Edit Submitted Pay Run

I need to edit a pay run which is submitted already to ATO, but when I click the revert back option, a message pops up saying….

"You cannot revert a pay run to draft if it has been included in a lodged SuperStream batch".

I have lodged super used BEAM and successful, the super batch option in payroll reckon one super stream has no cancel or revert to draft option.

I hope someone could help me on this.

Answers

-

Hi @Angie123

At this stage, any payruns that are linked with a SuperStream lodgement (such as Beam) cannot be reverted back to draft status. That's obviously not ideal so this is something we're working on developing a solution for this quarter.

In the interim though, to make an amendment there are a couple of options.

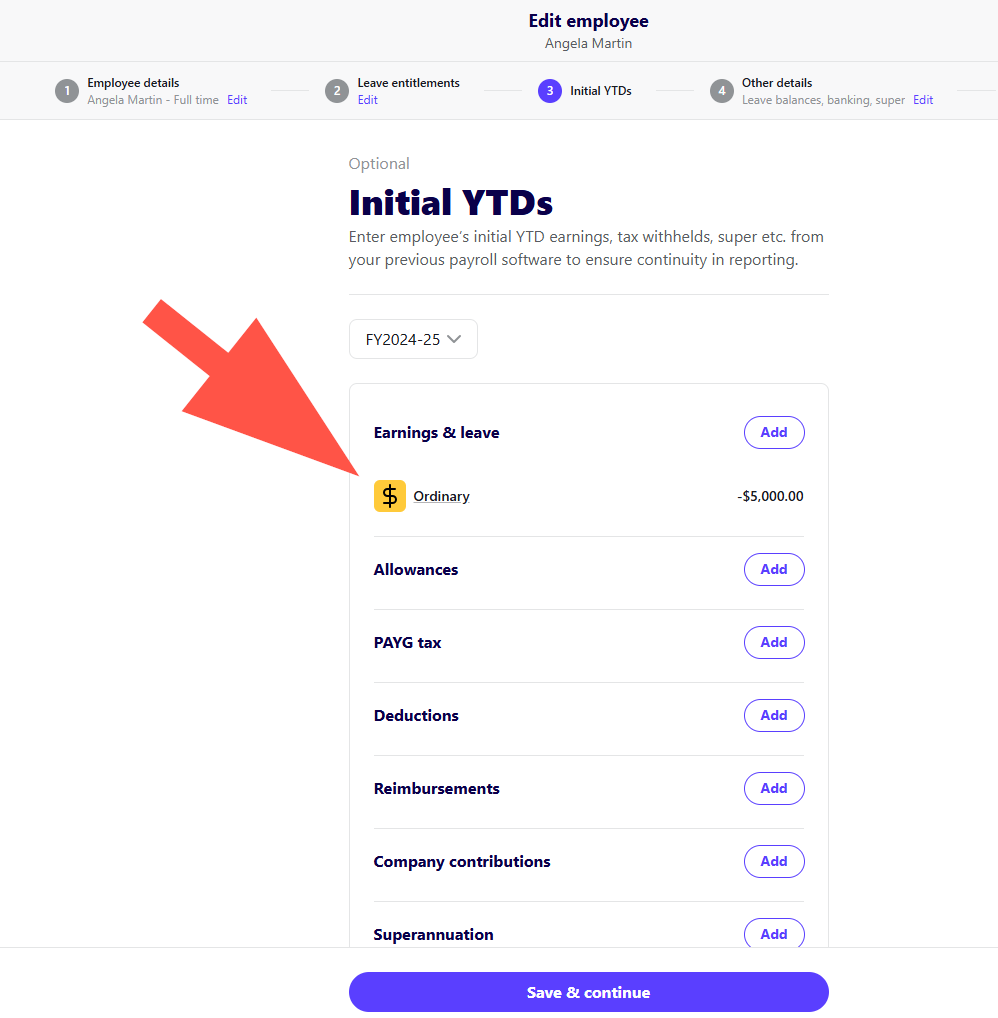

1️⃣ Make the necessary amendments to any pay balances via the initial YTD screen in the employee's profile.

For example, as you'll see in my screenshot example below, I've added a negative balance to ordinary earnings for this employee for the 2024/25 financial year. This will adjust their overall YTD earnings balance by that amount.

Conversely if you need to add to the earnings balance (or other items), you add in the relevant item and add the respective balance.

Its important that you select the appropriate financial year from the financial year dropdown when adjusting initial YTD balances.

2️⃣ The second option that you could look at is to create an additional pay run for the relevant employees to adjust the actual paid values required.

0 -

Dear Rav,

Thanks for your response.

I tried adding a negative regular amount and adjusted their overall YTD earning and it worked, but the PAYG tax calculation is still incorrect and needs adjusted accordingly, How can I ensure the PAYG tax aligns with their updated YTD earnings.

Regards

0 -

Hi @Angie123

I'm assuming its not allowing you to add a negative value for tax in the initial YTD, is that correct?

To be honest, I'm not sure if this is going to allow for an adjustment to reduce tax in this way. Can I get a bit more details around the type of amendment you're attempting to carry out to this pay run? ie. have you overpaid the employee?

0 -

Dear Rav,

Yes, correct, I realized I overpaid to employee and need to adjust their overall YTD earnings to the correct amount, the correspondingly PAYG withholding should also be reduced accordingly.

Regards

0 -

Dear Rav,

Any possible solutions for this situations?

Regards

0 -

Hi @Angie123

Apologies for my delay in getting back to you. I was actually speaking to the product team in regard to your situation yesterday and we're not having much luck so far in finding an immediate option around reducing the tax component. They are however continuing to look at anything they may be able to do that is a little more outside the box but they can't make any promises.

With that said, the current situation certainly isn't ideal and the team are actively working on improving the overall process around the ability to edit pay runs that are linked with a SuperStream lodgement and that's something we're hoping to deliver this quarter.

I'll see if the team have any other options for me around this and I'll keep you posted.

0 -

Dear Rav,

Thank you for your response. After reviewing other payroll systems and find they all support year-end adjustments for employee earnings and PAYG. This is a regular year-end procedure, and we're currently preparing to complete these finalizations for our employees.

As such, we urgently need to correct the affected earnings and PAYG amounts.

Regards

0