Best Of

Re: Payroll summary report error

Hi Rav,

I have tried quite a few options, selecting the pay FN also entering dates & even older pays (not todays that I am currently processing). The report takes a long time to even come up with the error so I reckon there is an issue. Hopefully it can be rectified soon Thanks, Bernadette

Re: GST not reporting in BAS from GJ entries

" … Our accountant came up with this solution as it was the only way to record the amounts …"

(This is why accountants shouldn't advise on bookkeeping !🤦🏻♀️😖)

The program isn't designed for exclusively using GJ entries as it's intended to also be accessible for those with no accounting knowledge. Every time you enter any type of posting transaction, the program automatically creates the applicable GJ for you, in the background. The tax reports are completely driven by tax codes. As the GJ window only has the Tax Item column, it may not always be able to reflect.

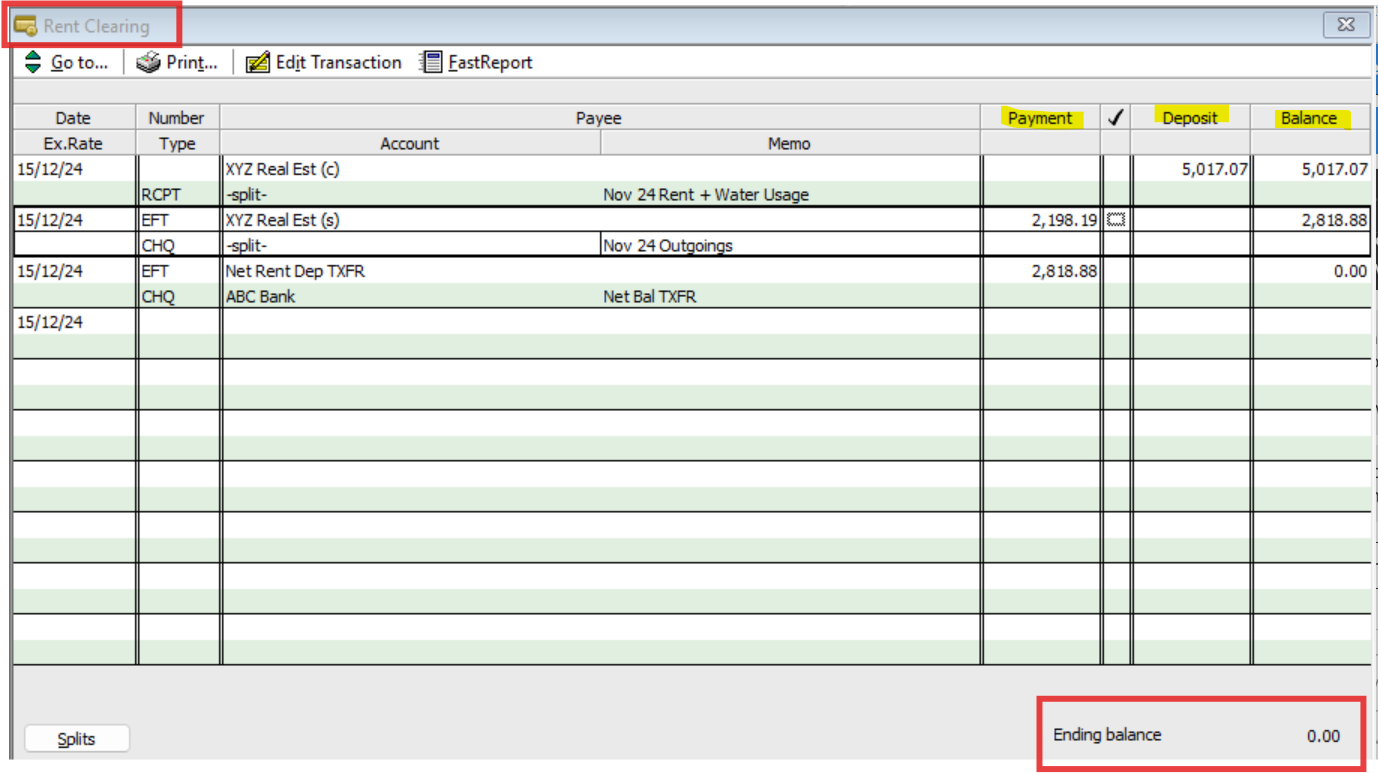

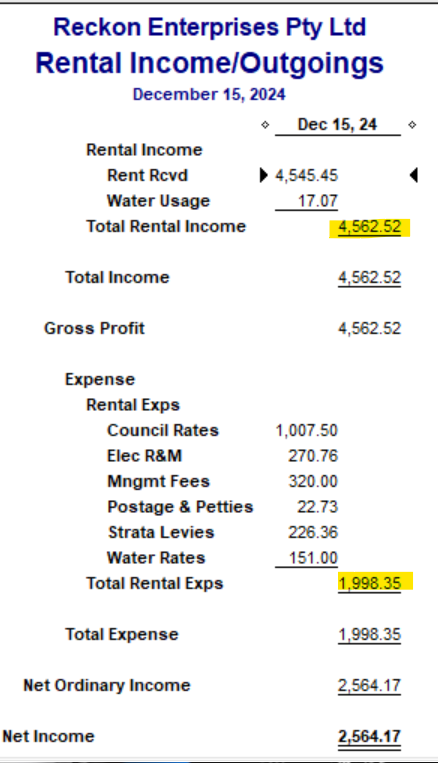

A clearing (Bank-type) account is the best method for tracking rental activity …

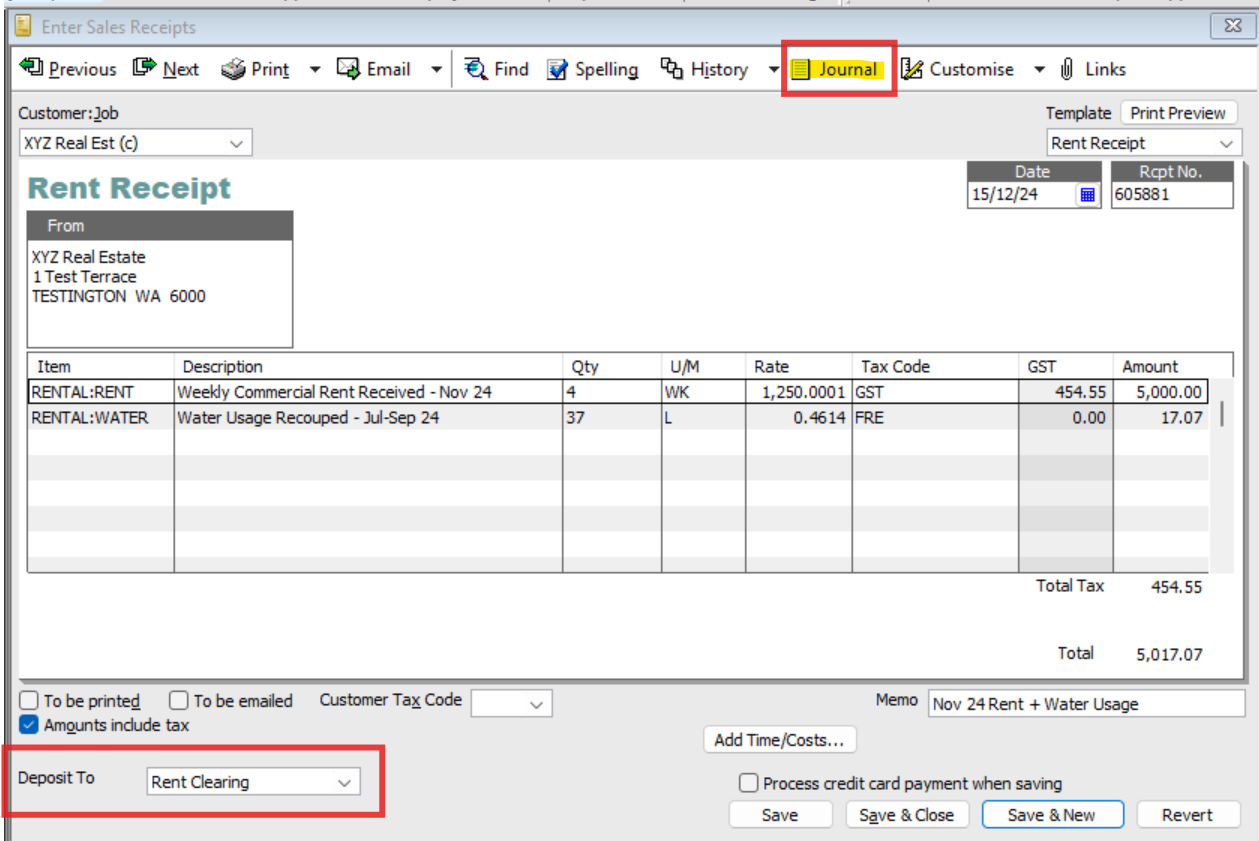

All incoming amounts are entered on Sales Receipts (Note the Journal button - If you click on here after saving, you will see the GJ this entry automatically creates for you) :

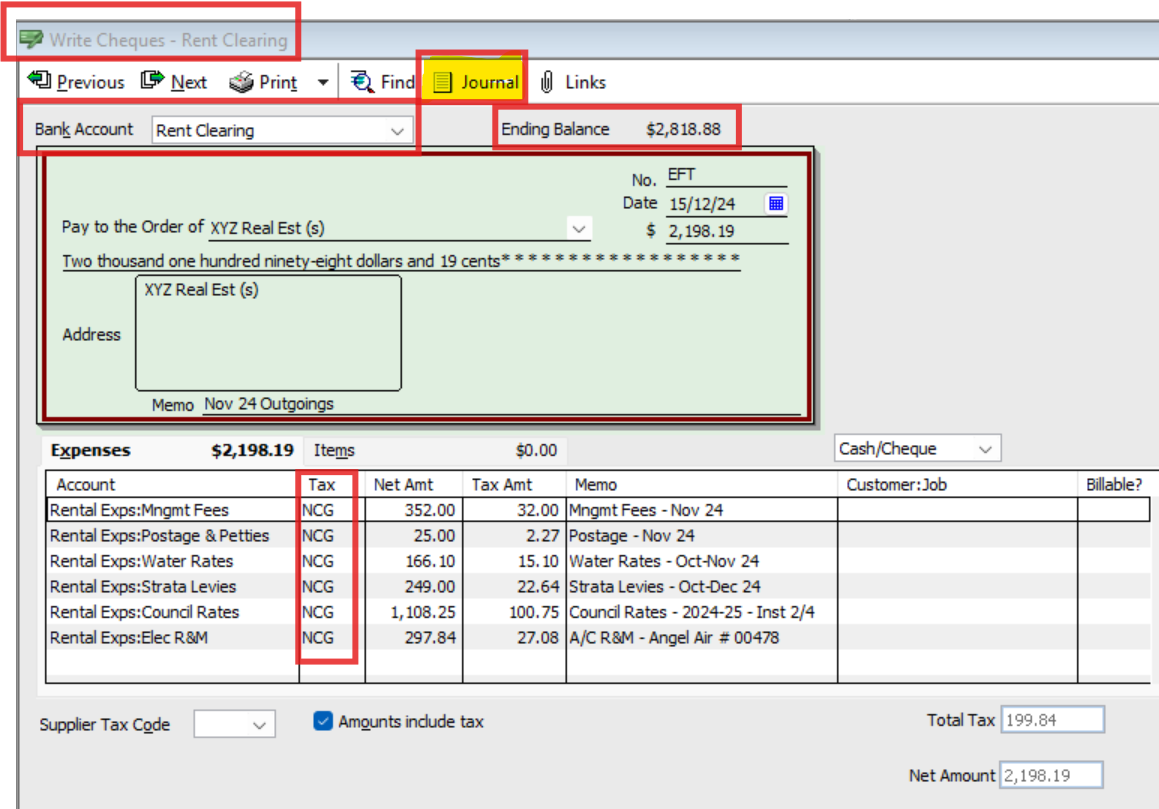

… & all outgoings via Cheques (Again, you can see the Journal button) :

Making entries this way ensures the full amount of income & expenses - along with the correct tax codes - are able to be used & reported on accurately.

