Salary Sacrifice amount not appearing in RESC column of payroll report

I have just amended the Salary Sacrifice amount of an employee for this payrun going forward from $50 to $200. Not other changes were made other than in their profile and for the payrun.

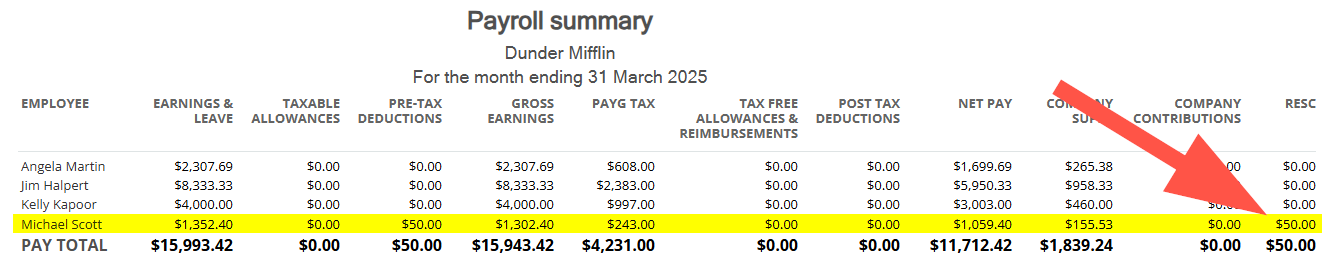

I notice that it is not appearing in the RESC column of the payroll summary report.

I have reverted the payrun to draft and double checked the amount. I have also checked the settings of the Super item. I have also logged out of Reckon Payroll and back in.

Any suggestions as to why this is happening? Everyone else who has the same super item is appearing.

The pre-tax deductions are all salary sacrifice amounts and therefore should all appear in the RESC column but as can be seen the $200 does not.

Comments

-

Hi @Therese R,

Thanks for reaching out!

Could you please send me a screenshot of the pay run items used specifically the names of them and the employee profile for the superannuation section that is affected by this issue?

Thank you and speak to you soon.

Lucas0 -

Hi Lucas

Will do but just also noticed that he has had no PAYG tax deducted in this payrun. So there are now 2 issues here.

0 -

It also may be in your best interest to create a new pay item and editing the employee superannuation items used to attempt another salary sacrifice with that new item like this:

Click on the Superannuation button and we will create it as below:

Enter in the required details for your item and create it. Once you have created, we will need to add it to the employee profile:

Please ensure that you have no pay runs currently sitting in draft and select the newly created item. Once you have done that use the item in your pay run and see if the issue is rectified in your reporting.

Thank you and speak to you soon.

Lucas0 -

HI again Lucas

Here are a couple of screen shots.

One showing the Superannuation items for under the employees profile and the others of the payrun today.

There is no ability to add the PAYG. It normally adjusts as the payrun is populated.

I have just noticed another employee who has not had any tax deducted. So I am wondering if there is an issue.

2 -

Here is the screen shot of the other employees pay and no option to add the PAYG.

Everyone else's pays appear to be fine but now I am worried that the tax calculation might be wrong? Do I need to go through everyone's an check?

1 -

Hi@Therese R,I'm a little confused here is the issue the RESC not calculating based off the Salary Sacrifice or the PAYG tax missing?I would take a look at the tax settings of the employee and ensure that it's completely filled out.Thank you and speak to you soon.

Lucas0 -

Please disregard my previous post.

It looks like the RESC issue is resolved by using a new payroll item for Salary Sacrifice. However for the PAYG tax amount not displaying at all. I would take a look at the tax settings for the employee and also create a new pay run but copying the last items from the pay run as an option like below:

Once you have done that, verify if the PAYG comes through successfully for me or not.

Thank you and speak to you soon.

Lucas0 -

HI Lucas

Thanks for the tips.

I am reluctant to make yet another Super item when the other 4 employees who are using this item have worked fine.

