Why does my june report not have any super totals?

I have generated a payroll report for june to check balances and super figures but the super has not been calculated

Answers

-

Which payroll report are you looking at specifically?

Also, how have you paid super in your pay runs? Did you use the default super guarantee item or did you create your own custom super item that you used in your pay runs?

Can you add a screenshot of your report (you blur any sensitive info) along with an example of super being paid in a pay run.

0 -

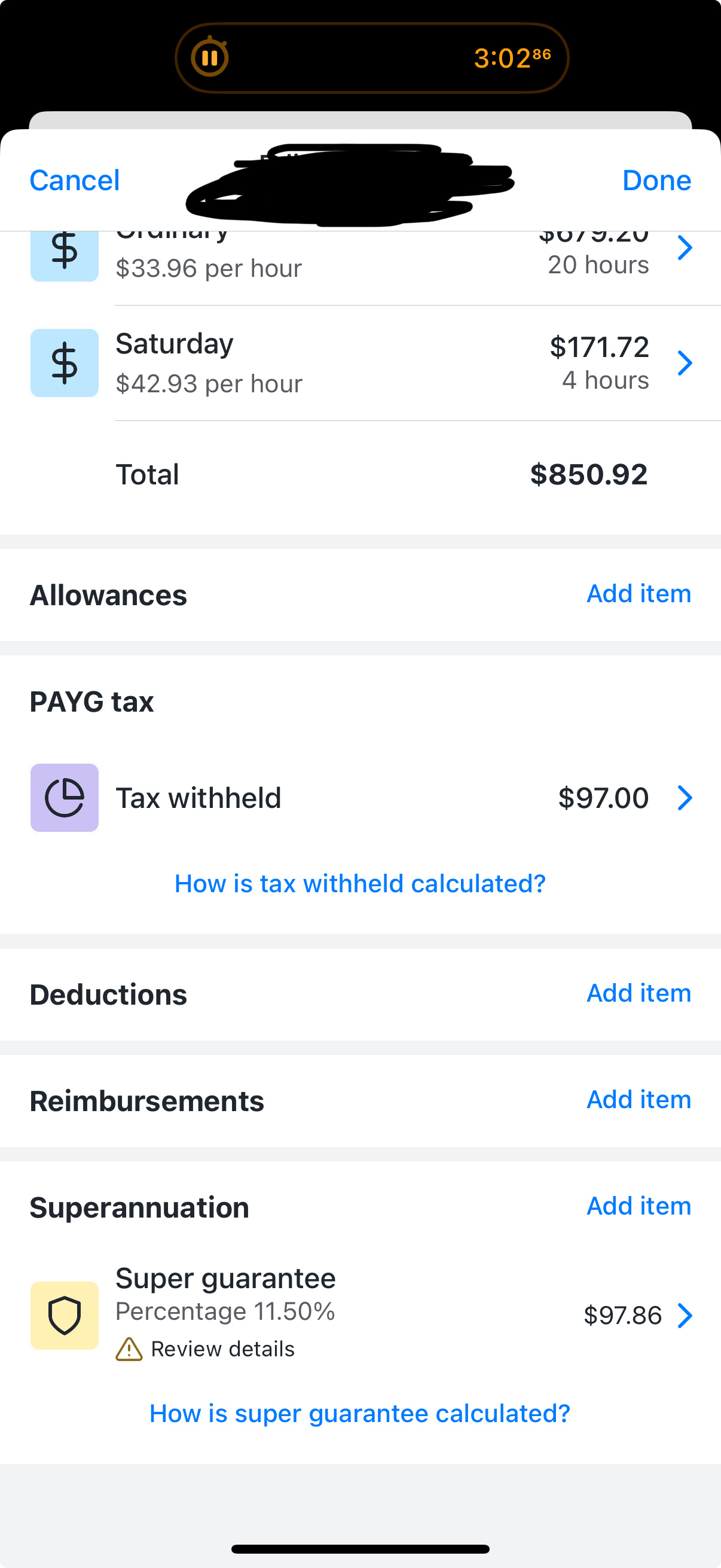

The first image is the payroll report for june second image is the latest payrun as you can see the super has been calculated but on the monthly report there is no figures

0 -

also the super figures for the whole year are also incorrect

0 -

Do you use the default super guarantee item or did you create your own custom super item that you used in your pay runs?

Is this occurring on all your employees or a select one employee?

Also, I've sent through an access request to your book, it will come through in a separate email. Can you please grant access when you have a sec and let me know when that is done in addition to answering the above so we can take a closer look.

Thanks

0 -

i created custom super because each employee has a different super fund and its happening to both employees

0 -

I haven't been able to take a look yet, have you had a chance to grant access? The access email was sent to the same email address that your Reckon Community account is registered under.

Once you've granted access let me know.