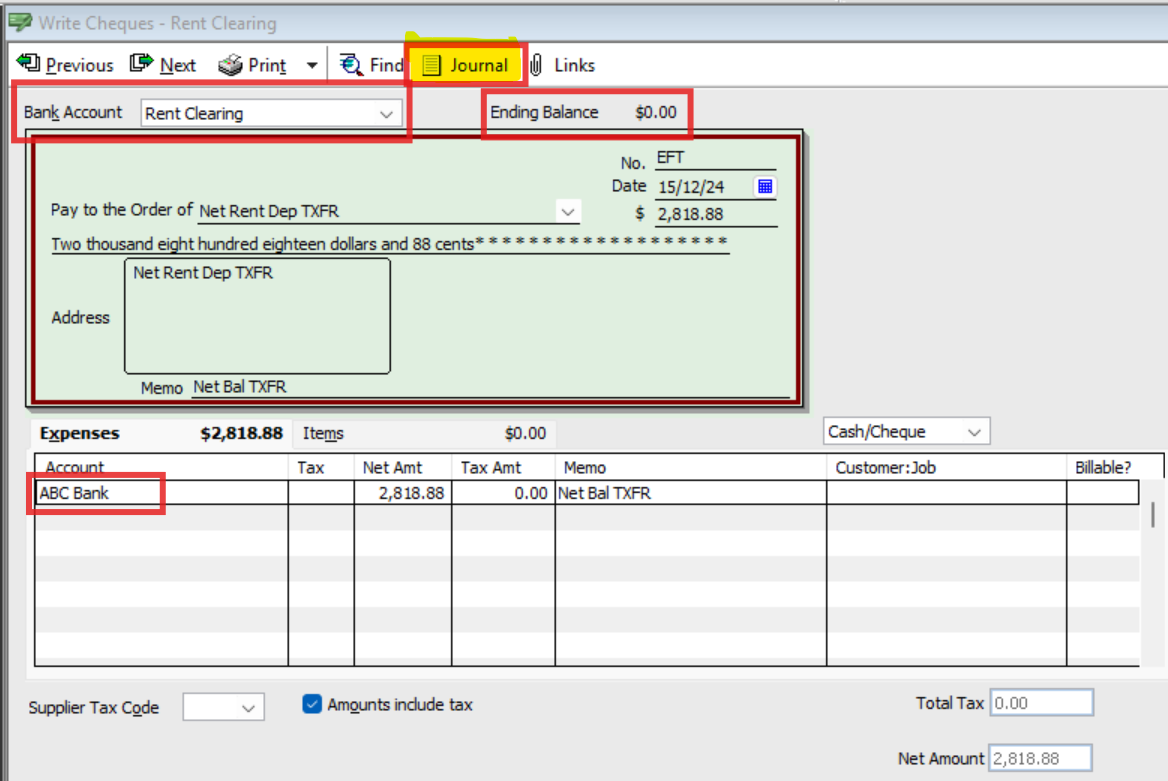

The remaining net amount(s) can then be deposited as per the actual bank account deposit(s) you receive. (I use a Cheque for this also):

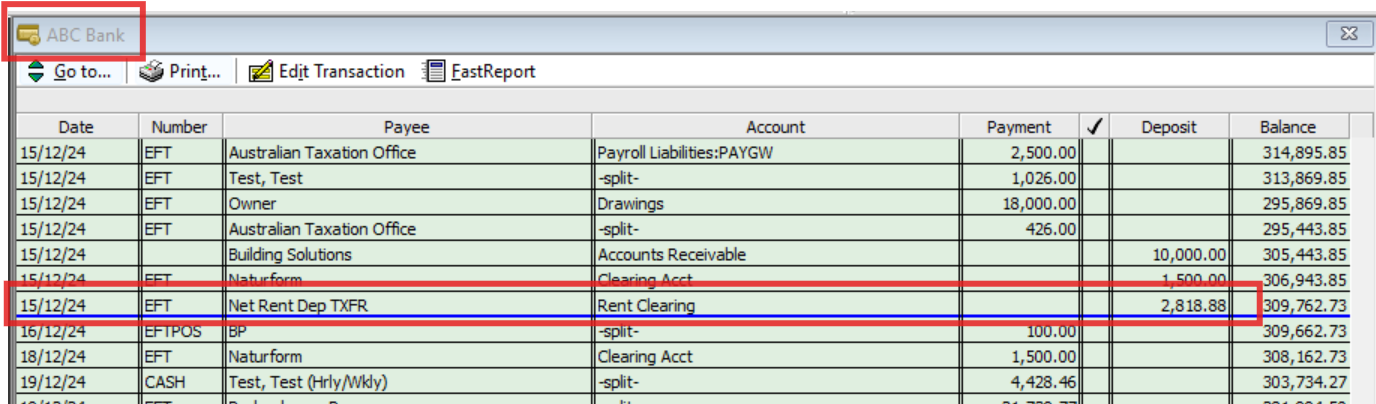

… & here's how the deposit displays in the actual bank account:

