Reckon Payroll: Employee not claiming tax free threshold AND has Medicare levy exemption

We have a new employee who is not claiming the tax free threshold AND has a Medicare levy exemption, as it is their second job.

At Reckon Payroll > Employees > [Employee Name] > Tax > Edit tax details, the box "Tax scale" appears to contain the two settings we need - "Scale 1: Tax free threshold not claimed" and "Scale 5: Full Medicare exemption" - but it only allows the user to select one or the other.

I called Tech Support and we tested it in a payrun. If Scale 1 was selected, the PAYG deduction in the payrun was correct, but there was no means to apply the Medicare levy exemption. If Scale 5 was selected, the Medicare levy exemption was applied, but the tax deducted in the payrun reduced to the tax free threshold claimed figure and became incorrect.

To cover this situation it looks the Medicare exemption setting needs to be split into two, one for Tax free threshold claimed and one for Tax free threshold not claimed.

Otherwise, is there a way both settings can be applied in Reckon Payroll? I am really not keen on having to do the calculations manually each pay. I'd much prefer to have the software do them so I know they are correct.

Best Answer

-

Hi Rav,

I called the employee and clarified.

The employee had filled in "Medicare levy is not payable" in the Medicare variation section of his tax file number declaration and I had assumed it was an exemption. My mistake.

In fact, he's a low income earner and did not pay the Medicare levy last year as his total earnings were under the threshold.

It's a bit complicated as he has two jobs. We can't know what he's earning in his other job to work out if he will exceed the threshold, but he said it is unlikely that he will earn over it this year.

On this basis will leave the setting at Tax scale as "Scale 1: Tax free threshold not claimed". Medicare levy will not be deducted from his pays from us (they will be too low to trigger it). If his combined income does go over the threshold in the year, it will mean he'll need to pay the levy via his next tax return.

Please advise if there is anything else I should do in Reckon Payroll to reflect this situation. Otherwise, the query is now resolved.

Apologies for the confusion and taking up your time.

DebW.

0

Answers

-

Hi @DebW

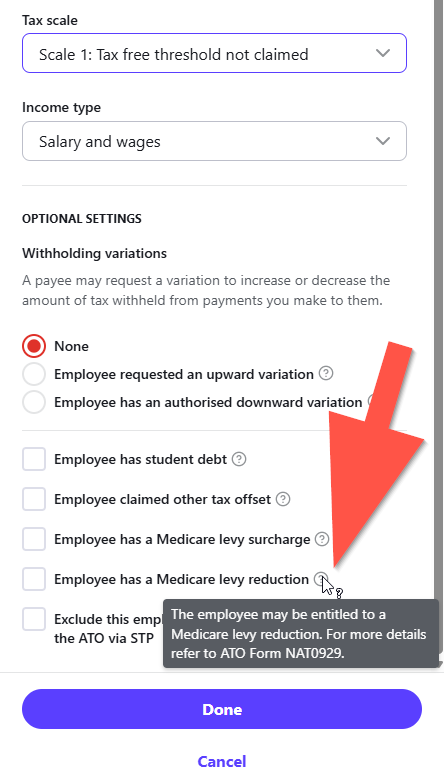

I can't say that I have a great deal of expertise in this area so I may need you to fill in some blanks in my knowledge here. When it comes to tax selections in Reckon One, you can't apply two different tax scales to an employee however, there are separate options when it comes to the Medicare Levy as you'll see below, although I'm not sure where that fits or if its relevant in your specific case.

When it comes to the Medicare exemption you've mentioned, what are the circumstances around that so I can check into it a bit more ie. is there specific information from the ATO that you can point me to with reference to both these tax scales for an employee with a second job?

0 -

No worries at all, glad you got to the bottom of it 🙂

From what you've mentioned, no I don't think there's anything further you need to do here and you should be good to go.

With that said, I'm not a tax agent or accountant so for 100% certainty on employee tax setup I'd suggest checking in with your accountant/tax agent.

0