With the PAYG, there are only 2 employees who have this issue. The PAYG has not calculated for them and there is no ability to add the PAYG manually to their pay run.

1 -

Thanks again Lucas. I used that option when I created the payrun.

I think I might delete the payrun completely and start again.

0 -

Hey @Therese R

I agree, lets not create a new super item just yet. I think we need to do bit of testing on this.

On that note, just to confirm, all you did was edit the existing salary sacrifice amount from $50 to $200 on an employee in their pay run, correct?

Also, from the looks of your screenshot it looks as though you're using a

Salary Sacrifice Fixeditem, is that one you've created yourself?0 -

HI Rav

Yes, all I did was update the employees amount from $50 to $200 in their payrun.

Yes - this is an item I created myself way back when we first migrated to Reckon Payroll because the default item wasn't working properly. Some of our employees have fixed amounts each week and a couple have %.

Up until today, this has been working fine.

I have deleted the payrun and going to start again to see if it was just a one off glitch. I have completed 2 other scheduled payruns and no issues with them.

I did actually start this payrun on Friday and it was left in draft over the weekend for me to finish off this morning. Maybe that triggered something?

Will let you know how I go once I redo the payrun.

1 -

Thanks @Therese R

Please do let us know how you get on.

For what its worth, I just tested in my own book changing an employee's salary sacrifice from $50 to $200 and seemed to work ok. In my case though, I used the regular system-generated salary sacrifice item.

Before the edit

After editing the pay run

0 -

Thanks Rav

Something strange is definitely going on. I just went through the process of deleting the payrun then closed completely out of Reckon. Went back in, created the payrun selected "Copy from last payrun" as I usually do.

Went straight to the two affected employees and neither of them have the ablility to add the PAYG.

So I will delete those 2 from the payrun (just so I can atleast pay everyone else) and will do a separate payrun for them electing to use the pay Using Default pay items.

Will let you know how I go.

1 -

Hi again Rav

No luck.

Completed the Payrun without the 2 with issues.

Started a new Unscheduled payrun and they still do not have PAYG available..

I would like to fix this before I try fixing the super issue.

I have checked their PAYG settings in their profiles and all looks fine - still there.

Any thoughts?

1 -

Thanks for trying @Therese R

Do both of these employees have upward variation added? I note in your screenshot there is an upward variation added in the employee profile.

If not, are there any other commonalities between the two employees or maybe more importantly, their pay run?

0 -

HI Rav

Yes both have an upward Variation for Tax but so do atleast another 10 employees.

1 -

Hi again Rav

Went through the profile again in edit mode of the employee with the super issue and his tax is now back.

Will process the pay run now and hopefully, his super is also fixed so that the SS amount is shown in RESC.

1 -

Thanks @Therese R

Is there anything specific you edited in the profile or just went to edit mode then back out?

0 -

Hi Rav

All good! Just processed the payrun and all appears to be fixed. The SS is now reporting under RESC and the PAYG has been calculated for both.

Thanks for your tips and also to @klaura and @Lucas . Still don't understand why these 2 were affected other than my suspicions that it has something to do with starting a payrun on Friday but didn't finish it until today. I thought I only worked on one of the employees but maybe I had also changed the SS amount on the other employee in readiness for today.

1 -

Thanks @Therese R glad to hear its working for you again. I do think there's something a little funny going on though which we'll need to take a closer look at.

I'll speak with our dev team in regard to some of the behaviour you've outlined and hopefully we'll get to the bottom of it.

Please sing out if you notice this happening again.

0 -

HI Rav

I didn't do anything specific except for Jeremy who had the SS. I added the $200 into the amount section of his pay profile so that it matched his payrun. It was zero. The payrun showed $200 though. I am pretty sure it was zero when he had the $50 - so not sure that this was the issue.

Otherwise I just went into the Edit Pay section of the profile in each - viewed line by line then closed and saved.

Will let you know if it happens again.

Thanks for your help though.

0