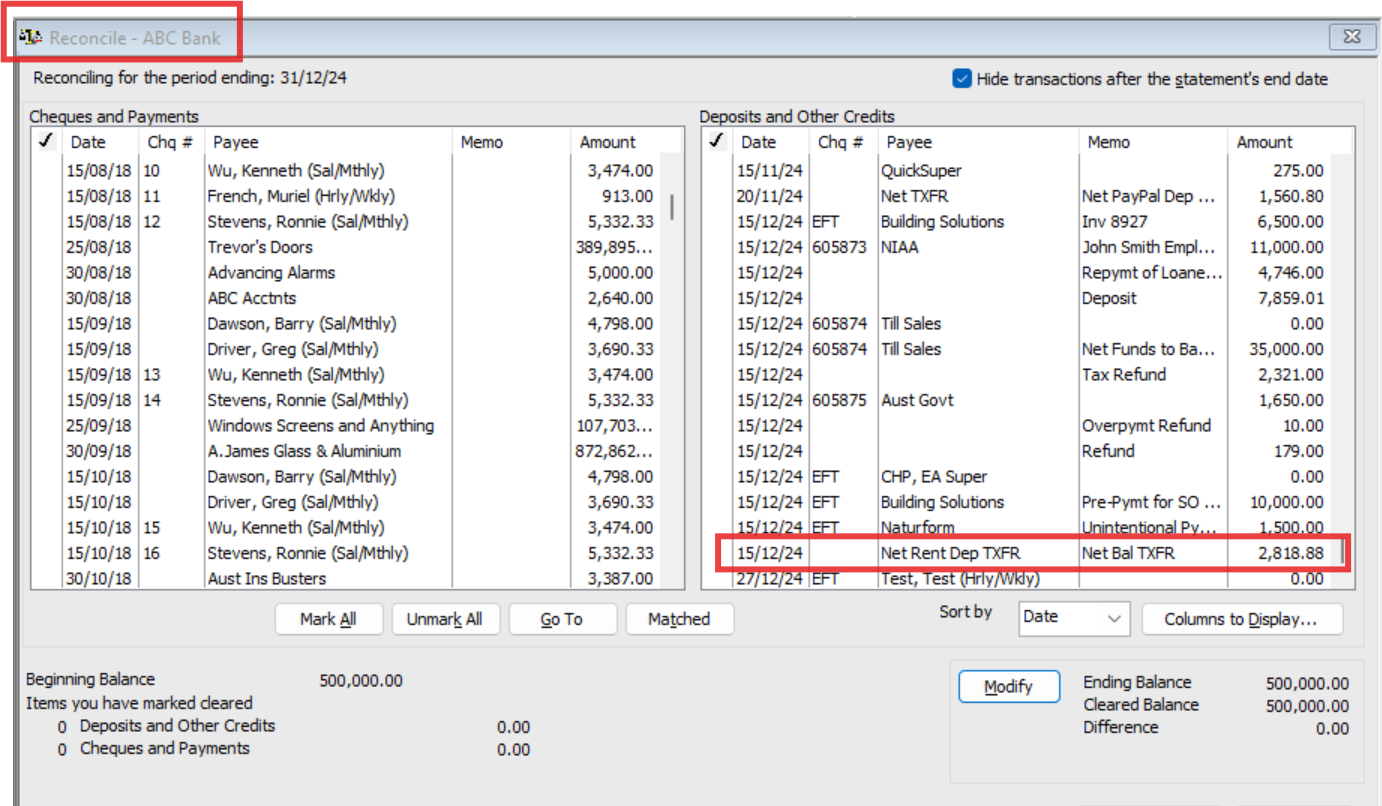

… & on the Bank Rec :

BAS

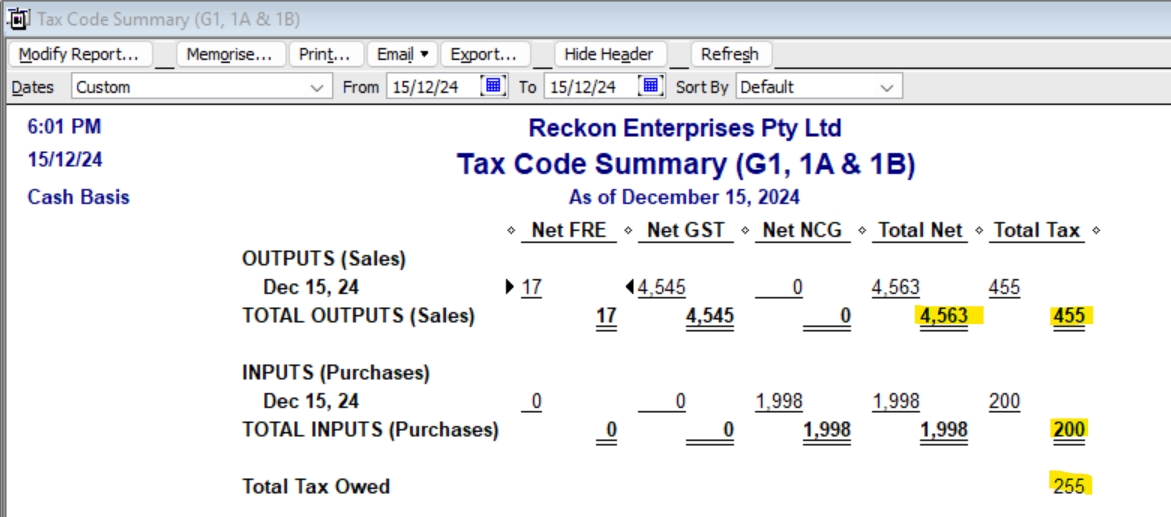

Tax Summary :

