Salary Sacrifice - PreTax

We have an employee with gross pay of $24,000 plus Salary Sacrifice pre tax of $27,000.

On income statement should be Gross Pay $24,000 and RESC of $27,000.

When enter data we put $27,000 to company contribution this gives a result of Gross Pay of $24,000 and RESC of nil.

To correct we tried to add salary pre tax contribution in initial YTD set up screen - the result of this shows correct RESC of $27,000 but Gross Pay of $51,000.

How do we record this to get the correct result?

Thank

Mary

Best Answers

-

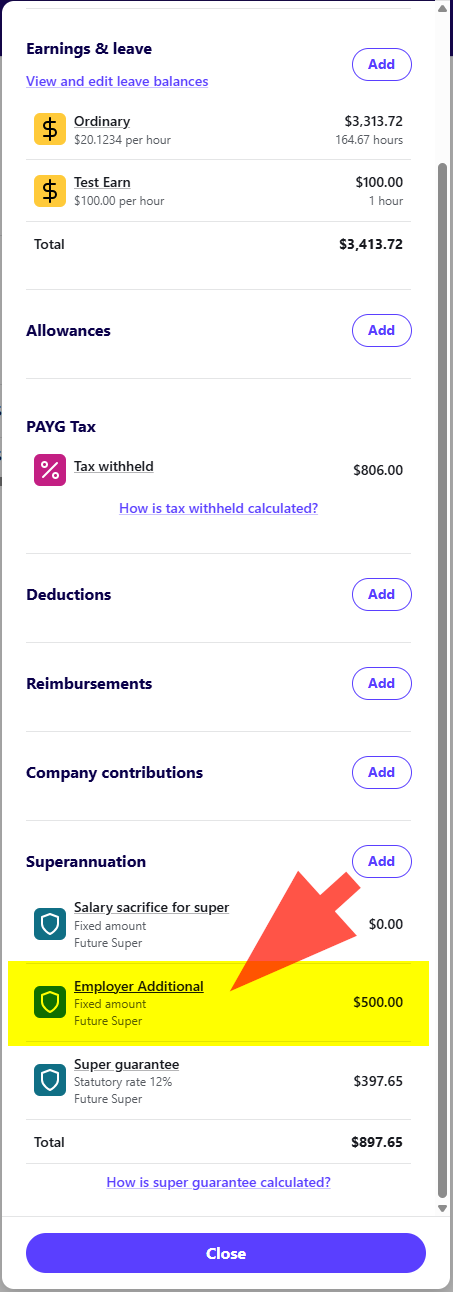

Yep I'm aware of that but again, that's not a company contribution, that's Employer Additional (EA) Super.

You need to add any EA as a super item so it's categorised to RESC

0 -

Hi there @Mary

I can see there's a bit of conversation around company contribution above. Can I just clarify, are you adding these amounts as Employer Additional super (example below) OR are you entering them using Company Contribution item?

An Employer Additional super item will attribute any balances to RESC when paid in a pay run.

Can you please give us a little more info on what you're looking to do and how you're currently doing so in your pay runs?

Cheers!

0

Answers

-

Hi Mary

Salary sacrifice isn't a company contribution, it's a sacrifice of earnings by the employee. You need use the salary sacrifice item in your pay runs so that those sacrificed earnings are categorised to RESC.

0 -

I appreciate your comment, however you can additional employer super contributions that are not salary sacrifice and therefore not part of Gross Earnings. This is a common for self employed an want to make additional super contibutions.

Other payroll packages allow you to do this. I have done this in Rockon One in previous years, however cant seem to find the right screens to do this new,

0 -

Thank you for helping find the solution, I appreciate your help.

1