Item on pay slip doubled up

We used to run payroll under Reckon One but have been moved by Reckon to their new Payroll module since last August. It’s not a smooth sailing all along but have managed to get by, not until the past 3 fortnightly pay runs which first happened in mid-December last year with one of the pay items on one of the employees’ pay slip doubted up affecting that employee's gross income received.

The issue was reported immediately to Reckon technical support and initially one of the team members we contacted tried to delete the pay run affected, then recreated that pay run again but only to find that the pay item was still doubled up on that employee’s pay slip. Consequently, we have stopped lodging STP declarations ever since pending Reckon's help of getting the double-up issue fixed and making sure the figures to be lodged are correct. We followed up by calling the technical support hotline a number of time but still remains unresolved so far, although we were told the case has been escalated. It would be very much appreciated if someone in this community can help as our unreported STP keeps piling up.

Comments

-

Hi there @StephenLi

Now that the full team are back on board after the holiday period, we're starting to work through the backlog of cases. Can I grab the case number for this please and I'll see where things are at.

Also, which pay item specifically is showing doubled up on the payslip? Is it one of the default items or a custom one you've created yourself?

0 -

Hi Rav, thank you for your prompt response.

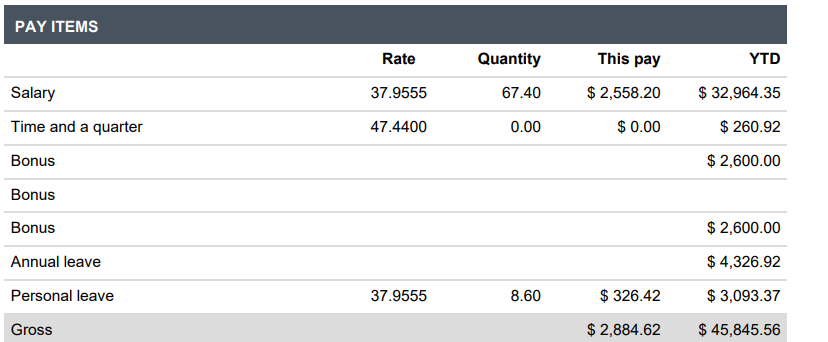

The case number is CAS-267526-R1R8H4 and the doubled up item is the Bonus as you can see the extract below :

The Bonus item has been there before I took over the payroll job a year ago and remains as the existing item after migrating to the new Reckon Payroll. Thank you.

0 -

Morning @StephenLi

Thank you sharing the case number.

I am currently checking your book to investigate. I will get back to you as soon as possible with some update on the case. Thank you!

Regards

Tanvi

0 -

Hi @StephenLi

I have been investigating for the issue that you have for the doubled up Pay items in the Pay slips. I have found there is a pay run for 12 Dec for an employee Alicia with a Bonus amount of 100.

What I did?

I reverted that Pay run in Draft for 12 Dec and 14 Dec to check if it's making any change to the Pay slips and found no change as such and there were 2 Bonus Items in the Pay slips.

I deleted the Pay run for 12 Dec with only Bonus item, reverted the Pay run for 14 Dec and then mark it as paid to check if there is any change in the Pay slip and found that there is only 1 Pay item for Bonus on the pay slips now which means it worked!

I would like you to have a look at that please once we try creating the deleted pay run for 12 Dec to add the Bonus Item for Alicia.

Once you confirm that it is correct, and you agree then I would like you to create that deleted pay run (Bonus - 12 Dec - Alicia - $100) and check if the pay slips are correct or again doubling up the items.

Please let me know how you went and will proceed from there further. Thank you!

Regards

Tanvi

0 -

Hi @StephenLi

I have created the deleted pay run as well, and checked the pay slips to check if the issue still persists and confirming that the issue has been fixed.

Now, there is only 1 Bonus item in the Pay slips means that it is not duplicating. Please check and confirm.

For the last 2 pay runs, they are required to reverted to draft and then again mark them as paid to reflect the changes in the Pay slips.

Feel free to let me know for any concerns/issues and will be happy to assist you. Thank you!

Regards

Tanvi

0