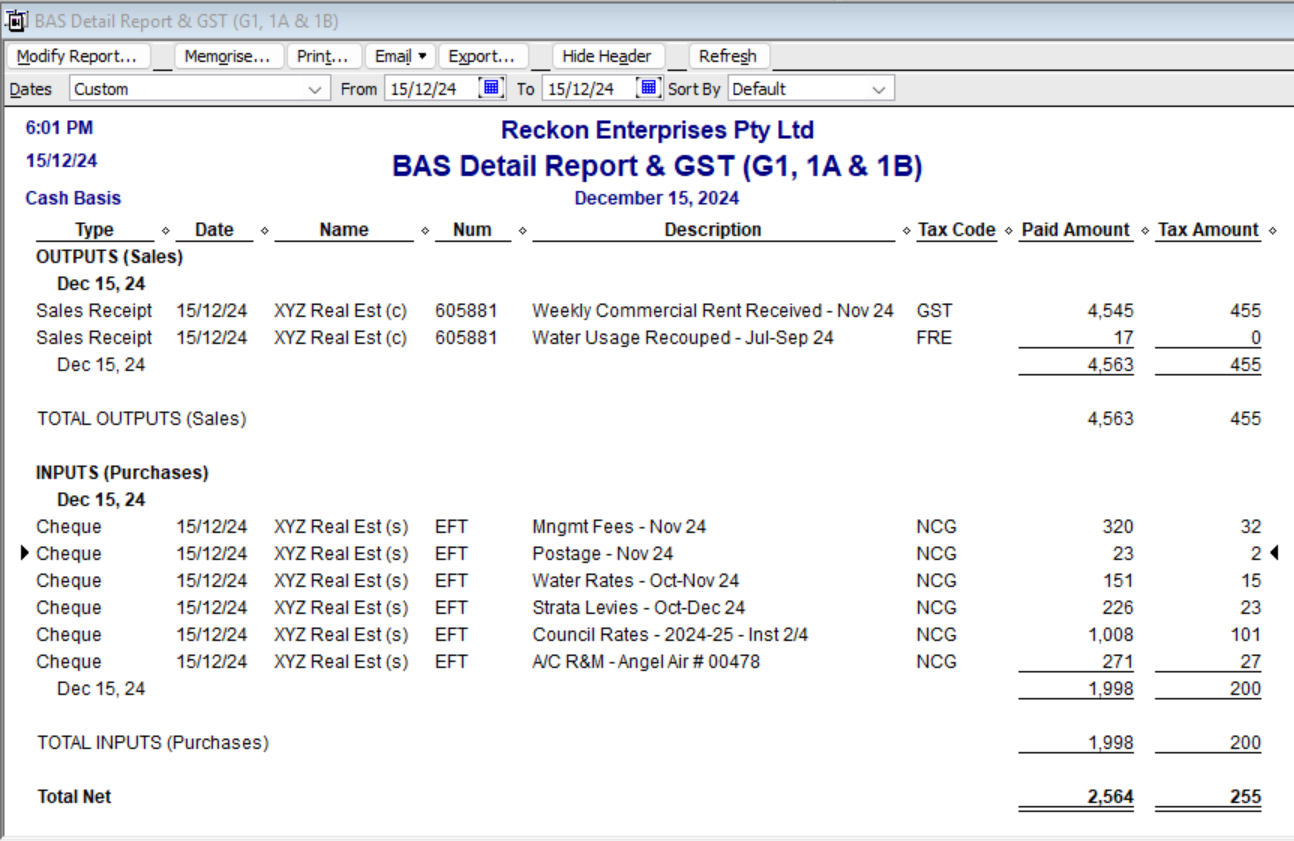

Tax Detail :

(I remove the cents from my BAS reports as they are reported in whole dollars only)

P&L :

Obviously, I've filtered the above reports to just show the rental transactions only, for the purpose of the example 😁

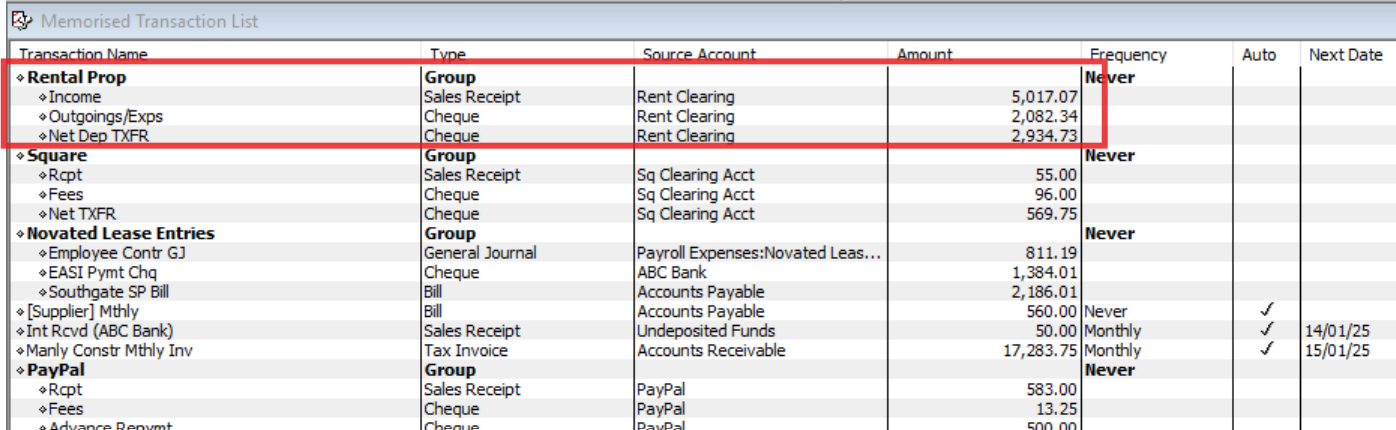

Lastly, I create a Memorised Transaction Group containing the Rental Income (Sales Receipt), Outgoings/expenses deducted (Chq) & net transfer (Chq)

These "templates" can then just be generated & edited as needed 😊 :

Hope that helps 😊

Acctd4

Acctd4

Re: Reckon One update! ✨ Brand new STP report & more!

Hey @Eric Murphy

In a way it does yes! In all honesty, the payroll summary report should no longer be the go-to report for payroll reconciliation with STP.

Last year I created a post outlining the new Employee Earnings Summary report and why its a better option than the Payroll Summary Report when it comes to insights for EOFY payroll reconciliation.

The Employee Earnings Summary report provides more of a detailed breakdown of earnings for each employee including taxable earnings, net pay and super contributions. Its a much better report with more insights for each employee. It also denotes which pay items are non-reportable in STP.

In comparison, the Payroll Summary Report will display ALL pay items used in payruns (including YTD balances if selected) regardless of whether they are reported as part of STP or not, this makes it less ideal when reconciling STP-reported balances.

The new STP YTD report is the perfect companion to the above as it provides a breakdown of each employee's STP balances which will be reported to the ATO when you send through a submission. Its a great way to keep track of reportable STP balances for employees and balances are disaggregated to their respective STP Phase 2 categories.

