Tax code to use for expenses

I asked this question in October 2024 but am still having issues.

For context

- I am a sole trader supplying services which frequently have travel expenses

- Most incur GST

- My main client reimburses my expenses, including GST

When entering expenses incurred prior to July 2024 I used the GST tax code for the expense. When the expense was applied to an invoice, the GST was automatically included.

However, that no longer occurs.

The work around was:

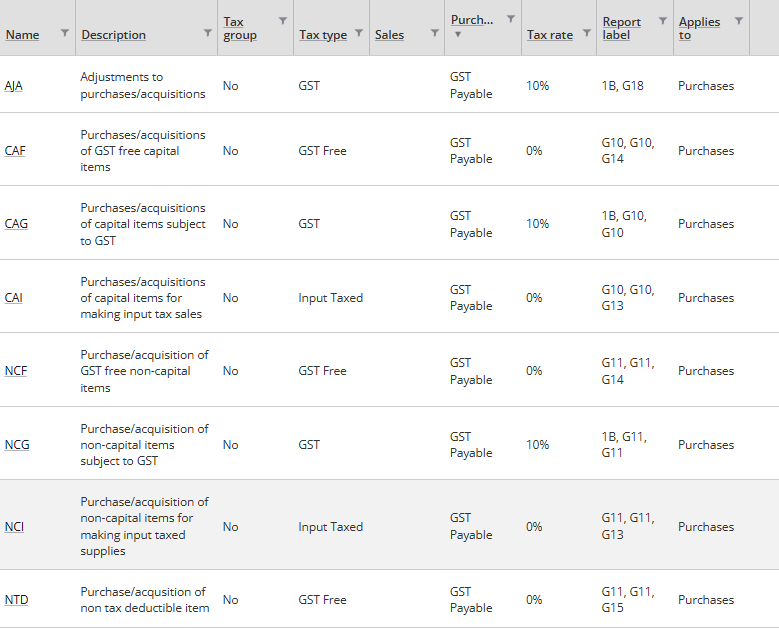

- have the expenses as NCG

- import them into the invoice

- change them to GST

- correct the amount to report the GST

When preparing my BAS the expense became a reportable item at G11.

This is incorrect as the supplier reimbursed the full amount, including GST.

The question is

- which tax code to apply to expenses?

- Can that automatically be included in the invoice with the GST

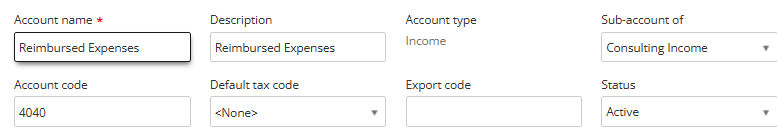

Does this relate to the fact that in the Chart of Accounts, the item for Reimbursable expenses has no tax applied?

If not, which of the following Tax Codes should be used in the expenses - or the Chart of Accounts:

Any help would be greatly appreciated.

Does this need a support ticket?

Answers

-

Apologies for the delay.

This is more of an accounting matter, and unfortunately, I won’t be able to provide much information on it. However, please check out the following resource: - Import Chart of Accounts - Reckon Help and Support Centre

I hope this helps. If you have any concerns/issues, please reach out. Thank you!

Regards

Tanvi

0