Superannuation Contribution amount incorrect

Hi, I have just changed the superannuation details for an employee in the last week of the month. Effectively she should have contributions from 'old fund' x 3 weeks and 'new fund' x 1 week. Payroll summary for the month is only showing contribution of 'new fund' x 1 week.

Why is this the case. Your payroll summary is a summary of all payroll payments for the month?

Answers

-

Welcome to the Reckon Community @watson

When you generated the payroll summary report, does it span the full date range that those changes took place?

Also, if you generate either the Super Transactions or Payroll Detail report, does it show the balances attributed to each super fund?

1 -

Hi Rav,

Yes the Payroll summary report does span the whole of the last month

The Super contributions by employee shows 3 weeks of old super, 1 week of new total - correct

The Super Transactions is correct

The Payroll Detail amount is correct

Both the payroll summary and payroll details were run with the following parameter ' Last month'

The Payroll summary report is the one that is incorrect.

0 -

Thanks for that @watson

I've just tried running a test in my own book to see if I can replicate your experience.

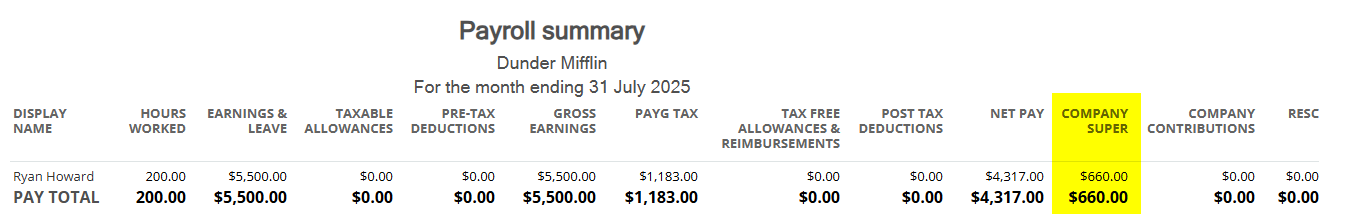

I created a 2x pay runs for an employee then generated a Payroll Summary Report which shows the correct balance 👇

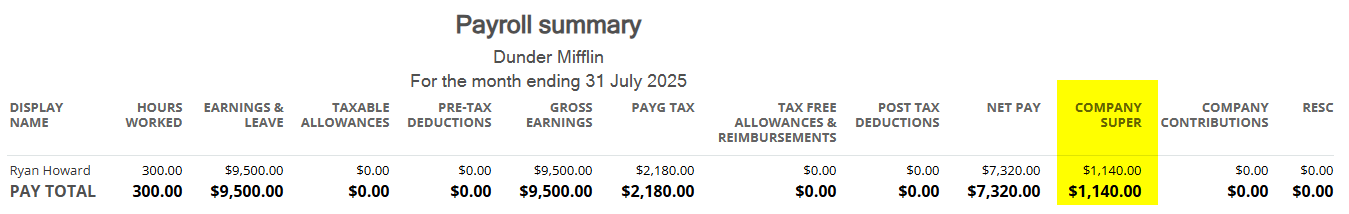

I then changed their super fund and generated one more pay run. After that, I generated a new Payroll Summary Report and it showed the combined total of super for all 3 pay runs 👇

How did you go about updating/changing the super fund for the employee?

Did you create a new super fund and then assign the employee to that new fund prior to creating the new pay run?

0 -

Hi Rav,

Yes I did. According to the summary when I run a Payroll Summary week by week for the month of July, Week 1+2+3 have $0.00 contribution and then prior to week 4 I changed the super fund and that is the only week that has a contribution.

0 -

Can you confirm also that Reckon automatically updates Superannuation % rates according to the ATO?

0 -

I think we might need to take a closer look at what's happened there.

I'm going to shoot through an access request to your book, it'll come through separately as an email. Can you please grant access when you have a sec. Also, what is the first name of the employee that this relates to?

In regard to the above, yes the statutory rate of super is automatically updated and applies to any pay runs dated 1 July or after.

0 -

Hi Rav,

Yes that's fine re access. Will look out for email.

Employee Name: Robyn Chivers

1 -

I've just had a quick look at your book and I can see what you mean in regard to the Payroll Summary report.

Just a question though, I can't seem to locate the previous super fund that the employee had in your list of super funds (Payroll Settings ➡️ Superannuation Funds).

Was that super fund deleted after their employee profile was updated to their new fund?

0 -

Hi Rav,

Thank you for looking into this. Robyn was The Trustee for MLC Super fund.

MLC SUPER FUND

MLC Super Fund

Active

APRA Regulated

005014151

0 -

Morning @watson

I've had another look and the previous payslips, pay runs and Super Contributions report shows the 3 pay runs in July for this employee were set to a super fund called Blueprint - Super.

However I can't see that specific super fund anymore in your list of funds (Payroll Settings ➡️ Superannuation Funds). Was the Blueprint - Super superfund deleted?

0 -

Hi Rav,

You are correct - Blueprint Super. I would not have thought so. I would have just Created a super fund in the settings function and then changed the fund in the Employee.

I cannot see it there either. Do you want me to re-create it?

0 -

Hi Rav,

The employee's fund is MLC which is still active

I am unsure why is state's Blueprint Super on the report however?

0 -

Don't recreate it just yet, what I've done is put the details of this together into a ticket so that I can get a little more investigation on this by my dev team.

Leave this with me for a bit and I'll keep you posted as soon as I get more info.

0 -

Thanks Rav. Will do.

0 -

Hi @watson

I haven't forgot about this one but I'm really sorry its taken so long to get this addressed. Upon investigation of this by our devs, the root cause of the issue looks to be a fairly complicated one and its taken a lot longer than initially anticipated to work this out. Apologies for that.

They're definitely still on the case though, and they've been doing some testing on a potential solution. The team would like to test this on your book to see if it resolves the issue for you. Unfortunately, your book access has now expired so I'm going to shoot through another request, when you have a chance can you please grant access and I'll get our devs on this.

0 -

Hi @watson

I know this has taken a really long time to address and I'm really sorry about that, unfortunately the cause of the problem is a larger one that work is still continuing on. I have however received confirmation from my dev team that this should now be sorted for your book.

When you have a chance, can you please take a look and let me know if its working as expected for you.

Apologies again for the long time in getting this sorted.

0