Rav

Rav

Re: How to set up Super for Contractors without making them Employees

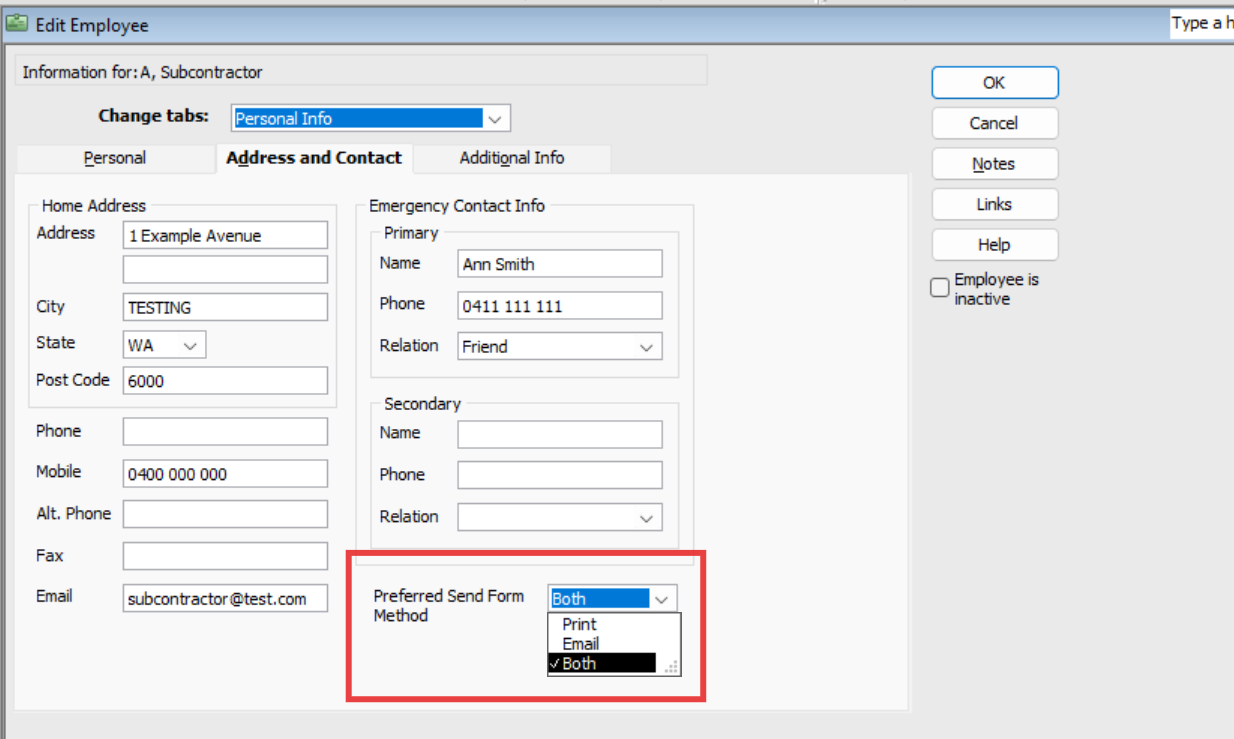

The Payslip issue thing will usually be due to their individual selection here:

(I always ensure everyone's is set to Both)

" … I also can't find a way to export the super data to the clearing house …"

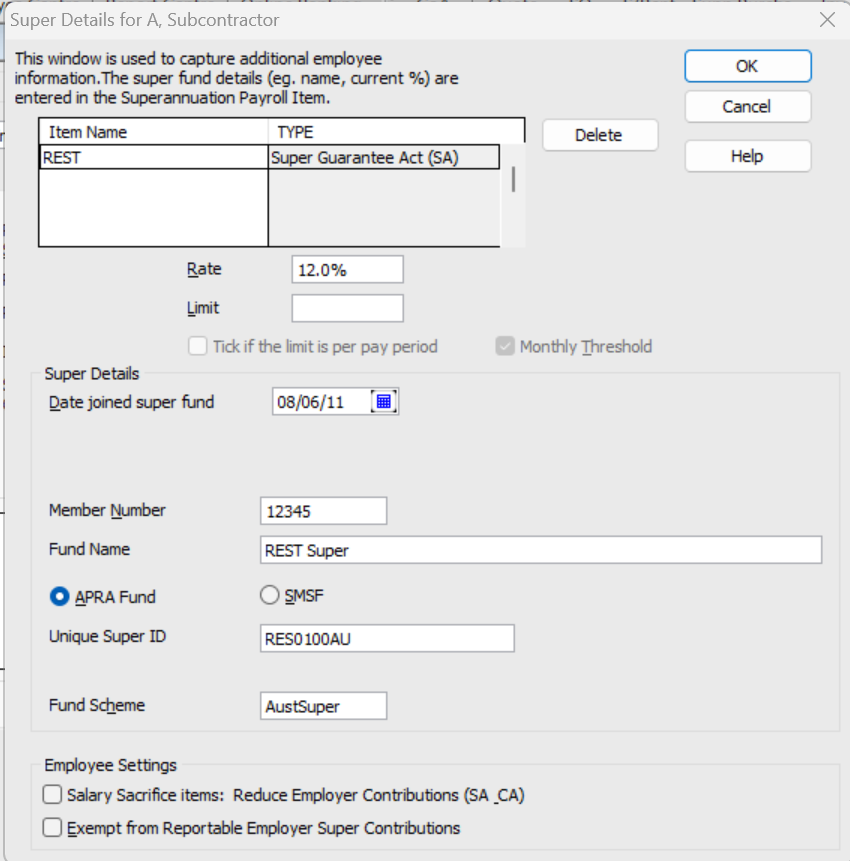

The ability to do this relies on you completing their Super details here:

… & having the super line on the Paycheques.

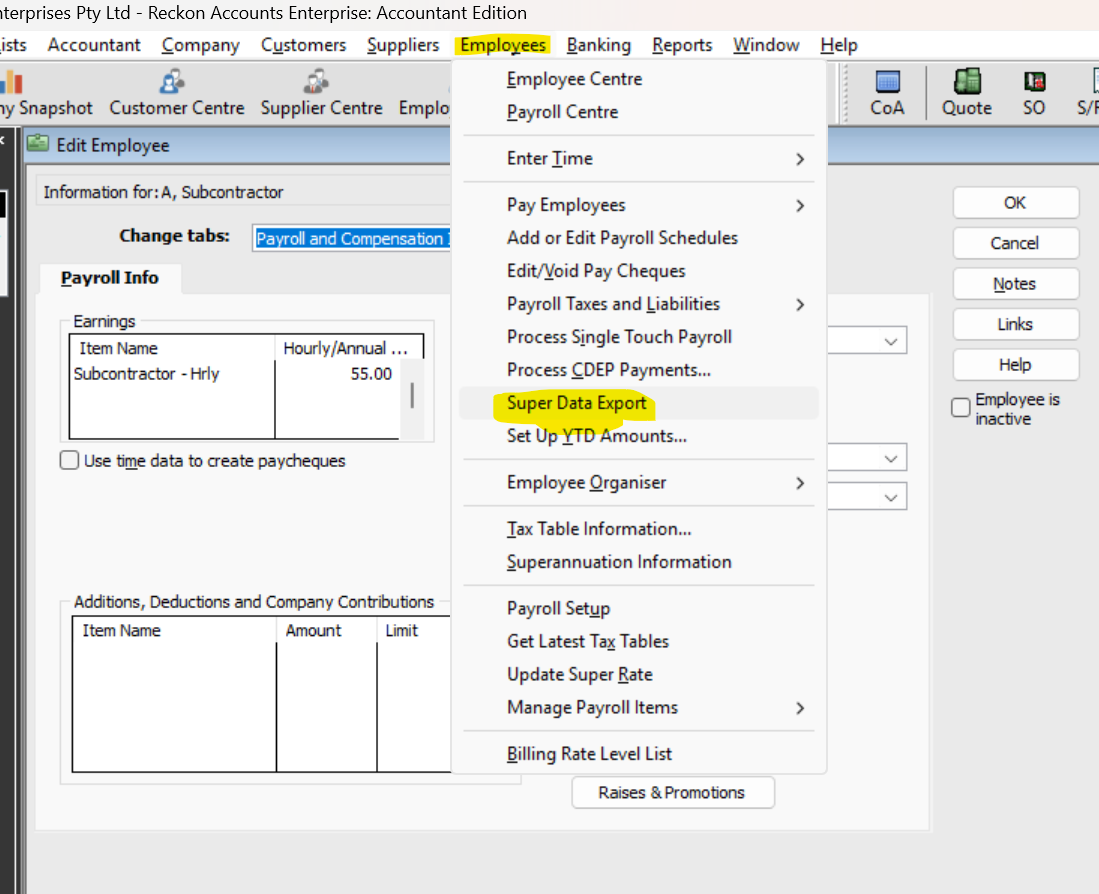

If you've done that, you can access it from the Employee dropdown menu:

The Super Data Export (which creates the upload-able "SAFF" file) process is clearing-house dependent/specific, so you need to check the mapping required for the particular clearing house you're using.

