposit Refund of Liabilities (under the Employees dropdown menu > Payroll Taxes & Liabilities)

This allows you to select the Payee (eg Super Fund Supplier), refund the relevant Payroll Item into the bank account on the correct deposit date (or deposit with other funds) & also choose the applicable period to be affected:

0 -

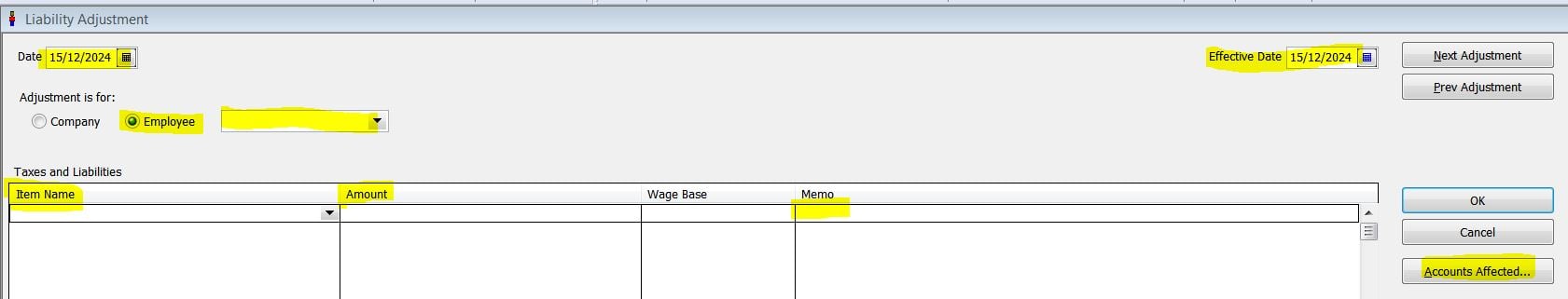

To correct the employee's record, do the same adjustment under Adjust Payroll Liabilities for the specific employee, selecting NOT to affect accounts.

You can choose to submit an "Update Event" for STP or wait until you submit the Final EOFY STP Submission for the year when all final employee YTD balances - incl any corrections - will be automatically updated.

0 -

I have figured out and implemented a tidy solution different to any above. However I am disappointed that the Reckon software isn't up to accommodating a straight reversal adjustment in an unscheduled pay run in the current month. Now no bank rec is out of balance from October onwards, and all I need to do is sent a replacement STP file to the ATO for October to show there is no Salary Sacrifice in October now. And of course, pay the employee. Nice and tidy.

1 -

Hi Shaz, your solution wasn't there when I wrote last, my solution was to change the October sal.sac. to a deduction, coded so that the net pay was still the same as it was.

Then in Feb. I did an unsched.payrun to "pay" the deduction back, and included approp.tax, and it all seems to have worked ok. The Payroll Summary is all correct. Similar to yours, the STP will need to be updated for October to show the removal of sal.sac .

I like your solution better, it appears to be a more professional way of doing it. But since the accounting has turned out ok, I will leave my solution as is.

Many thanks,

Jean.

1 -

Hi @Acctd4 and @Jean - I'm having the same salary sacrifice issue.... the "more professional" solution doesn't seem to work for me.... perhaps I'm misunderstanding, but when I tried to use adjust payroll liabilities to amend the super salary sacrifice for the employee the following pop up came up "You have chosen a payroll item that cannot be adjusted. You can only adjust tax payroll items". I don't understand how this solution would then result in the refund being paid to the employee and tax being adjusted in any case - is this another transaction?

I am going to attempt to use Jean's solution, once the refund comes back to us!

0 -

Hi Brooke

" ... I don't understand how this solution would then result in the refund being paid to the employee and tax being adjusted in any case - is this another transaction ..?

What is your specific scenario? What needs to be refunded & why? My previous info is to adjust & correct your records in RA/RAH (If the ' ... can't adjust ...' message pops up, you'll need to select Company rather than Employee).

0 -

Thanks Shaz @Acctd4 :) We have paid salary sacrifice super to our clearing house and it has been refunded due to employee's ineligibility (recently turned 75) and so we need to pay it to the employee (deducting appropriate tax). This happened in August. As Reckon will not allow you to process a 'positive' super salary sacrifice, I am trying to work out how to process the payment so it is reflected correctly....

0 -

This will be a multi-step process - the first is to receive the Refund - via my instructions above for Deposit Refund of Liabilities (This will correctly receive the funds back into your account as per your bank transactions & make this liability reflect as "owing" again)

Depending on how you have been accruing/reporting this amount in the Payroll will determine how you will need to correct it in there - You should be able to just adjust the liability - as per my instructions above for Adjust Payroll Liabilities - to clear it out of your Payroll.

I would then just create a new Paycheque (using the usual Payroll Item for this employee as that would be where this amount originated from), allow the system to calculate PAYG & Super accordingly, then pay the net amount to the employee as per normal.

0 -

Thanks so much Shaz, your assistance is very much appreciated!

1