How to view pays in Govconnect

Can we still access Govconnect to view the details of the STP reports from Reckon Payroll. We used to be able to toggle in to it via the toolbar at the top

While undertaking the EOFY reconciliations, I have differences in totals between the EOFY report and the Payroll summary report for 3 employees. Wanted to check what totals were submitted for these employees over time to see if I can find the difference.

Comments

-

Hi @Therese R,

Access to Reckon GovConnect remains available via your Portal. Select the desired STP submission to view detailed information for each submission.

Best regards,

Karren

Kind regards,

1 -

Hi @Therese R

Just adding to Karren's info above, when it comes to variances between the Payroll Summary report and EOFY finalisation, there may be specific reasons for that and I'd highly recommend checking out the info in our latest #TipTuesday post here -

#TipTuesday - Why does my Payroll Summary report not match my EOFY finalisation? 📆

1 -

Hi Rav

I have 3 employees who have discrepancies and I have located two of them so far which relate to the same payrun.

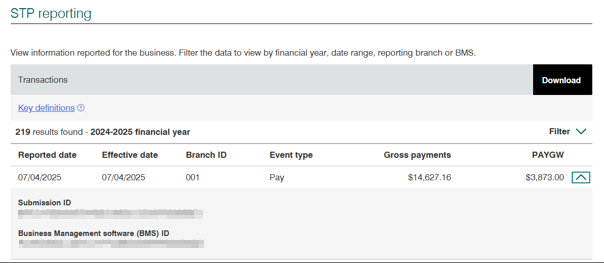

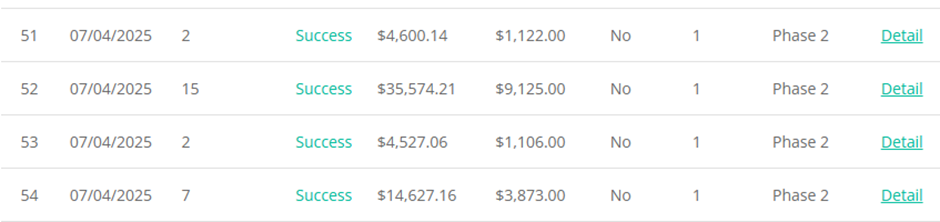

On 7 April, one of our pay runs appears to have been lodged to the ATO incorrectly. At the time of doing the monthly PAYG Activity statement, I noticed it and adjusted the ATO report wages total amount manually. I assumed that as there had been several pay runs since the one that wrong, that the employees totals would be fine. However, I now see that they are not.

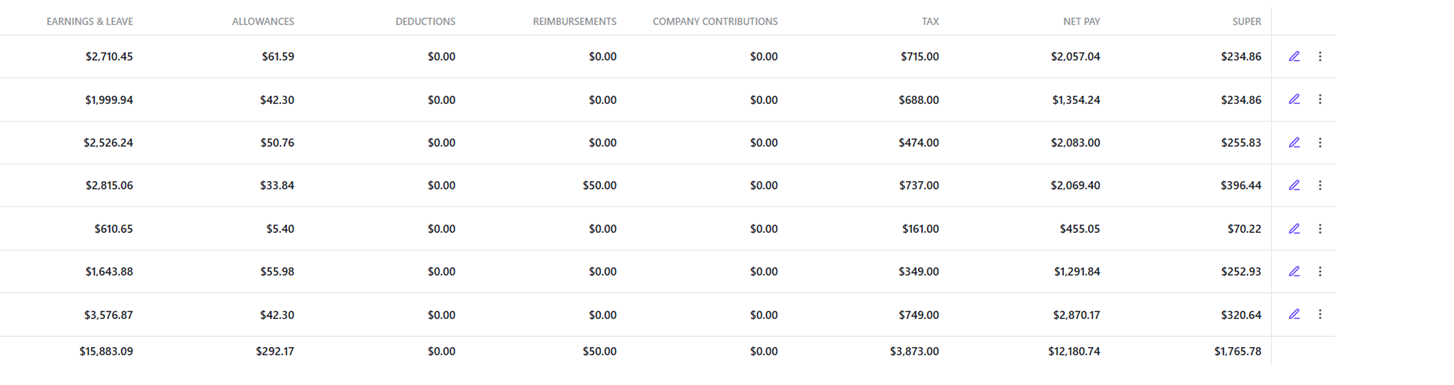

Attached are screen shots of the lodgement in Govconnect as well as what is in our ATO profile. I have also screen shot the payrun. The gross totals for 2 employees needs to change. They are currently showing wages totals less than they have earned.

Should I do a payrun update event or an individual update?

The gross payments that should have been submitted are Wages $15984. The PAYG was submitted correctly. There are 2 employees affected by this.

