Backorders on Tax Invoices

Hi,

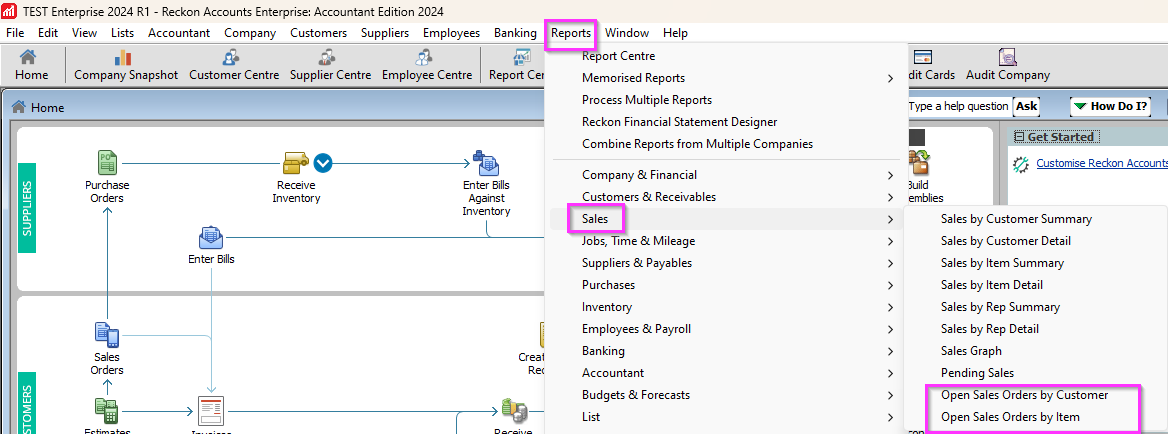

We currently have a column for 'backorders' on the tax invoices we provide the customer, however, how do we use this effectively to create reports on outstanding backorders? Is there a way?

Answers

-

Do you know what, I've been using Reckon / Quickbooks for a long time and I have never used it. There doesn't appear to be anything in the help files either. Or the reporting. Most peculiar

ZZappy

0 -

Hi @Jacqs

When you refer to 'backorders' do you mean 'sales orders'?

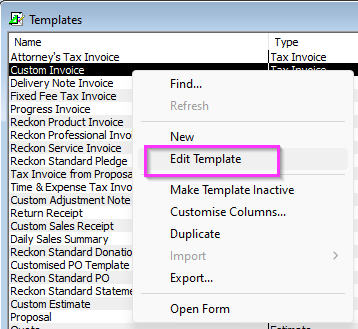

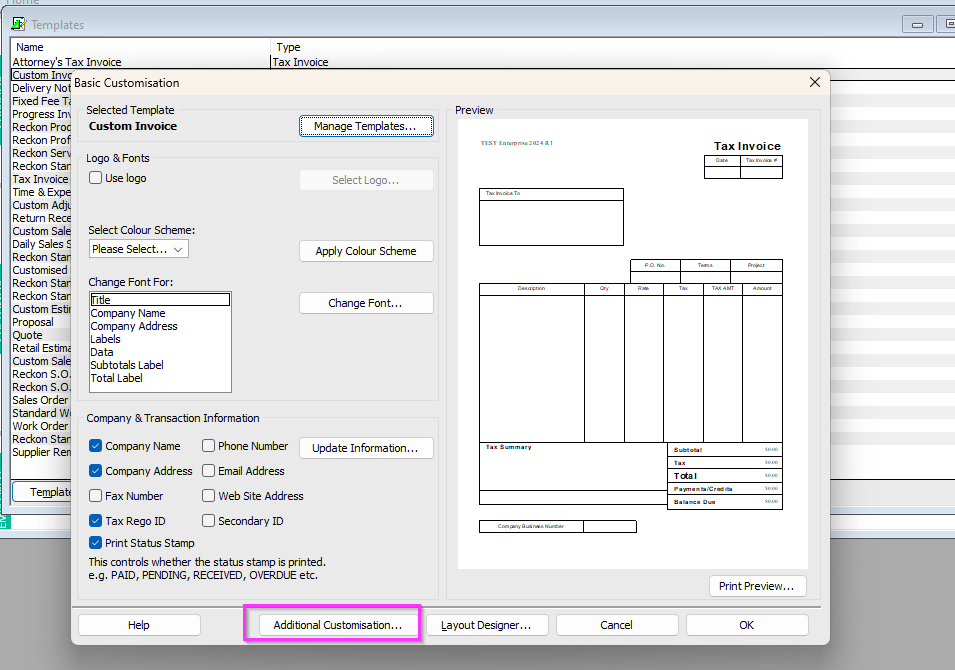

Can you confirm whether this column 'backorders' was added to a template you have customised or confirm which specific invoice template you are using?

