GST and SG on NETT not the full invoice

I have setup a contractor to be paid through payroll because we need to pay SG for him. How do you make the super calculate on the nett amount - that is - the invoice total less the GST?

Comments

-

Hi @Drinkwater, welcome to the Reckon Community 🙂

Can you let me know what, and how, are you entering in as the earnings for this employee?

Are you using the Ordinary Earnings pay item or have you created your own custom earnings item? Is super calculating for the employee when you add in your earnings item?

0 -

Hi. I have not processed a payment for this sub-contractor yet. I have him as labour ire, labour hire agreement, sub-contractor. For income type - salary and wages excluded from STP/PAYG reporting and at the moment Tax scale C. I have deleted annual and personal leave. When I go to the pay tab - it comes up with create new pay template.

I have changed him from weekly pay with other employees to Unscheduled weekly pay

Can I entered ordinary here for the NETT pay and put the GST in as a non-taxable allowance to which super does not accrue - then recode to recognise this as the GST in the CoAccounts?

TIA for any assistance

Sally

0 -

If you're using the default ordinary earnings item, super guarantee will calculate on any earnings entered using that item, although it can be removed from the pay run manually.

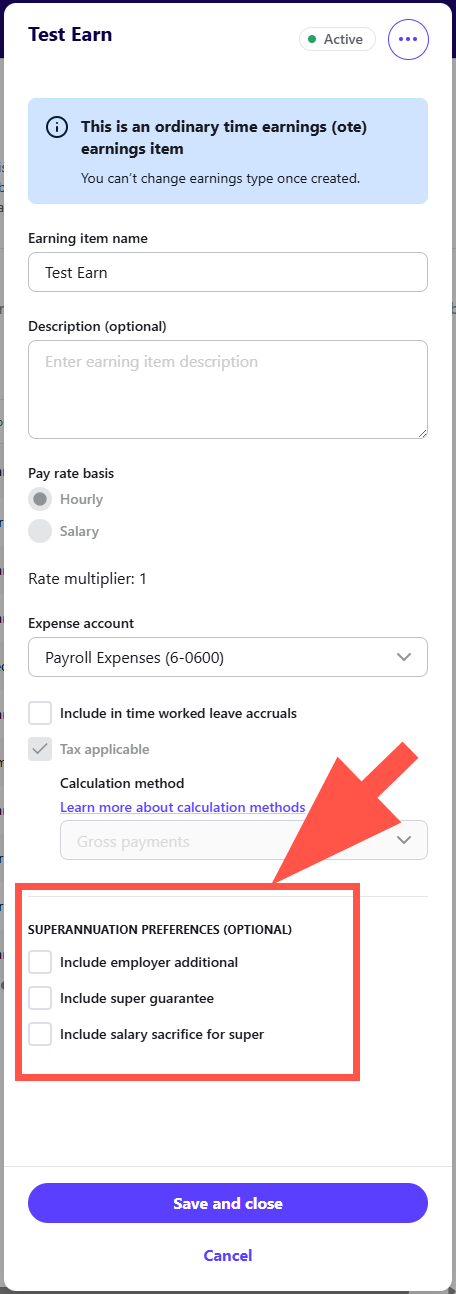

If you setup your own custom earnings item, you can set the option for that item to not calculate super in the setup of the item, check out my screenshot below.

In regard to what you should enter and where, unfortunately I can't really advise on that as its better placed for an accountant to provide more qualified advice on so I'd definitely recommend reaching out to them.

0