0 -

Hi @Therese R

Just to clarify, are the actual balances entered into the individual pay run for the two employees incorrect in Reckon One? ie. do those payruns require amending?

The main thing we need to focus on at this stage is ensuring the balances on the Reckon One side of things is correct and valid. The reason I say that is, sending an EOFY finalisation is going to overwrite any/all balances that have come before it when it comes to the employee side of things.

It won't however touch or change any employer balances which are the W1 or W2 balances that have been prefilled from previous submissions. That will require manual editing within the ATO Portal.

0 -

HI Rav

The payrun that was lodged through STP was incorrect. I don't know why or how this occurred. The actual payrun is showing more wages for both employees than was lodged with the ATO. If we lodge the EOFY as is, their totals won't be correct. I have reconciled the Payroll in Reckon to our General ledger. I have reconciled Gross Wages to ATO lodgements allowing for the manual adjustment on the April Instalment statement. EOFY figures are incorrect.

0 -

Thanks @Therese R

Ok in that case, I would go into that incorrect pay run, switch it back to draft status and make any necessary corrections to the affected employees balances in that pay run(s).

Once you've corrected the earnings and any other required items in that pay run, re-mark it as paid. You can forgo sending an update event as it will taken care of with the EOFY finalisation.

I'll add a link here to our post on how to edit a previous pay run - Edit an existing pay run and send an update event ⏪

0 -

Hi Rav

Sorry but the pay in Reckon is correct - no further adjustments to be made. It's just that when it was submitted to STP, the gross was incorrect. The PAYG was correct though. Should I still resubmit the payrun - switch to draft then resubmit? Do I say it is an update event? I read through your link and I think this process should change it but it is baffling as to why the the report lodged was different to the payrun.

0 -

Oh ok sorry I must have misunderstood. Right ok if the pay is correct, if you open a brand new EOFY finalisation in Reckon One and look at the totals for these employees (and others too), are they correct in terms of what they should be?

0 -

No they aren't correct. The EOFY totals are understating the wages paid for 3 employees. I have located the discrepancy for 2 employees for the payrun dated 7 April 2025. The payrun in Reckon is correct but the payrun submitted to the ATO is incorrect.

0 -

Sorry @Therese R, I might be having a slow day as I don't think I'm not quite on the same page 🤔

Setting aside the STP side of it for a second, if the pay run is correct in Reckon One ie. it shows the correct balances for earnings, tax and super right now then the EOFY finalisation that you generate in Reckon One should match that as well.

Is that not the case here?

0 -

HI Rav

I know - its confusing. The pay run is correct in Reckon One but the Gross wages balances are not reconciling between Reckon One's Payroll Summary report and the EOFY report.

0 -

Just keep in mind, the Payroll Summary report shows things a little differently.

For example, it shows earnings and leave balances on an aggregated level whereas the EOFY finalisation shows them as disaggregated as that is required for Single Touch Payroll Phase 2 submissions. The Payroll Summary report also doesn't include any initial YTD balances.

So there will be some variances between the EOFY finalisation and the Payroll Summary report which is outlined in my linked post above.

If you think there's a genuine issue though, let me know and I'll send through an access request to your book so I can take a look.

0 -

Hi Rav

I have followed the process for reconciling both reports. I have located the transactions that are causing the variances. I have actually located the third employees discrepancy as well and just resubmitted the payrun in question. So it's just these other 2 employees that I need confirmation on that I can do a resubmit of that payroll to see if the balances adjust. Happy for you to access our book.

0 -

Hi again Rav

I think someone will have to look at our book. I did the pay update on the third employee and it has not updated the totals in the EOFY report.

0 -

-

Yes - how do I do this please

0 -

Hi @Therese R

I've sent an access request to your book, it'll come through separately via email. When you've got a sec, please grant access.

Just separately, just bear in mind sending through update events only amends EMPLOYEE data within their MyGov account. Its not going to change anything within your ATO Portal if that's where you're looking as that is EMPLOYER data. There's some info on this here - #TipTuesday - What's in an STP submission? 💻

More importantly though, can you let me know the specific details of the discrepancies to check once we have access, which pay runs they're in and which employees they relate to

0 -

HI Rav

Okay - I have granted access - thankyou.

Will read your tip Tuesday while you are accessing the book.

There are 2 payruns that are causing the issue.

One dated 7 April where there are 2 employees affected - Dean and Taylor. I might have to actually show you which payrun it is.

The second payrun is dated 24 March where there is one employee affected - Michael E. Again will have to show the particular pay run.

I can also send you my workings so you can see what I have reconciled to date but would prefer to do that on a private email thread.

0 -

Of course, not a problem. Send me a private message with the details.

Just a little favour though, try and break it down for me like I'm a 5 year old just so I can understand what I'm looking for/which balances you're referring to that don't look right and include screenshots too 😄

1