Reckon Payroll - STP Phase 2 double recording one of the payrun

Hi, I am using Reckon One (transferred to Reckon Payroll STP Phase 2) and I accidentally doubled recording one of the payrun (I submitted twice from the same payrun). The STP pre-fill on BAS has also recorded double amount of the same payrun.

How can I reverse/delete one of the payrun from the ATO?

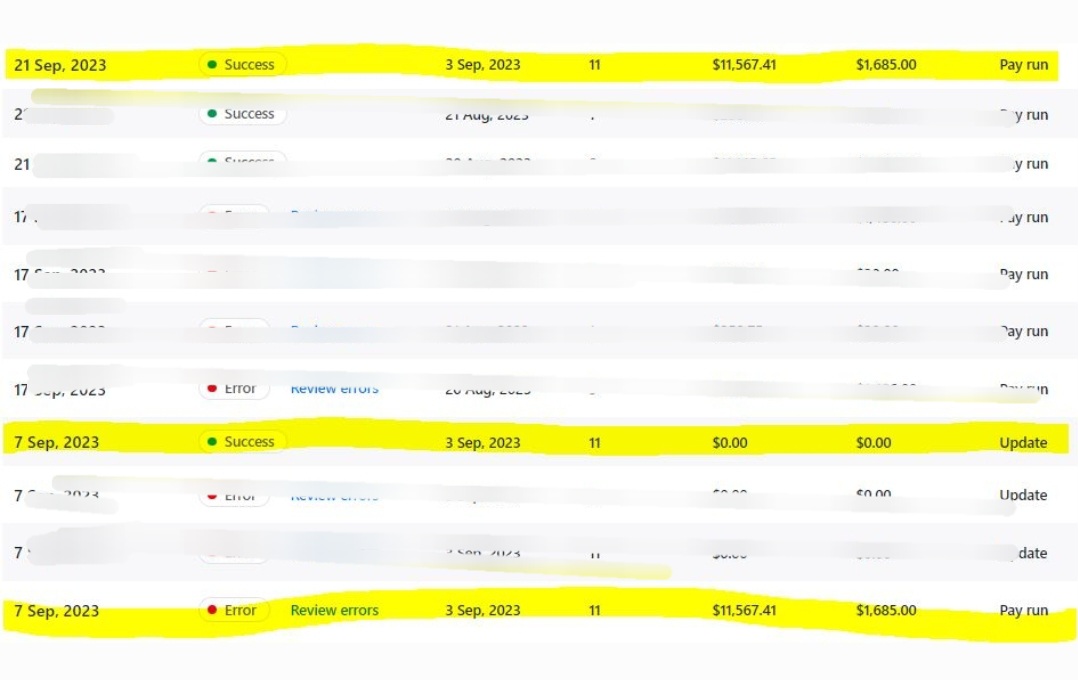

From the first time it came out error, so resubmit with update event. I didn't expect it pick up as usual and I resubmit without adjustment tick, that's why doubled up.

Thanks for your help,

Louise

Answers

-

Hi Louise

Can you let me know where you're seeing those inflated BAS figures? Is it within the ATO Portal itself?

Are the pre-fill fields editable? ie. are you able to amend the balances that have currently been pre-filled?

0 -

Hi Rav,

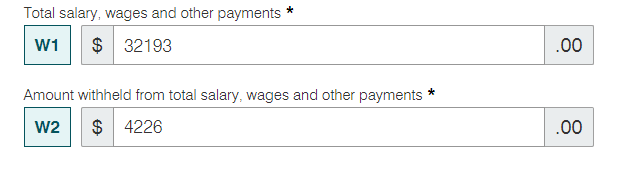

ATO recently has a STP pre-fill in BAS form. Once you lodged your STP reporting, it automatically calculate and adjusted the total amount of the month or quarterly Gross fig and Withholding Tax fig. e.g. below is from ATO portal (BAS form):

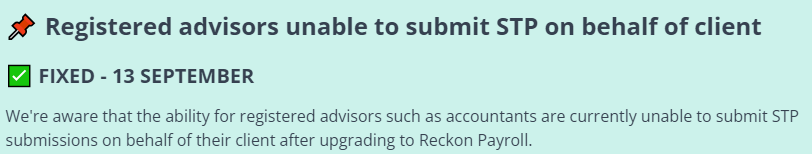

The pre-fill fields editable, but it will alert you if you made changes because if your total gross and withholding tax fig doesn't match with what you have submitted to ATO through STP reporting. It happened when Aug 23 BAS (monthly BAS), when I lodged Aug 23 BAS, STP reporting shows error (due to registered advisor unable to submit STP?) and I read from community post and it has fixed the problem.

Then after that I resubmitted all my missing/errors payrun from Aug 23 to Sept 23.

So, as you can see some of the payruns are repeated and resubmitted. Aug 23 total and BAS is matched now (cos I have resubmitted) but not September BAS because September BAS not due yet but the pre-fill total will add up according to what I have lodged through STP report i.e double up $11567.41+11567.41(double)+9059.07=32,193.89 (pre-fill total at the moment).

So does it matter for STP reporting if the same payrun reported twice? Or ATO will only pick up the EOFY figure when I lodged the 2024 final update event for reconciliation?

Thanks,

Louise

0 -

Interesting, I did this on STP1 and haven't found an answer. The Accountant has advised inflated W1 & W2 figures from July?

I have now rolled over to STP2

0 -

Hi Louise

Hopefully I can add a bit of context here. There are two elements that are included and sent in a STP submission; employee data which is the employee's running YTD balance and employer data which includes total gross and tax amounts for that specific pay run and is what the ATO use to prefill for BAS.

Historically when a submission is missed and the next one sent in its place, or if the same submission is sent twice/multiple times, it hasn't made too much of a difference until now because all its done is overwrite/update the employee's YTD balances.

However, now that pre-filling for BAS is in the mix, it makes things a tad more complicated and I feel that it potentially puts the emphasis back on a couple of things; not missing a submission/sending it multiple times and also ensuring that its correct before its sent.

Obviously, that won't always be the case 100% of the time as mistakes happen but when it comes down to it, the payroll software is what you should lean on as your source of truth so if the BAS prefill isn't matching, then adjust/amend the W1 & W2 prefill amounts in the ATO Portal where needed. Hopefully that isn't something you need to do often and I'm sure this process will become more streamlined as prefill continues to progress/evolve over time.

2 -

Hi, I have just discovered that I too have accidentally submitted the same pay run twice - STP Phase 2

Is there a way to reverse/delete one of the payruns through Reckon Gov Connect / from the ATO?

0 -

Hi @TrishB

You can't delete a submission that has already been sent however as explained above, employee data is only sent as a YTD balance so it will just be overwritten and not duplicate.

Employer data on the other hand, which is prefilled in the ATO Portal may be showing an incorrect balance if you've sent the same submission twice. If that's the case then I'd recommend that you edit the W1 & W2 prefill balances in the ATO Portal to what they should be.

1