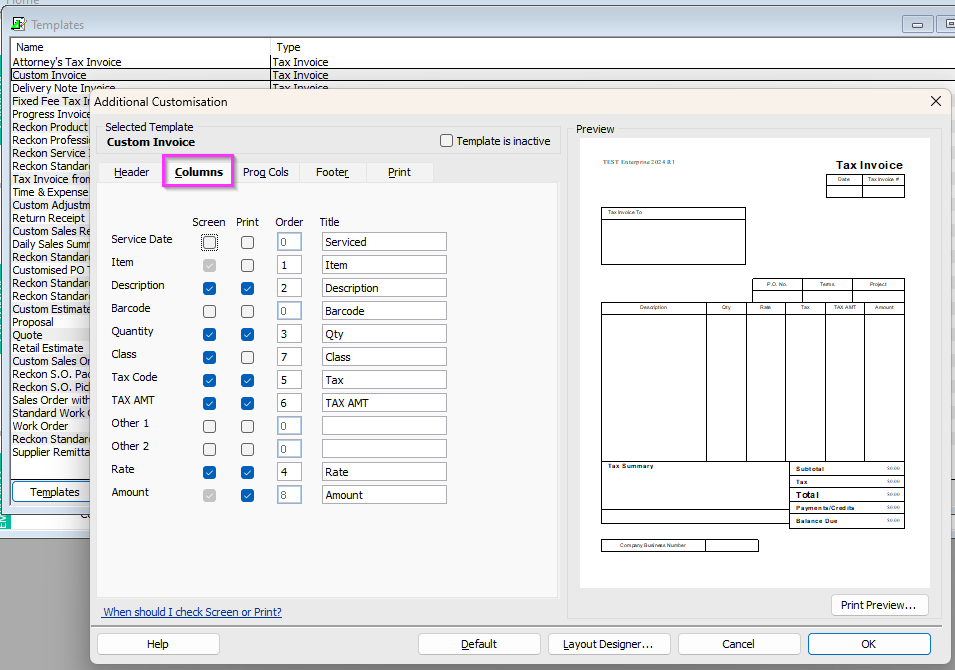

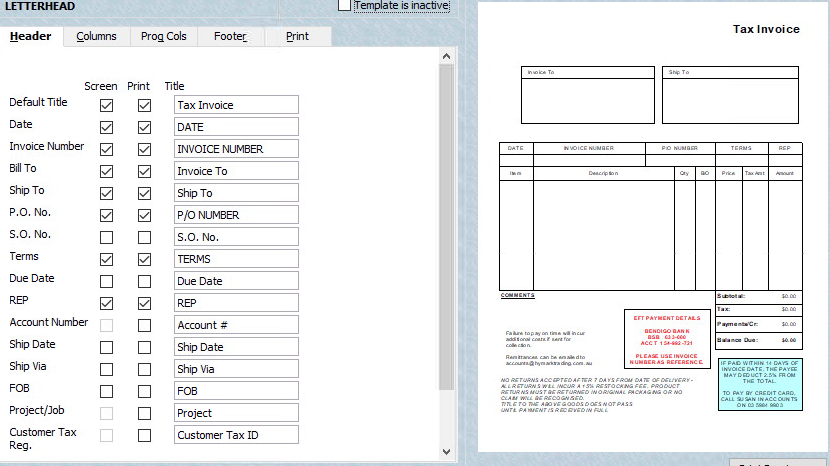

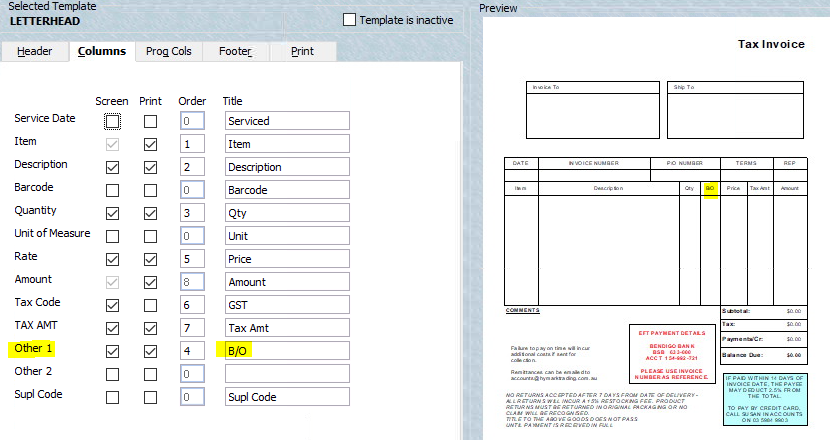

If you have customised an existing template, take a screenshot of the template customisations you have done.

Example:

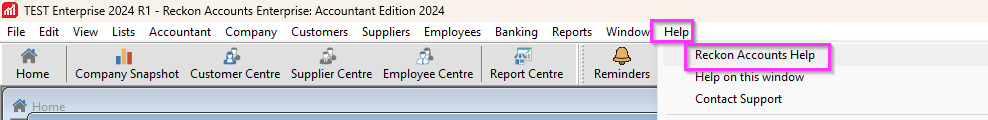

Searching the Reckon Help and Support Centre | Asking good questions on the Community

#TipTuesday: Picture Paints a Thousand Words | How do I add screenshots to my discussion?