Cheers

0 -

im still waiting for the email to come through

0 -

Hi rav are you able to send through the link so we can work out why the super hasnt calculated please

0 -

The access invite email was sent last week. I've just re-sent it again just now, if you don't see it in your inbox in the next few minutes then maybe check out your spam/junk folder to see if its diverted there.

0 -

i have granted access now

0 -

I've just had a look at your book and while I can see what you're referring to in the Payroll Summary report, I believe this is likely related to changes you may have made to the super funds.

I can see that the default system generated super fund has now been made inactive. That's ok because you should be creating and using the employee's own super fund like you're now doing, however when did that occur? Was it before or after these pay runs were created?

If my understanding of what's happening here is correct then here's what you need to do 👇

- Go into the pay runs and switch them back to draft

- Change something in the pay run eg. add an hour to one of the earning items and click Done for each employee in the pay run.

- Go back and change it back to what it should be. You're essentially just making the pay run recalculate.

- You'll notice a new super entry will appear that is attributed to employee's own super fund.

- During my testing, I noted that this was set to calculate at a set 11% percentage rather than the statutory rate. You'll see an example of this in the 25 June pay run so please ensure its set correctly. You can change how super guarantee is calculated by clicking on the item and changing the selection from % to statutory rate.

- Remove the default super entry from the pay run where required.

- Once you've done that, mark the pay run as paid again and you should see super calculate.

0 -

once ive marked it as paid do i then have to resubmit it to the ato?

0 -

If you're going to send your EOFY finalisation right after making these corrections then you can just do that. The EOFY finalisation will pick up the changes and send them over within that submission.

0 -

I have reverted the 4 pay runs affected and changed one hour of earnings and clicked done i then changed it back to what it should be and clicked done and then marked the pay runs as paid i have done a payroll summary report but it has only picked up on one super amount!

0 -

i did those changes on the app so does that matter i also checked the 25th of june and super is 11.5%

this all has to be sorted before i do my finalisation is that correct?

0 -

@mel_10460334 You need to do this for each employee within each of those pay runs.

Once you've actioned that it will pick up super and reflect in the payroll summary report and EOFY finalisation.

0 -

it hasnt though can u please look at my book ive just checked the payroll summary theres only one super amount

0 -

I've taken another look at your book. The reason why it wasn't working for you is because it looks like below steps from my previous reply weren't actioned.

You'll notice a new super entry will appear that is attributed to employee's own super fund.

During my testing, I noted that this was set to calculate at a set 11% percentage rather than the statutory rate. You'll see an example of this in the 25 June pay run so please ensure its set correctly. You can change how super guarantee is calculated by clicking on the item and changing the selection from % to statutory rate.

Remove the default super entry from the pay run where required.

This has now been done for you and you should see this reflected in your Payroll Summary report.

0 -

ok so there is an extra payrun in that payroll summary so the super figures are incorrect also can u please delete the default super fund and put in the correct one for both employees

I was doinf the steps u explained in the app on my phone which still did not work should i delete the app and re install it??? If i do i wont lose any of the information?

0 -

do i have to go into each payrun again and make sure that the super is not the default one and change it if it is and then mark as paid?

0 -

do i have to go into each payrun again and make sure that the super is not the default one and change it if it is and then mark as paid?

No that aspect has already been actioned for you.

I can't however change or delete your employee or super fund information. If there are changes required there, you'll need to action that but I'm happy to help guide you.

If there is an additional pay run that you've created which is unnecessary you will need to either adjust it to correct it or delete it if its not required.

0 -

yes please could u please help me also the payroll summary report for the last financial year is correct in terms of gross earning tax and net pay however the super figures are in correct ive just added them up one employee there is a differnce of 153.79 and the other employee its 75.99???

0 -

Do you mean the super balances now showing the Payroll Summary report are over or under what they should be?

0 -

super balances are under whats actually been paid if i look at the payroll summary report for the last financial year however if i look at the super contributions the balances are over what has been paid!

0 -

so which report figures do i use when doing eofy?

0 -

The balances that you see in the EOFY finalisation are the only balances that will be sent to the ATO and will be what is marked as Tax Ready when successfully processed.

If the super balances that you see in the EOFY finalisation are under what they should be, then go through your pay runs and see if there are any additional pay runs that are missing super guarantee.

If there aren't any pay runs missing super and you're adamant that you need to add additional super, then you can do so by adding it via an employee's profile in their initial YTD section.

