Incorrect Tax Withheld - only occasionally

Hi Everyone

I have had an employee query the tax withheld in his pay . Over the last 6 pay runs ( which are fortnightly ) they have all been correct when I have inputed them into the ATO calculator except 2 . One was $136 short and the other $146. I have not gone back any further

I cant find any reason why these would be different when it is usually perfectly accurate.

He has also said he was very close to having to pay tax at his last return. All his pay is setup as everyone else's so I cant see why this would be the case.

Employee is scale2 for tax threshold

Thankyou

Comments

-

Hi @BobW

Can we get a bit more info on the tax setup of this employee from their profile and are they a full-time employee.

Also, can you provide a screenshot of the setup of the pay run where you believe the tax calculation is incorrect. It should show the pay items used along with the tax item and their respective amounts.

Please feel free to blur out any names or other info in the screenshots.

0 -

Hi Rav

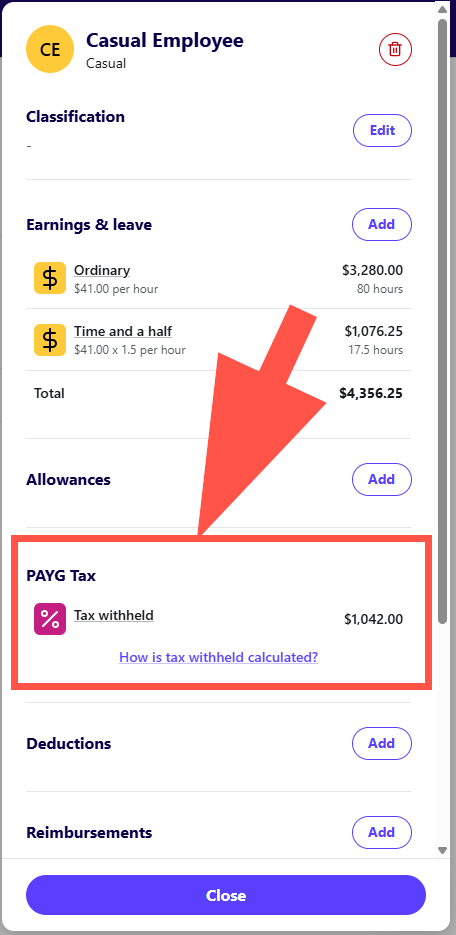

Please find attached. This pay run is the last one where he has flagged it was incorrect. He is a casual employee

0 -

Hi Rav

When i put it into the ATO calculator it says it should be $1,042.

0 -

Thanks @BobW

I've had a look into this and I can see from your screenshots you've added dates into the Ordinary Earnings item. When you do so, it applies the daily tax rate for earnings for daily and casual employees.

If the daily tax rate does not apply to this employee then I'd recommend editing the pay run back to draft status, click the Earnings item and remove the dates entered into those earnings.

Once that is done, the tax component will recalculate.

I've tested this in my own book using the details you provided and can confirm $1042.00 is the tax amount calculated when the daily tax rate is not applied ie. by not entering dates in for earnings.

Also just an FYI - I've removed the attachments you provided as one of them contained a TFN number.

0 -

Thanks Rav that has fixed it.

Im still unsure as to why it only seems to have been happening sporadically ? I went through and checked which other employees had the dates in there and there were a few but not all.

Is there a pay item i have inadvertently attached to them to make it come up ? I cant see anything different

0 -

I don't think you've done anything wrong other than inadvertently adding dates into earnings which has applied the daily tax rate to employees who may not necessarily be subject to them.

Just something to note, the dates field for earnings will only apply the daily tax tables when entering dates for earnings for a casual employee but should only be used when that employee requires the daily tax table to be applied based on their specific circumstances.

It will not apply those tax tables when entering dates for earnings for a full time or part time employee.

0