0 -

Hi,

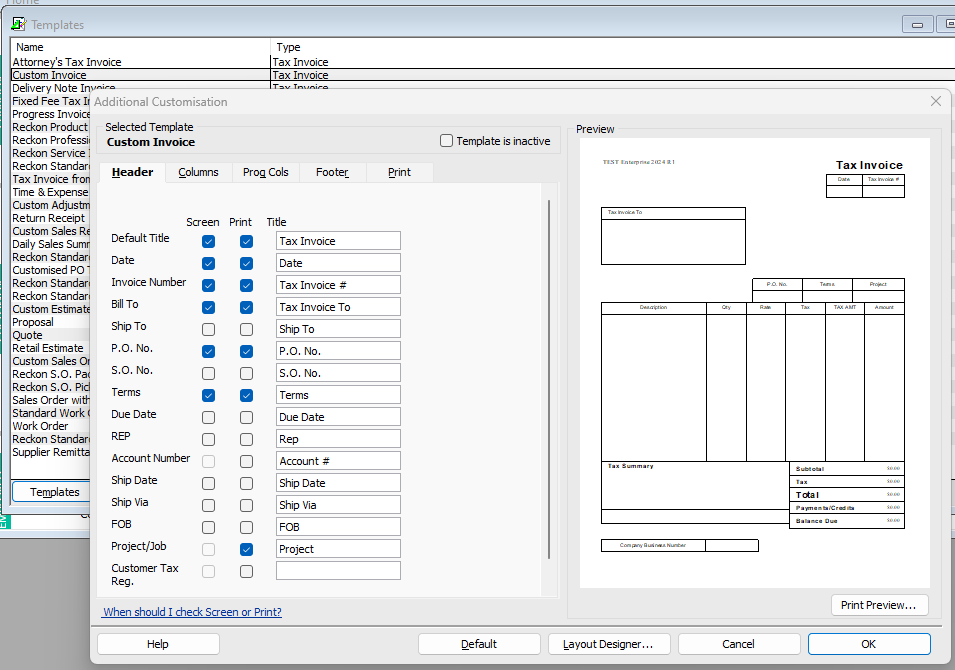

So we dont use the sales order at all. We just do a Tax Invoice for the customer. The issue I have is that sometimes we cannot fulfil the complete order so some of it has to go on backorder. On the tax invoice template, we added the backorder column however we need to know a way to track these backorders, hence wanting to know if we can run a report to show outstanding backorders.

