#TipTuesday - The brand new STP Year to Date Report! 📊

Welcome to 2026! Hopefully you're all settling back into the swing of things and the holiday hangover has passed by.

#TipTuesday is back and we're starting the year off strong with a brand new report that is quickly going to become your favourite payroll report.. The STP YTD Report!

What is the STP YTD Report?

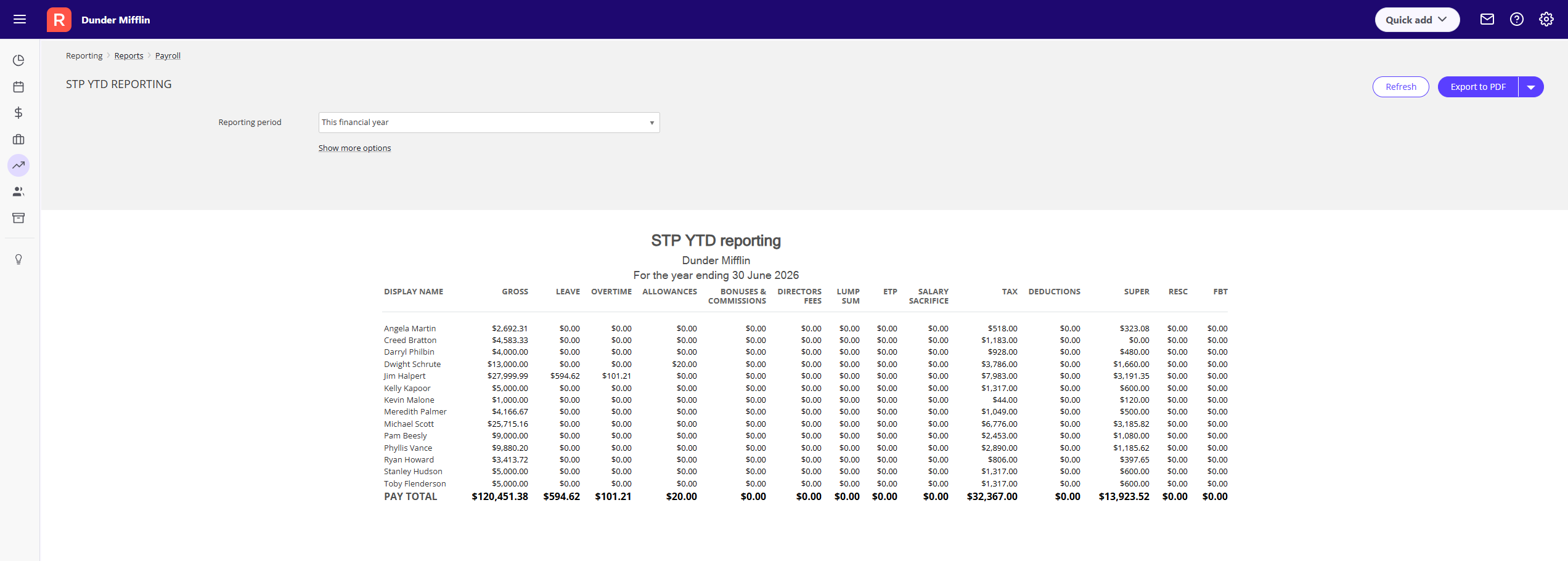

The new STP YTD report allows you to easily view employee YTD balances that will be submitted to the ATO as part of your STP submissions.

The report shows STP-reportable YTD values from Paid or Posted pay runs, including Initial YTDs, for a selected financial year (draft pay runs are excluded).

Employee balances in the report are always calculated from the start of the financial year however you can set an end date when generating the report if required.

The STP YTD report makes it much easier to reconcile payroll throughout the year, and will become valuable companion at EOFY time. The STP YTD report will also allow you to compare balances with the Employee Earnings Summary Report, identify discrepancies earlier, and eliminate any stress not just at EOFY time but throughout the financial year.

Add the STP YTD Report as a favourite report

I'd recommend adding the STP YTD Report to your favourite reports by checking the star icon next to the report. That way your report will be elevated to your favourite reports for quick and easy access.

That's it for this week, if you have any questions about the new STP YTD Report let us know below. Tune in next week for more tips!