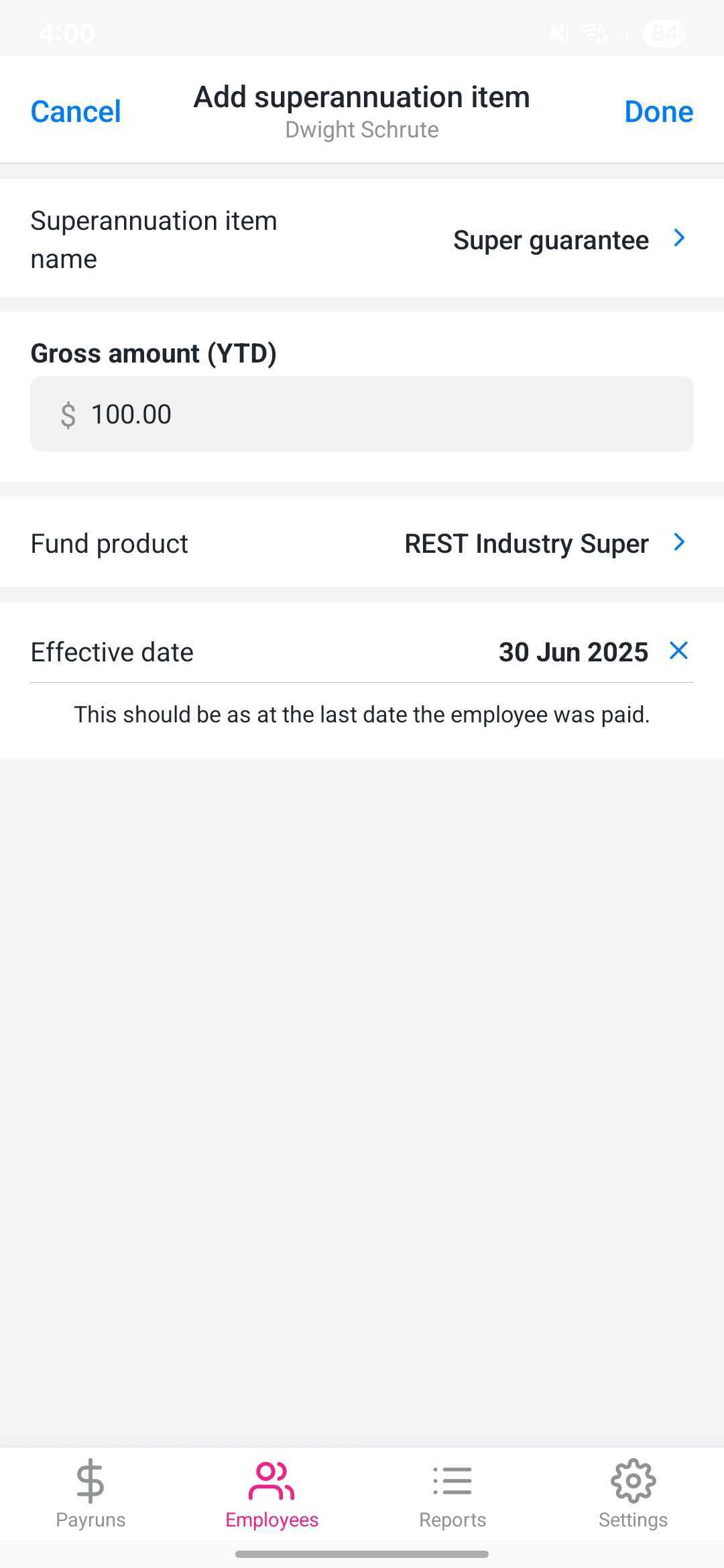

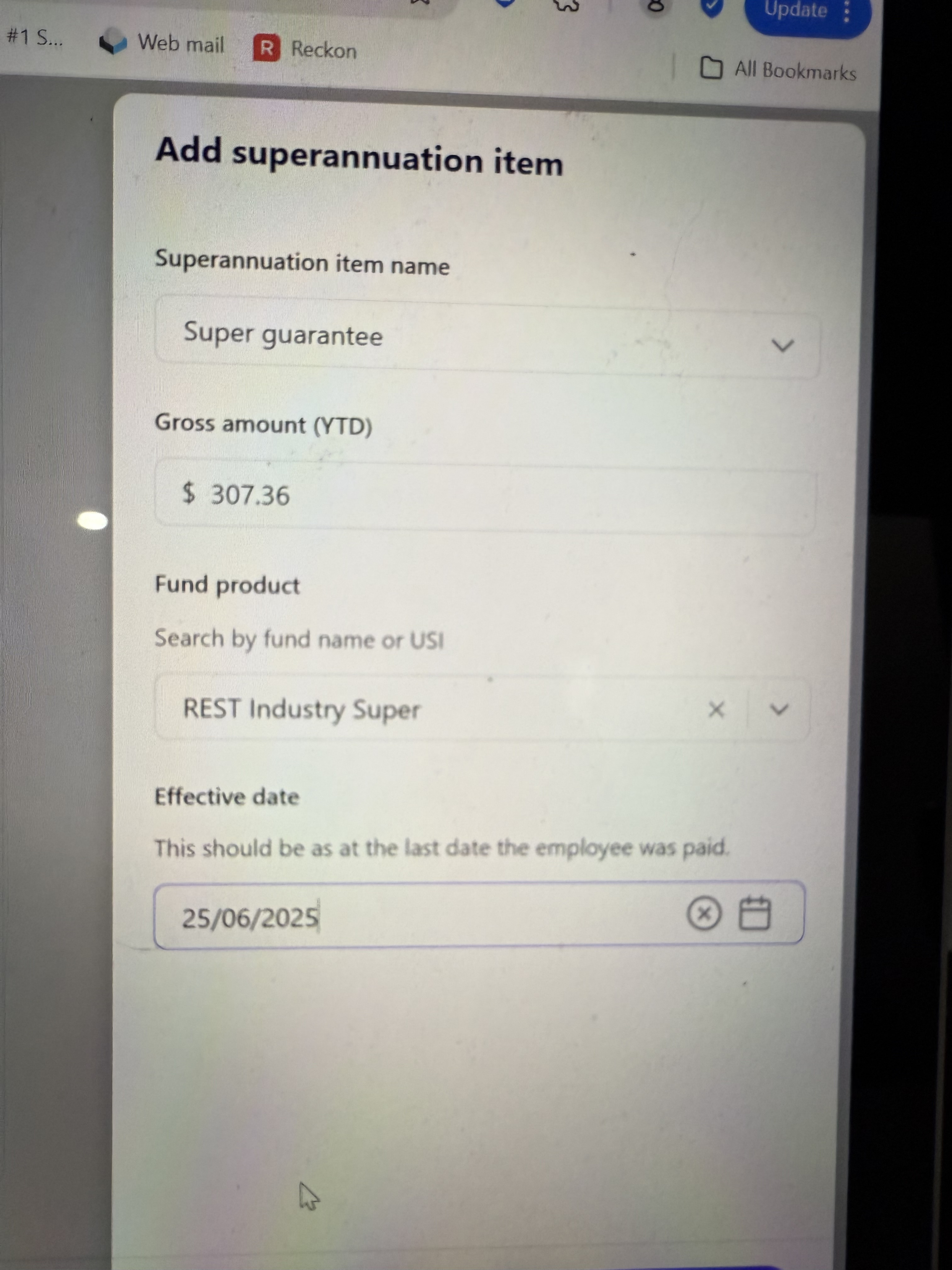

Go to an employee ➡️ Edit ➡️ Enter Initial YTD's ➡️ FY2024-25 (its important that you select this FY) ➡️ Superannuation - add the super item and the amount of superannuation that you require ➡️ Save.

Do the above for each employee that requires it.

0 -

just a thought the super balance should match what I have whether or not they have gone to the default super fund or the custom super fund is that correct?

0 -

so on all the pay runs with this they need to be changed to the custom super fund?? Before I do eofy??

0 -

So if that’s the case do I need to revert the affected payruns and mark as paid can u please give me an example of how to do this please

0 -

At this point you don't really need to do that unless you really want to and/or you're using a superstream service to pay super.

You've setup the correct super funds now so moving forward any super balances will be attributed to those funds.

I think at this stage, you just need to ensure your balances are correct so that you can proceed with your EOFY finalisation.

0 -

which they are not i think that the payrun i accidentally deleted on the 2nd of april is the mistake so do i add that pay run in and mark as paid and do it need to be submitted to the ato again?

0 -

Yes if you've deleted a pay run mistakenly then recreate it and mark it as paid. You can forgo sending the STP submission for it because its going to be picked up and sent in the EOFY finalisation.

0 -

So i have checked every pay run for the last financial year and all have the correct super however eofy is stating less than what i have actually paid for both employees !!!! can this be edited when i do the eofy???

0 -

ok so i do i have ro put in exactly what i have paid in the ytd? also what date do i put in? and does this then update so i can do my eofy?

0 -

or do i add the difference between the eofy to what ive actually paid? one employee theres a difference of 153.79 and the other is 75.99

0 -

Go to the first employee and add in the super guarantee item and put in the balance that you'd like to add ie. $153.79 for them. Date it with any date in the 2024/25 financial year such as 30 June 2025 for example.

Do the same thing for the second employee but the relevant super balance for them.

0 -

is this correct and then should this be the correct amount of what was actually paid and then I can finalise eofy?

0 -

I'm not sure where the balance of $307.36 is coming from as you mentioned above that one employee is short $153.79 so add that amount for the respective employee for super in initial YTD.

Then go to the other employee and do the same but add in the super guarantee balance they need which you mentioned is $75.99.

0 -

I went through all the pay runs and added it up I went into the eofy year and the super had changed for some reason I submitted what I have paid and finalised it

0