Salary Sacrifice after changing to STP Phase 2

Comments

-

Hi Rav,

We updated to the new 2023 STP2 version before year end (due to a laptop upgrade), and now have an issue with salary sacrifice super as the amount isn't showing up as RESC.

The existing salary sacrifice super payroll item can't be changed to comply with STP2 so we have created a new one, but need help with how to adjust the amount to the new item. Have tried an adjustment payrun, but cannot input a +value to adjust out the old item.

How can we adjust the annual figure to reflect the new STP2 salary sacrifice super amount & remove the value against the old payroll item.

0 -

“ … The existing salary sacrifice super payroll item can't be changed to comply with STP2 …”

A bit puzzled by this … It just needs to be mapped to the new Salary Sacrifice Super (S) Tax Tracking Type.

Are you not able to do that ? 🤔

0 -

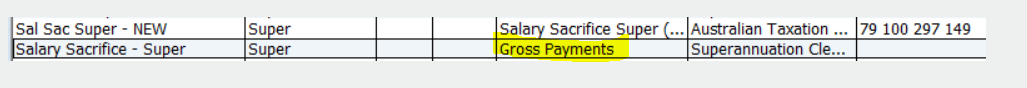

The payroll item we had already set up is a Salary Sacrifice - the item itself shows as Salary Sacrifice (SS) and says it will show on the payment summary as RESC - but it doesn't.

On the Payroll Item list, the tax tracking for the item shows as Gross Payments.

Snapshot of the original Salary Sacrifice payroll item is attached.

The new payroll item we created also shows the item as Salary Sacrifice (SS) with the same message that it will show on the payment summary as RESC. This new payroll item looks exactly the same as the screenshot of the original payroll item, although in the Payroll Item list this new item has a tax tracking column of Salary Sacrifice Super (S).

We need to either change the original to show the correct tax tracking info (& hopefully it will then appear on the summary as RESC), or we need to use the newly created payroll item & somehow transfer the amount across.

0 -

It's this bit highlighted here that needs to be changed:

If you just click though Next - another 2 windows on from that Super Contribution window - you change it there:

NOTE: Are you referring to the old "Payment Summaries" within the program ? These are not longer able to be used as they're not STP2-compatible so can not display the new breakdown format 😬

0