Tax category set up

I have set up a new casual employee and selected the Actor TFT in error. Is there a way to delete that as I can't seem to change it.

Comments

-

What's happening specifically when you attempt to remove the Actor TFT tax category from the employee?

Is there a particular message or error appearing on-screen? If so, what is it? If you could provide a screenshot here that would be great.

0 -

Hi Rav

I don't get an error message it's just that I can't clear it even though it appears in blue.

Sorry I don't know how to do a screen shot. In the end I terminated the employee and set him up again.

0 -

Hi @bella_10864825 ,

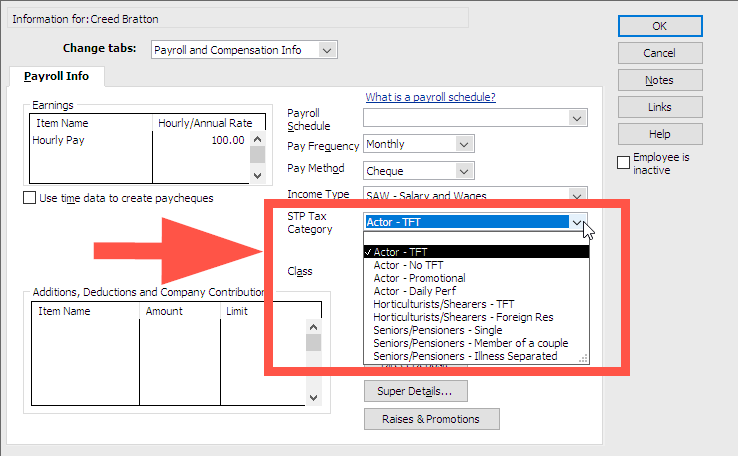

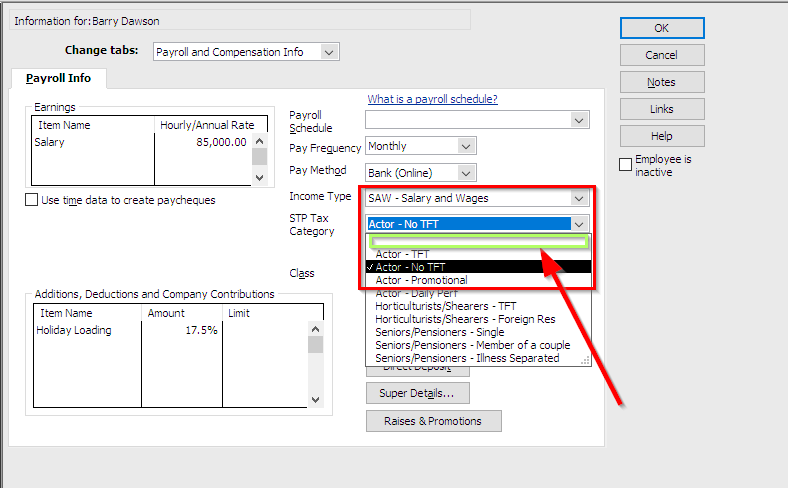

If you'd like to change the STP tax category, it's quite simple. Just follow these steps:

- Click on the drop-down arrow next to the STP tax category field.

- At the top of the list, you'll see a blank space ( shown in green box below ). Simply click on that blank space and leave it empty. This will ensure that no tax category is selected.

Note: It’s crucial to select the correct income type and tax category to ensure that your tax calculations are accurate. Selecting the wrong category may result in incorrect tax reporting.

If you're unsure about which category to choose or if you're feeling confused about the options, it's always a good idea to consult with your Accountant. They can help you determine the correct tax category based on your specific situation.

Please don’t hesitate to reach out if you need any further assistance!!

Kind regards,

Reeta

2 -

Hi Reeta,

Thanks for the instructions.

I’ve done the same as @bella _10864825 and followed your guidance to change the field to blank. I just have a quick question:

Do we need to take any further action to update the correction of the STP Tax Category with the ATO? Should we submit an update event for the STP submission to reflect the changes?

Thanks again for your help.

Kind regards,

Yujun

0 -

Hi @Eurowindow ,

Welcome to Reckon community !!

Submission of the update event is not mandatory in all cases, as Year-to-Date (YTD) figures are typically submitted to the ATO with each pay run. However, if you wish to confirm the changes, you may choose to send the update event.

Please refer to the KB article I have attached below for instructions on how to submit the update event.

I hope this helps.

Regards,

Reeta

0 -

Hi Reeta,

Thank you for your advise.

Best regards,

Eurowindow

0 -

Hi @Eurowindow ,

No problem at all 😊

If you have any more questions , don't hesitate to get in touch with us !!

Regards,

Reeta

0