Reckon One two software ID

Hi, we're having trouble submitting the last pay run to ATO.

First software ID, we tried branch 001 or002, and still encountering error.

Second software ID, we tried branch 001 or 002, still the same.

The issue is, before submitting the last pay run's to ATO first, we did setup the new STP phase 2, the one where you have to manually enter branch ID. Initially we used 002, although we havent clicked on switching to the new payroll system.

I think this is what triggered to have two software ID. Please note we already registered the second ID to ATO this week.

Why we cannot submit the recent payrun under the old version, is a puzzle. Should we just delete the last pay run and switch to new payroll?

We reverted to 001 in book settings and still the same, unable to submit STP to ATO.

Thank you.

Comments

-

Just adding to @klaura's advice above.

Your ABN is registered to the default 001 branch which is what you've been using for submissions until now. Please ensure that you have entered 001 in the branch number field in your Reckon One book (Settings ➡️ Book Details ➡️ Branch Number) as shown in Karren's post above 🙂

0 -

thanks for responding. i have not switched to phase 2 yet for FN ending 27 August payrun. My payrun is still based on phase 1.

I rang ATO, according to them, branch ID should be 002 as 001 is only for income tax.

ATO also advised, the data I have been trying to send, they are actually receiving them. So the issue is, reckon is showing status as error.

I think I should not reattempt sending data again, as ATO already has them. For the next fortnight, I will switch to phase 2, and try to lodge using 002 branch.

RAV, please advise if this step is the right way.

Thanks

0 -

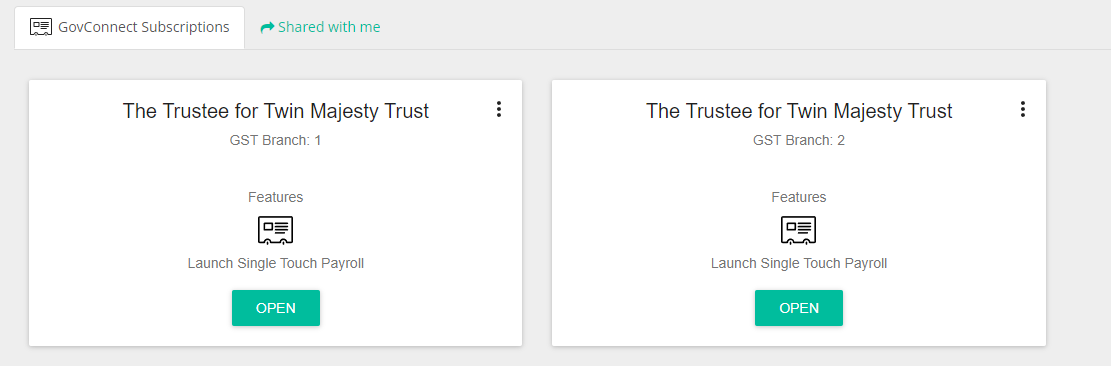

if I use 001, the data will appear under Branch 1, and if I change 002, it appears on the second.

0 -

What is the ABN you are using with Reckon One & Reckon Payroll?

0 -

Rav can you please check 76876120947.

Thanks

0 -

Hi @twinning

It looks as though you've been using the default branch 001 for your submissions up to now. Please ensure that you enter 001 into the book settings as outlined above and your submissions will just continue on as normal with Reckon Payroll.

Cheers 🙂

0 -

thanks Rav, we are switching to phase 2 in this weeks payrun. The last payruns error in Reckon, do we just ignore that? Although ATO advised they received the data anyway.

0 -

What was the specific error messages you received for those pay runs?

Also, before you sent those pay runs, did you enter or change your branch number to 002 in Reckon Payroll during the company setup process?

0 -

"Also, before you sent those pay runs, did you enter or change your branch number to 002 in Reckon Payroll during the company setup process?"

this is what happened, entered 002 during setup.

0 -

What was the specific error messages you received for those pay runs sent under branch 002?

0 -

Hi Rav:

ATO Messages

The following error messages have been returned from the ATO and need to be reviewed. You may need to make changes in your accounting product before submitting again.

- The value specified for an item does not match the item type (value = "", item type = String, uniqueID = http://www.sbr.gov.au/ato/payevntemp:PostcodeT) Hint: The Pattern constraint failed.

0 -

That message means there is a missing postcode in either your company information (Settings ➡️ Company Details) or an employee profile.

If any of the submissions you sent under branch 002 were successful then you'll need to zero out those submissions before reverting your branch back to 001 in your Reckon One book. You can do this by creating, and sending an EOFY finalisation for branch 002 and selecting the toggle option to set all your balances to 0.00.

Once that is done, switch the branch number in your Reckon One book settings back to 001 and then continue on as normal.

0 -

you are correct, theres missing post code in the new employee pay run.

how do i know which branch was the last successful payrun?

0 -

all my successful lodgments are on the left side only.

am guessing left side is branch 001? all attempts on branch 2 below are errors.

0 -

ok, some good news, i set last payruns to draft, and resubmitted. and under Branch 1, it became a success this time, no more errors.

next question, for this incoming payrun, should I change branch to 002 before switching to phase 2?

or leave it at 001, then switch to phase 2?

0 -

is it going to cause an issue if I have two branch setup? how do we delete branch 2? or should I call ATO to deregister the second software ID?

0 -

Hi Rav, any comment on the above issue? is it ok to leave it like that with two software id and branches?

0 -

Hi @twinning

We can't delete the branch 2 registration because there have been submissions sent under it however there's no issue with it remaining as is. I would strongly recommend that you do the steps to zero out the balances sent under branch 002 as outlined in my earlier reply above prior to switching back to 001.

0 -

but I have already switched back to 001 and resubmitted to ATO, which was a success.

all of submissions in 002 are in errors.

0 -

Hello Rav, what happens now that I submitted under 001 which is showing success in govconnect? does this mean ato sees that the employees earned two incomes because of doubling up of submissions?

i dont get the zeroing out of YTD. why should I do that when i already chnaged to 001 and successfully submitted to AtO?

0 -

There is no doubling up of submissions when it comes to STP since its reported on a Year to Date basis only.

In regard to your reluctance on zeroing out the submissions you've sent under branch 002, hopefully this can add a bit more context - From what I've been previously advised STP submissions are processed under a partial acceptance model which means that although those submissions sent under 002 returned an error, that error could have only been for one employee. Whereas any other employees included in those submissions which the error didn't apply to would have gone through.

Ultimately, its up to you whether you wish to send through the zero submission under branch 002 however I'm just recommending it to keep things clean and simple for you.

0 -

ok will check it.

We have option to delete the second software ID in Ato. should we just remove it? at least only the first Software ID will be sending data each payrun.

0 -

Yes you can do that if you'd like to however removing the software ID for the branch 002 registration should only be done after you've sent the zero submission if you decide to send it.

0 -

Hi Rav, i did eofy under 002 and the details are showing zero earnings for all employees, which is how it should be then?

can I now switch to phase2 under 001? just concerned the next payrun will not show proper YTD values.

0 -

Hi twinning,

Stepping in for Rav today.

Yes, you can now switch to STP ph 2 under the 001 branch. Since you have done the NIL submission under the 002 branch, you may delete the duplicate pay runs in Reckon one before switching to STP Ph 2. This is to ensure you have the correct summary when you upgrade to STP Ph 2.

Kind regards,

1