BAS statement not including PAYG in W2

Options

Charles_7722762

Member Posts: 2 ✭

I have been using Reckon Hosted of a while, and last year, set up Payroll, with Super and PAYG liability accounts.

This seem to be reporting fine, however, I have having an issue with reporting the PAYG on the BAS statement and calculating the BAS correctly.

I have selected PAYG Liabilities under the W2 button, and instead of reporting the amount processed in the period as shown on the Payroll Liabilities report, it reports zero?

Before I seek the help of an accredited partner - I'd like to ask whether there is something 'simple' I have missed.

Thanks in anticipation

This seem to be reporting fine, however, I have having an issue with reporting the PAYG on the BAS statement and calculating the BAS correctly.

I have selected PAYG Liabilities under the W2 button, and instead of reporting the amount processed in the period as shown on the Payroll Liabilities report, it reports zero?

Before I seek the help of an accredited partner - I'd like to ask whether there is something 'simple' I have missed.

Thanks in anticipation

0

Comments

-

Hi Charles. The most likely explanation is that you have not configured the W2 label correctly on the BAS. The account that you select there must exactly match the account to which the PAYG tax is being sent to. First of all, have a look at your balance sheet to determine which account the PAYG is going to and then check that this is the specific account that you have used at the W2 label. I would be of the opinion that you have got the tax going to a sub account of Payroll Liabilities and that when you have configured the W2 label you have used Payroll Liabilities, the parent account, rather than the specific sub account. John L G.1

-

John, you are a legend!

I changed W2 to the parent account, and presto - it works.

I was hoping it was something simple!

0 -

Very good Charles. But are you sure that you changed it to the parent account, rather than the sub account under the parent account, or do you have a set=up which is a bit different? In any event, it is the configuring of the W2 tab which is generally the issue. John L G0

-

I have been having this same issue for years but never got around to fixing it. I have just been doing it all manually.

Anyway thought i better try and get it fixed. I am using Recon Accounts Premier 2017.

When i click on the simplified BAS report. The W2 is pointing to the right account, but it is not showing the correct figure.

I will upload photos to show that the correct account is selected. I have checked in the COA and the BAS report looks like its definatly pointing to the right one. But for example W2 shows -$78 in the column. When i go and check manually, it should be showing $4240 so there is a big discrepancy.

Not sure what i am doing wrong.

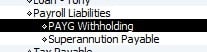

The top little photo is a screen shot from my COA. Obviously the bottom is the BAS.

The config screen shows the box is ticked to include PAYG Report

0

0 -

HI Tony. My question to you is this - how come you are using the tab PAYG Instalment instead of PAYG Withholding?

John L G

0 -

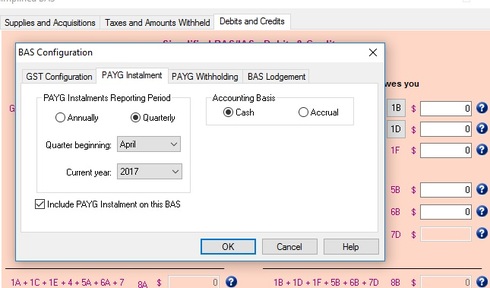

My apologies. Ive clicked on wrong screen.

Here is the Withholding one and its ticked

0 -

Tony. The value that goes into your BAS is the actual balance in your tax account for the period you are running it, at the time that you run your report. Have you had a look at the transactions within the Tax Account? It seem likely to me that you have got something else coming out of that account, during the reporting period, which is reducing the balance.of the account which then affects what is being reported on the BAS. The figure reported on your BAS is from the actual Tax account and not from the Payroll Report.

John L G0 -

John thank you very much for the response. I am no longer at work but that certainly makes sense. I will have a look next chance I get0

Categories

- All Categories

- 6.4K Accounts Hosted

- 10 📢 Reckon Accounts Hosted - Announcements

- 5.9K Reckon Accounts (Desktop)

- 3 📢 Reckon Accounts Desktop - Announcements

- 1.3K Reckon Payroll 🚀

- 21 📢 Reckon Payroll - Announcements

- 21 Reckon Payroll Help Videos 🎥

- 21 Reckon Mate App

- 3K Reckon One

- 7 📢 Reckon One - Announcements

- 10 Reckon Invoices App

- 14 Reckon Insights

- 107 Reckon API

- 822 Payroll Premier

- 307 Point of Sale

- 1.9K Personal Plus and Home & Business

- 62 About Reckon Community