NOTE: The ATO's ("Small Business Super Clearing House") does NOT have this data import (SAFF) function!

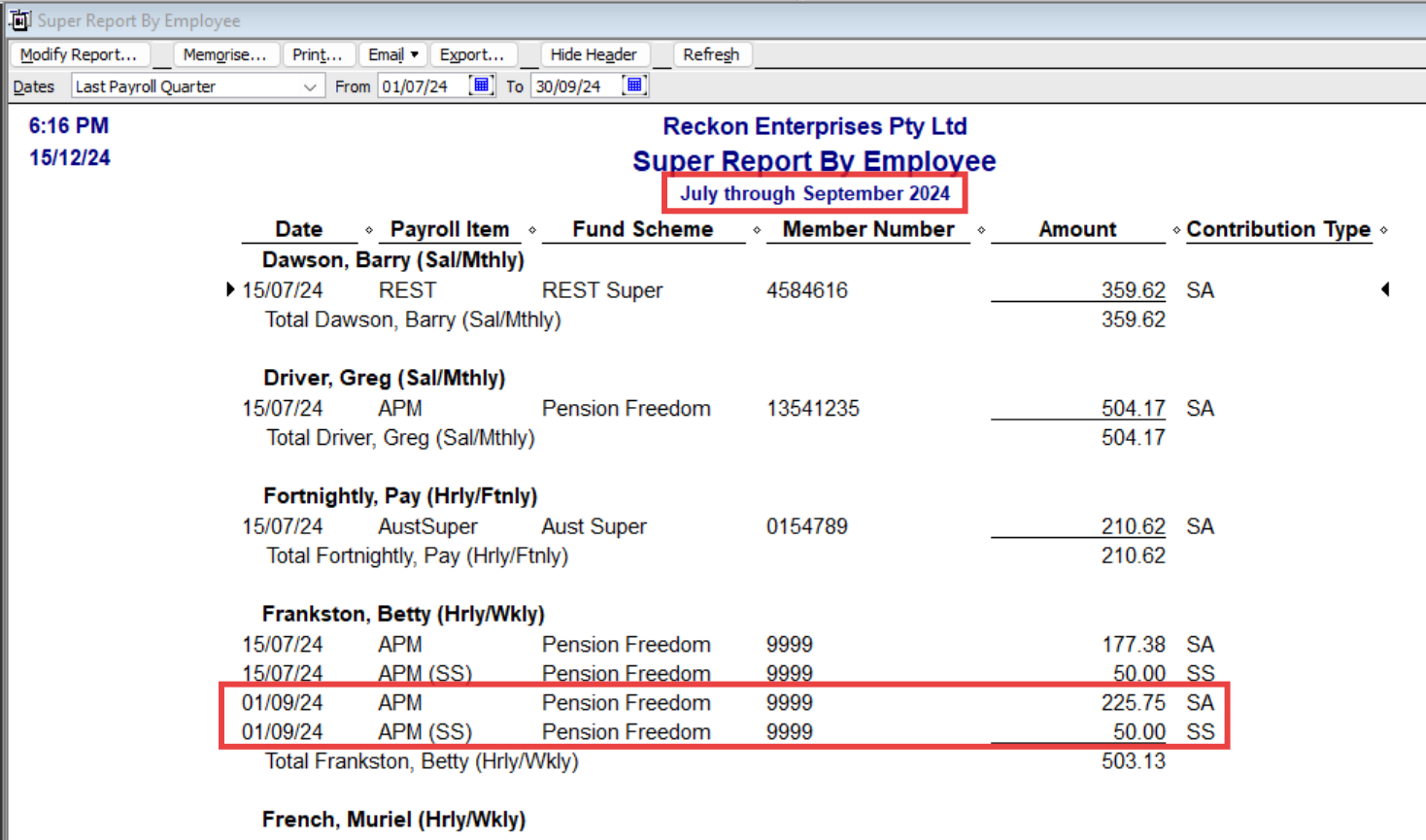

Do you use the Super Report by Employee (Under the Reports dropdown menu > Employees & Payroll) ?

This will display all Paycheque super amounts for a specified Date/Date range (regardless of varying employee pay frequency) :

Acctd4

Acctd4

#TipTuesday - Reckon Accounts Hosted/Desktop - re-import a bank statement file

🌟 Tip Tuesday – Welcome to 2026! 🌟

Good morning everyone, and welcome to my first Tip Tuesday of 2026.

I hope you all had a great New Year and are feeling well-rested and refreshed.

For this week’s tip, I want to remind everyone how to re-import a bank statement file (QIF) that didn’t import successfully the first time. You might see a message that there are no new transactions to import, or nothing happens at all when you try again. Following this tip can help you re-import these bank statements.

Why does this happen?

When Reckon Accounts Business imports a QIF, it remembers the first transaction in the file. If the same transaction appears again, it’s flagged as already imported, and the import won’t continue.

Renaming the file won’t help, because Reckon recognises the transaction data itself, not the file name.

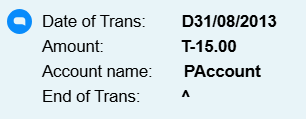

Bank QIF file format (example)

Header:

The transaction block:

The ^ symbol marks the end of a transaction.

How to fix it

To work around this, we simply need to move the first transaction to the bottom of the file.

This makes Reckon treat it as a “new” QIF file and allows the import to proceed.

Summarised steps

- Make a backup copy of the QIF file.

- Open the duplicate file in Notepad.

- Cut the first transaction block.

- Paste it at the very bottom of the file.

- Remove the blank line left behind.

