How do I change the Tax settings in Reckon Hosted ?

A new employee has been under taxed but I don't know how to adjust the permenant tax setting.

Best Answers

-

How do you mean he's being under taxed; does he have HECS or is he on a No TFT rate or has he agreed o taking more out of his PAYG

1 -

He only started with us at the beginning of this month and I hadn't checked any tax boxes so Reckon must have selected the last box.

After asking the question I found the solution was to select the correct Tax code.

Thank you for answering

1 -

Thank You. This has sorted the problem.

1

Answers

-

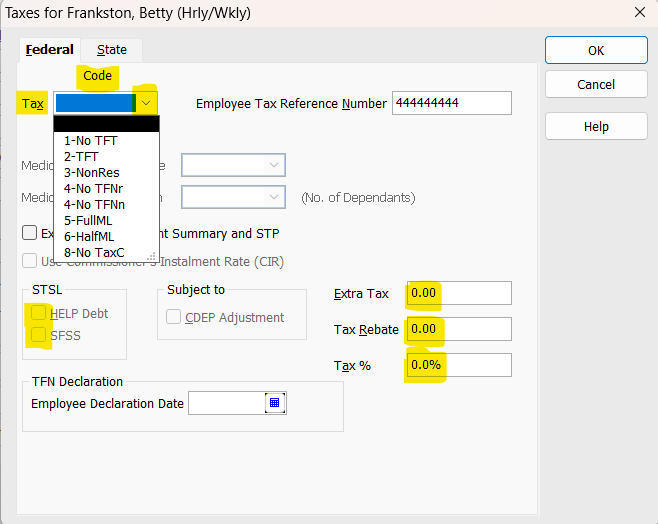

@ARRB1 The tax calculation is driven primarily by the code selection here (under Taxes in the Employee record, in the Payroll & Compensation tab):

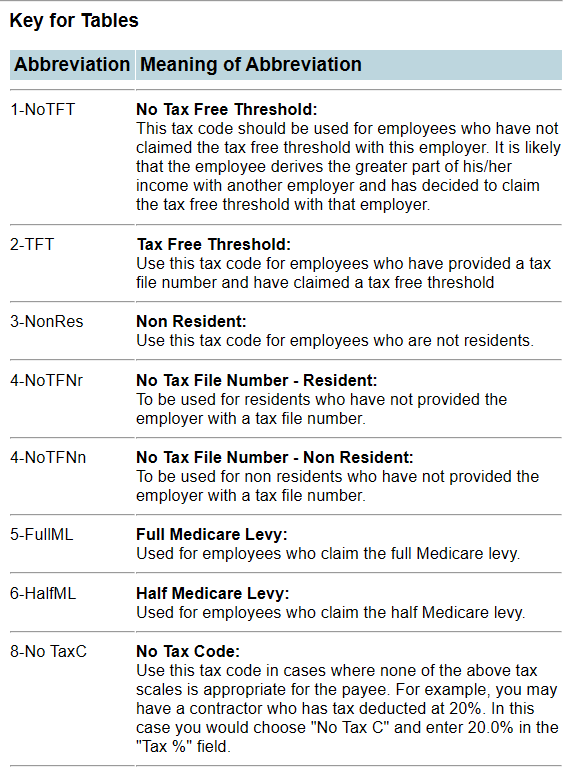

This useful table below - explaining each of these codes & when to use them - is under the Employees dropdown menu > Tax Table Information > Tax Table Info under the Key for Tables link:

The STSL options (also highlighted in the screen snip above) relate to TAFE & Uni fee (the old "HECS") debts. The SFSS is actually now obsolete so it's unlikely you will come across that one nowadays but if either are selected, the system will identify when an employee's earnings are likely to exceed the income threshold for compulsory "repayment" of these debts. These repayments are then calculated based on the applicable repayment percentage of the income & are made via additional tax withheld.

The last 3 fields highlighted all relate to employee-initiated scenarios. If an employee asks for an additional amount of tax to be withheld, you would enter the amount (as a Tax $ figure or a Tax %) here.

… Have yet to ever need to use the Tax Rebate field !

1 -

Hi there Shaz, thanks for the helpful table.

What would one select for an employee who is on a working holiday visa?

0 -

Hi @Chet

That would specifically be 8-NoTaxC & - if the employer is registered as a WHM employer - enter the Tax %.

You'll find the relevant rates here:

(You may need to paste the link into your browser as it looks like the link isn't displaying) @Rav ???

Most will be on 15% (taxable income up to 45K) or 32.5% (taxable income $ 45,001 - 120K)

NOTE: These percentages are not automatic & need to be manually changed if/as the employee's earnings exceed each threshold.

0 -

Yes, the tax code selected will override any percentage entered in that box UNLESS 8-NoTaxC is selected ☺️

0