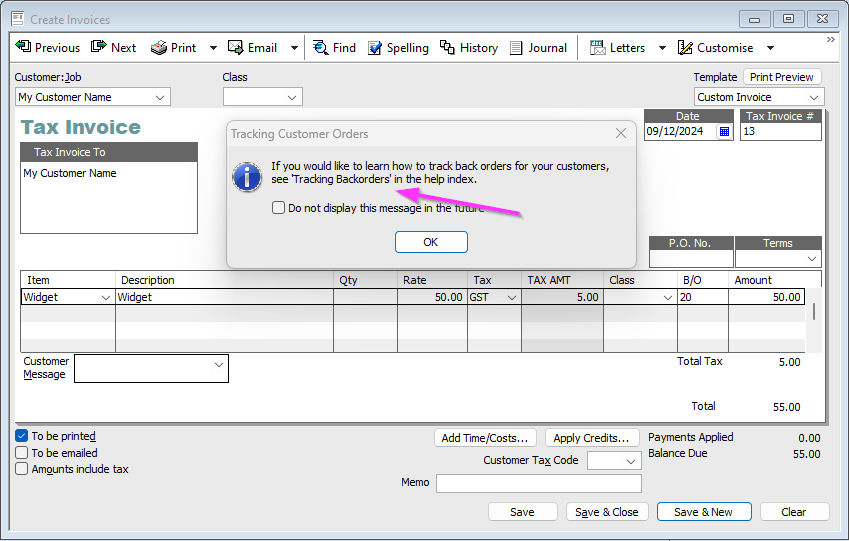

Here are some screen shots of how we have it set up-

.

Hope that helps :)

0 -

Since you are using a Custom Field (Other 1), then that is what you need to add to a report when you modify one.

So in terms of 'tracking the backorders', what type of report are you normally generating or which existing report most closely has the info you need, which that B/O (Other 1) custom field can be added to, in order for you make meaningful sense of the report for your intended purpose?

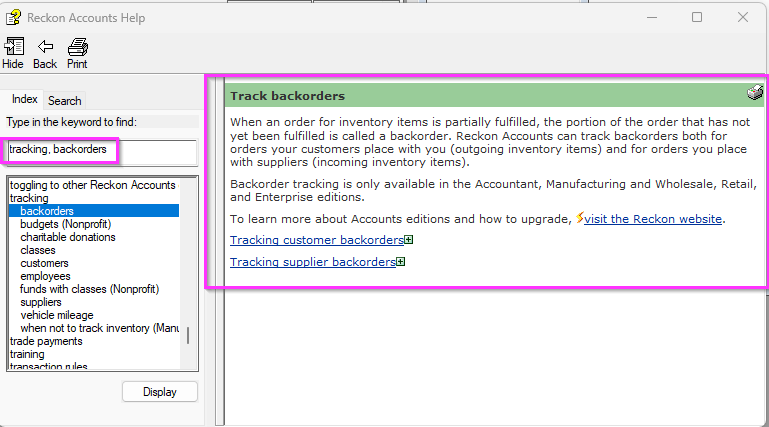

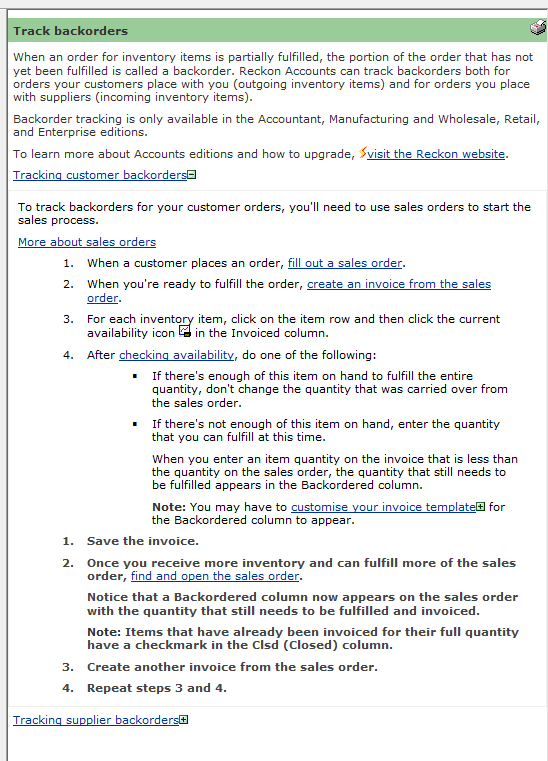

The in-product Help articles provide useful information that can guide you.

Searching the Reckon Help and Support Centre | Asking good questions on the Community

#TipTuesday: Picture Paints a Thousand Words | How do I add screenshots to my discussion?

0 -