Corporate acquisition with cash component on Reckon Accounts Home and Business 2016

Dean Dadhaniya

Member Posts: 4 Novice Member

I am using Reckon Accounts Home & Business 2016.

I need to enter transaction for OneVue's acquisition of Diversa.

Everywhere I search it say I need to enter Action "Coporate acquisition" or something similar on my investment account but I can't find that option in this version of Reckon.

I tried to look at this step by step process but I don't think a TakeOver account is an option available on Home and business 2016 version. http://kb.reckon.com.au/issue_view.asp?ID=5352&_ga=1.119738509.443931407.1475880883

Can someone help me with this corporate acquisition please? I would greatly appreciate your help.

I need to enter transaction for OneVue's acquisition of Diversa.

Everywhere I search it say I need to enter Action "Coporate acquisition" or something similar on my investment account but I can't find that option in this version of Reckon.

I tried to look at this step by step process but I don't think a TakeOver account is an option available on Home and business 2016 version. http://kb.reckon.com.au/issue_view.asp?ID=5352&_ga=1.119738509.443931407.1475880883

Can someone help me with this corporate acquisition please? I would greatly appreciate your help.

0

Comments

-

When you say "corporate acquisition" I am assuming you mean that a company called "OneVue" is buying another company called "Diversa" Those would not be their full names but they are the nick names you use to refer to them.

I am also going to assume for this part of my answer that Diversa will continue to trade as Diversa. It is only the ownership that will change. In this situation both companies continue to have separate sets of accounts. What you need to do is record the fact in the accounts of OneVue that it owns Diversa. In OneVue's accounts, record it as the purchase of any long term asset. Technically it is an Investment but if you do not have that type of account available, use "Other Asset". Set up an "other asset" called "Investment in Diversa". Then record the purchase as you would for any other asset.

If on the other hand the idea is that there will be only one trading entity, then what you are really buying is the assets and liabilities of Diversa not Diversa as a trading whole. You need to decide what value you agree to put on all the assets etc You could take them up at book value - that is the value that they stand at in Diversa's books or you could put your own agreed value on them. You might find qualified valuers to value the assets separately.

I am thinking of giving you all sorts of examples of what to do if this value is higher or lower than that value and what to do if the total value less liabilities is higher than you paid or lower than you paid - in other words if you end up with a goodwill account or an asset revaluation reserve but really I think you need to go to an accountant to do this for you. Once the accountant sees the actual situation he/she can tell you what you need to do. I am just dealing with possibilities.

Doing your accounts in Reckon is one thing but for some things you really need an accountant.0 -

Oops I just realised that you have shares in Diversa and they are being taken over by OneVue. I have not been paying much attention to the stock market since I retired many years ago. Don't worry, they will tell you what to do. If you do not understand it, your accountant will sort it for you.

0 -

Hi Dean & Margaret,

Thanks for asking.

I haven't been able to find all the information required for this takeover, so the final details may still be in the making (The Federal Court approved the merger on 27/9/16). You should receive a statement from the company with all the details required. I've only been able to source this outline of the merger.

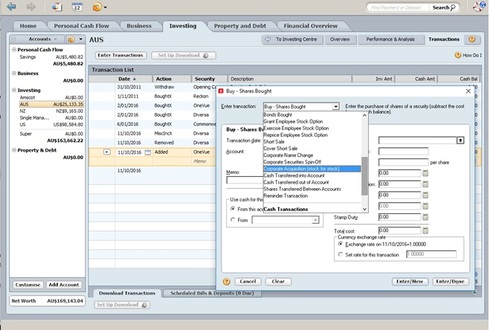

The main transaction is "Corporate Acquisition" which is a transaction type available on your share brokerage account in the Investment Centre.

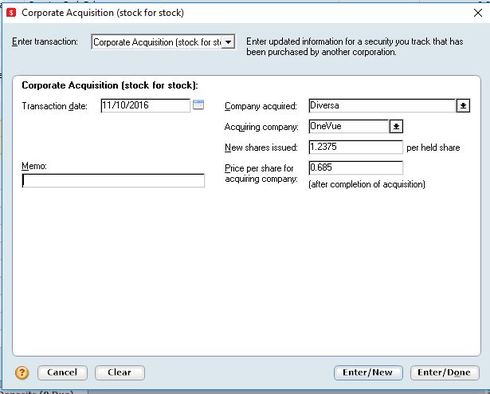

This merger gives you two Options. Option 1 is a straighforward Corporate Acquisition transaction - 1.2375 OneVue shares for each Diversa share. The uncertain element is the price at which the merger is struck. The merger announcement used a OneVue share price of 0.685, which was the share price on 10/6/16. Please see your document for the proper share price.

Option 2 is a combination of Cash plus shares.

Firstly, see your documentation and talk to your accountant on the tax status of the cash component. If it is tax free then use a Return of Capital transaction type to accept $0.10 per Diversa share held. Otherwise, use the Miscellaneous Income transaction type. You will need to nominate a category for this income, something like Investment:CashComponent. Then you'll need to do the Corporate Acquisition transaction with the ratio 1.073 and using the appropriate Onevue share price.

Hope this helps.

Regards,

John

1 -

Thanks John. I was looking for that Corporate acquisition option and it is a little hidden. I have click edit on a transaction to get to it.0

This discussion has been closed.