How to reconcile credit card payments minus the fees.

Can you please tell me how to do this: Accounts Hosted.

We have a credit card machine at work, and on charge the fees to the customer.

Square then takes the fees + or – a few cents. It is never quite exact.

So my question is, how do I reconcile that and come up with a correct total in the reconciliation?

If an invoice is $100 and the fees are 2.3% (this is what they charge for payments over the phone) we charge the customer $102.30 but only make the invoice out for $100.00

Then the invoice and the payment don’t match because Square deposit me $100.02 (its always a couple of cents either way)

What we have been doing is I have a separate account that so it does not have to be reconciled. When the money comes in from Square, we transfer the exact $100 to the main trading account, then everything matches.

But how do you do it normally in a reconciliation if the Square account is paid directly into the main trading account? The reconciliation would never balance, especially if we actually put the credit card fees onto the invoice, which Square take.

In Reckon do we have an account we should be attributing the credit card fees to? I just can’t figure out how it works.

Could somebody give me an exact example please? TIA!

Comments

-

You need to use a clearing account

Deposit the money to the clearing account

Write a cheque from the clearing account for the fees

Transfer the balance from the clearing account to the bank account

Easy peasy

Kr

0 -

Hi @SuzyA

You're on the right track ! 😊

You need to add the Fee as another line (Other Charge-type) Item on the customer invoice:

IMPORTANT: The fee calculates automatically, based on the line directly above it ONLY. Therefore, if there are multiple lines on an invoice, make sure you use the "Subtotal" line FIRST (as above) !

If there are different percentage charges, create a main header Item & relevant subs:

IMPORTANT: Make sure you enter the percentage symbol, otherwise it will interpret it as $ amounts ! :

Then, Receive Payment - for the FULL amount - into that separate Clearing bank account (I've named it "Sq Clearing Acct" here, for clarity):

Next, create a Write Chq - OUT of these funds in the Sq Clearing account - for the Fee they are deducting from your deposit amount:

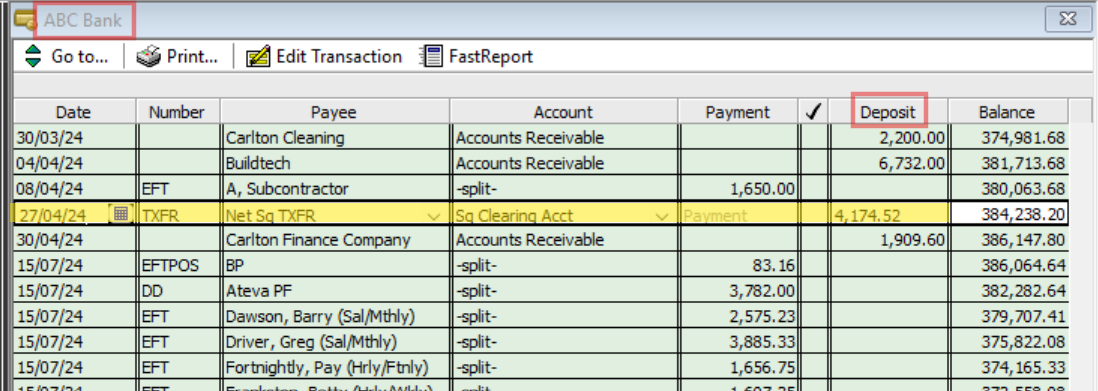

Check the Sq Clearing bank account register balance & you'll see you now have the exact deposit amount from Square:

Then, use either another Write Chq or Transfer Funds to move this from this clearing account into your actual bank account (You could also use Make Deposit but I find it's clearer to do it this way)

IMPORTANT: There should be NO tax code allocation on this as this is not a "sale" or "expense" but simply just a movement of funds, from one account to another :

Square (Fees) is set up as a Supplier - The Fee MUST be entered via a Chq in order to claim the GST on these fees.

Net Sq TXFR is set up as an Other Name-type (If using Transfer Funds, that doesn't require a name so the Payee name will be blank in your registers … which is one of the reasons I prefer to use a Chq as there's more detail !):

Hope that helps

😊

4 -

Shaz you are a legend, I am going to try all of this out today. Thank you so much! I will re-post if I run into trouble but thanks for the detailed "how to", its exactly what I needed!!!

2 -

-

That was great, I think the biggest problem is you don't always know the client will pay their bill so the invoice will have to be modified based on how they pay.

Gerry id 6376

Gerhard Winter

Ph. 0418907140

Reckon Store Next Door

"Always at your Service"

Email: gwinter0808@gmail.com

2 -

0

-

The clarity, accessibility and level of detail provided by @Acctd4 in posts is well worth the time to read.

Searching the Reckon Help and Support Centre | Asking good questions on the Community

#TipTuesday: Picture Paints a Thousand Words | How do I add screenshots to my discussion?

4 -

Agreed @GerryWinter - In Suzy's case though, it sounds like this is at the time of payment 😊

1 -

This was really helpful, great contribution Shaz 😊

0 -