GST refund off PAYGW

Hi

How do I record a gst refund off the PAYG figure in Reckon Accounts Hosted?

Thanks in Advance.

Comments

-

A stand-alone Deposit direct to your GST liability account.

If you use the Manage Tax feature (under the Supplier dropdown menu > Tax Activities > Receive Tax Refund), it opens to there pre-filled for you ☺️

TIP 1: Use both Memos to note what the refund was for eg “GST Refund - Oct-Dec BAS”. This helps to identify it in lists & reports.

TIP 2: There’s a long-standing glitch that drops out the Payee name in stand-alone deposits so after saving it, locate the transaction in your bank account register & add back in/select the Australian Taxation Office Supplier name again, then Save (“Record”). This ensures the entry displays in your ATO Supplier’s transaction list ☺️

2 -

Hi Shaz

Thanks for your help, will this automatically take it off the PAYG amount? or do I need to do another step?

To clarify $500 of GST Refund needs to come of $6500 of PAYG to send balance of $6000 to ATO.

0 -

Because you are paying or receiving a refund from two different accounts, you need to keep them separate. In these instances, I use a clearing account to do this.

For the GST refund, use the method described above by Shaz, but receive the funds to the clearing account, not your bank account.

Pay the PAYGW amount as you usually would through Employees > Payroll Taxes & Liabilities Create custom liability payments. Make sure you pay the full amount of $ 6,500 to clear this liability.

The last step is to do a transfer from your bank account to the clearing account for the amount you paid the ATO, namely $ 6,000. This will then zero the amount in your clearing account and reflect the correct amount paid to the ATO in your bank account.

HTH

0 -

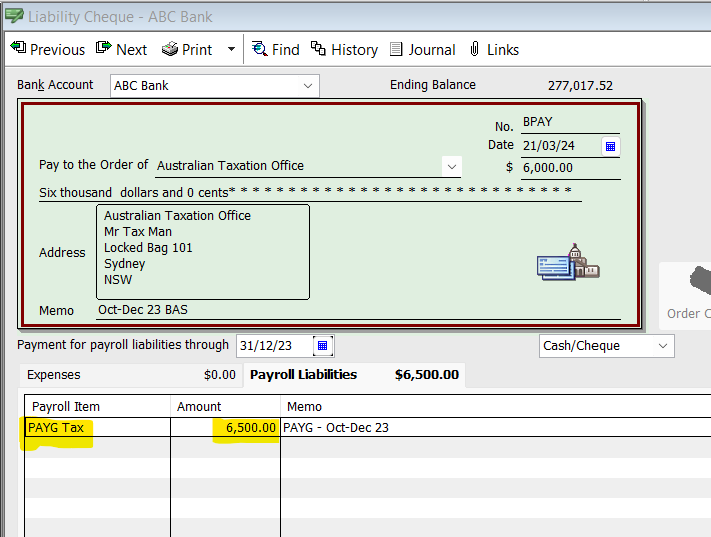

In that case, the Liability Cheque should be created for the PAYG for the FULL amount ($ 6,500):

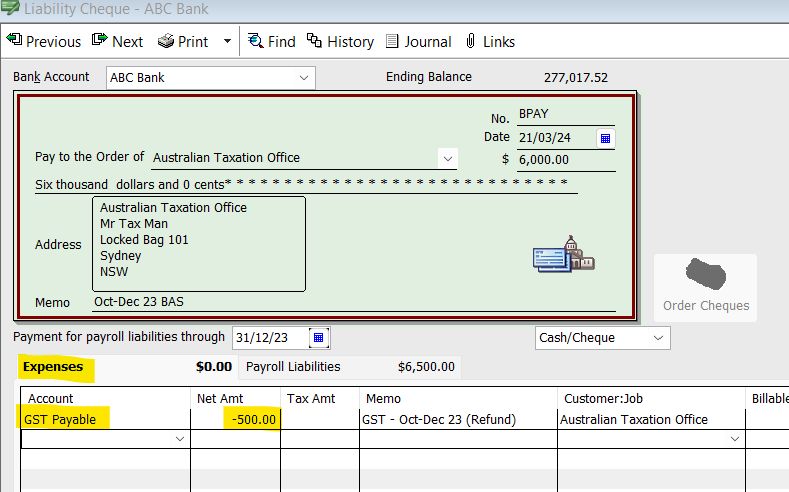

However, on the Expenses tab, instead of a positive amount, the GST refund should be reflected as a NEGATIVE figure:

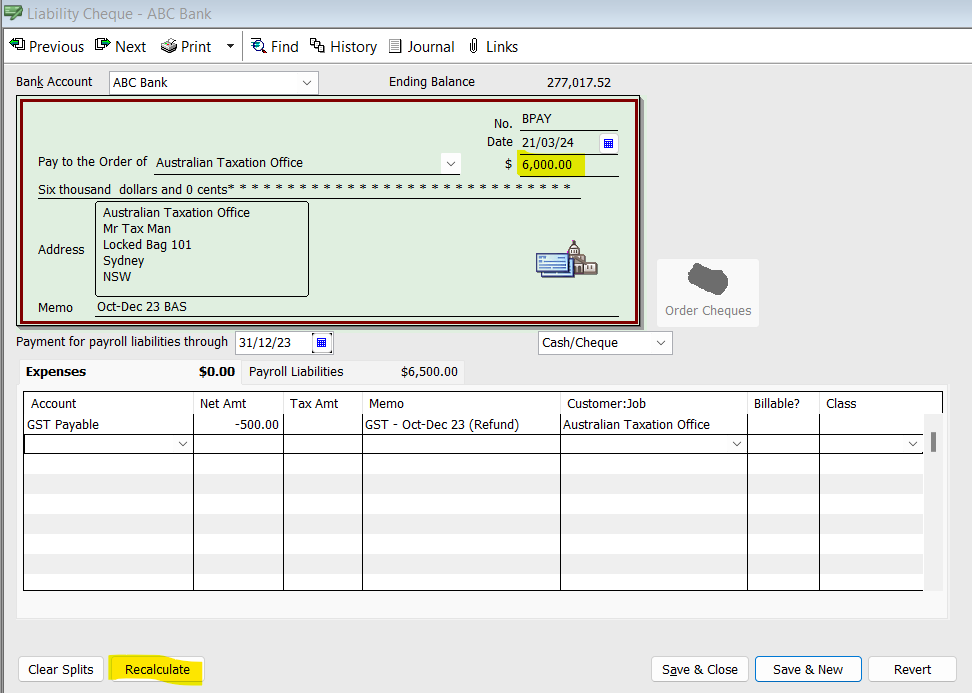

Click on the Recalculate button at the bottom to refresh the figures & this will correctly reflect the $ 6,000 net payment:

The above ensures:

- The correct PAYG has been allocated & paid

- The GST account has been credited by the reduction

- The bank account net payment amount is correct

😊

TIP: It's not necessary to create separate transactions for your BAS components - They should all be on the ONE Liability Cheque with the account-based liabilities (GST, PAYG Instalments, FBT, FTC, LCT etc) just on the Expenses tab instead. This makes reconciling much easier & is much more efficient for tracking!

1