Payroll Tax % & Work Cover %

Hi,

How would I set up Payroll Tax & Workcover percentages from payroll to record these extra costs into Job Costing. Any suggestions on how?

Cheers

Karina

Answers

-

Hi @Karina_9242901

Are you referring to WorkCover on-paid to the employee ?You can tick the checkbox on the Payroll Item for this (NOTE: You should also be job costing the reimbursement received, to ensure accuracy)

Payroll Tax is a liability, outside of the STP-specific payroll expenses. However, it is expensed for tax purposes so you could apportion percentages across multiple lines, on your payment entry, based on your job cost reports ☺️

0 -

Hey Shaz,

We want to create provision for Payroll Tax and Workcover on our weekly payroll. Do we have to create a payroll item to have this calculation to work and attach to each employee card for this to work.

Cheers

Karina

0 -

As they're not individual-employee-specific, you can't link these to employee Paycheques. Every Payroll Item you add on a Paycheque will display on their Payslip.

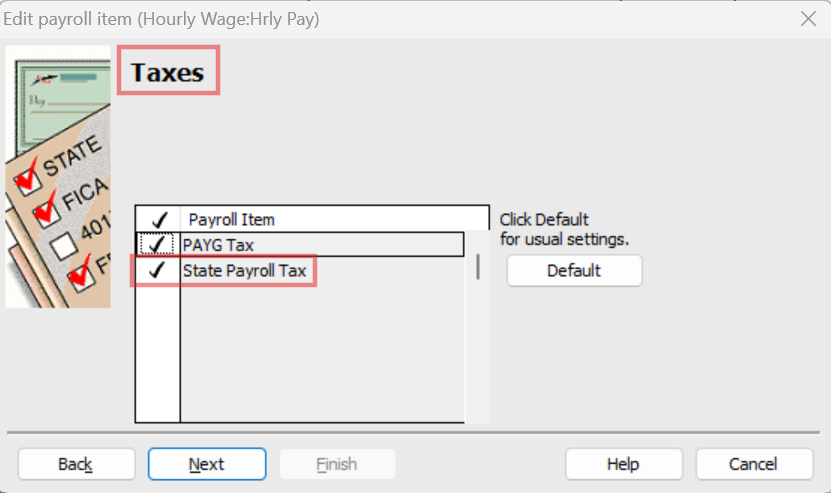

There are 2 default State Payroll Tax reports - Summary & Detail - within RA/RAH (under the Reports dropdown menu > Employees & Payroll) that can show you your liability in real time. However, their accuracy is entirely dependent on correct selection for EVERY Payroll Item here:

Alternatively, you can modify a Payroll Summary report & filter it to include only the relevant Payroll Items for your particular state. Although, this one doesn't give you the calculated, payroll tax amount, you can then use these figures for reporting, to generate that.

For WorkCover, again, this is an employer liability that's not individual-employee-specific so again, it shouldn't be on an employee's Paycheque. Instead, I use another filtered Payroll Summary to determine this, displaying columns by employee, for the relevant period.

TIP: Once you have these reports modified/filtered as required, give them relevant Titles & Memorise them, so you can easily generate them again - pre-formatted - as needed! 😊

0