- Save the file and re-import.

For more information check out our full help article here:

Jason_Z

Jason_Z

Re: Having a clear visual indicator when a link is added

Thanks @Rav

I have just started looking at it. I think it could be useful. I could attach a Quote from a supplier to a PO for example

Re: Open Banking Bank Feed issues

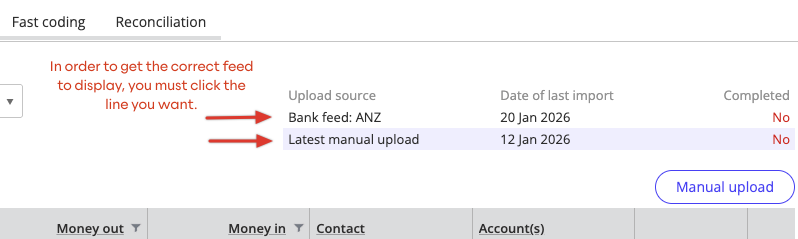

I've discovered my issue was not understanding the user interface. In the top right corner it displays the upload source. Since I had recently changed over to a bank feed I had two options: Bank Feed; or Latest manual upload. Mine was highlighting the manual feed so I wasn't seeing the bank feed. Clicking on the bank feed row allowed me to view the bank feed. See attached.

Hopefully I wasn't the only one getting lost here and this post will help others.

Re: Giving a customer more time to pay

Hey @SydneyFlow

What an awesome thing you're doing for your customer! 🙂

Yes, you can designate a specific payment term to an individual customer which differs from your book's default payment term.

Its super easy to do as well, simply head into the specific customer's profile and click the Customer tab. You'll see a Payment Terms option which allows you to apply a payment term only to that customer.

When you next create an invoice, the payment term will automatically prefill when the customer is selected.

Rav

Rav

#TipTuesday - The brand new STP Year to Date Report! 📊

Welcome to 2026! Hopefully you're all settling back into the swing of things and the holiday hangover has passed by.

#TipTuesday is back and we're starting the year off strong with a brand new report that is quickly going to become your favourite payroll report.. The STP YTD Report!

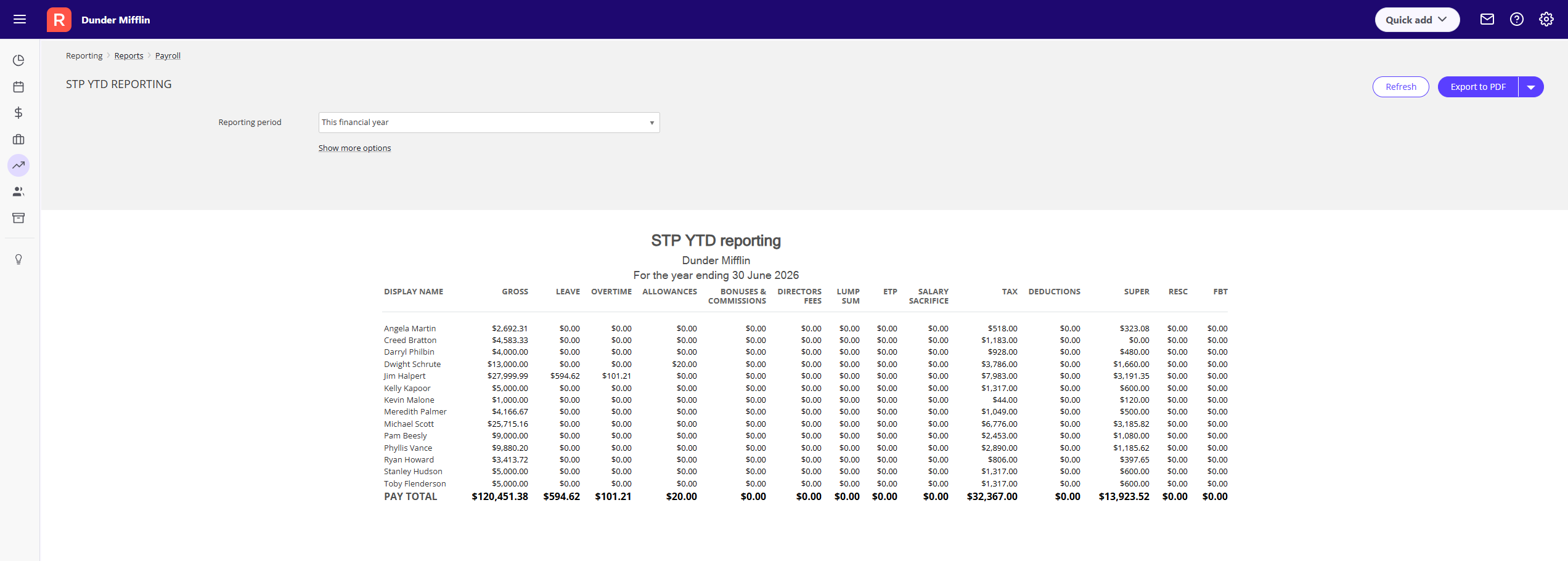

What is the STP YTD Report?

The new STP YTD report allows you to easily view employee YTD balances that will be submitted to the ATO as part of your STP submissions.

The report shows STP-reportable YTD values from Paid or Posted pay runs, including Initial YTDs, for a selected financial year (draft pay runs are excluded).

Employee balances in the report are always calculated from the start of the financial year however you can set an end date when generating the report if required.

The STP YTD report makes it much easier to reconcile payroll throughout the year, and will become valuable companion at EOFY time. The STP YTD report will also allow you to compare balances with the Employee Earnings Summary Report, identify discrepancies earlier, and eliminate any stress not just at EOFY time but throughout the financial year.

Add the STP YTD Report as a favourite report

I'd recommend adding the STP YTD Report to your favourite reports by checking the star icon next to the report. That way your report will be elevated to your favourite reports for quick and easy access.

That's it for this week, if you have any questions about the new STP YTD Report let us know below. Tune in next week for more tips!

Rav

Rav

Re: Reckon Desktop Automatic Backups

Hi @Joanne O'Sullivan ,

If a user is logged in when an automatic backup is scheduled to run, Reckon does not kick the user out; instead, the backup simply does not run. Backups set to run will only occur once the file is actually closed, so if someone is still logged in, the backup is skipped until the next qualifying file close. Once the file has been closed, the backup will be generated. Reckon never forces a logout or closes the company file automatically.

Reeta

Reeta