Cheque/Payment not appearing on Bank Rec

Chris_9981716

Member Posts: 4 Novice Member

??????Bank reconciliation is missing a payment. Checking the supplier confirms that the payment falls in the month and is against the Cheque Account (the one being reconciled).

I've run the Reconciliation Discrepancy report and there are none.

Reckon Hosted Edition 2018

I've run the Reconciliation Discrepancy report and there are none.

Reckon Hosted Edition 2018

0

Comments

-

Hi Chris. Go back to your supplier list and I assume that it shows that a cheque has been entered. Double click on the check to open it. Does it show as being cleared? If it does, it has already been reconciled.

John L G1 -

Hi John. Thanks so much for the rapid response firstly!

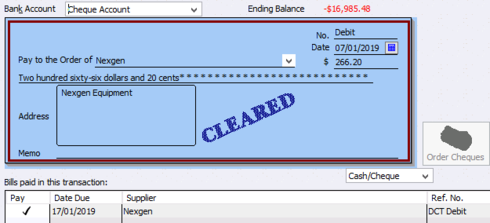

Yes it shows as cleared (shown below) but my bank rec is out by this amount as the payment is not listed in the bank rec.

:-S

0 -

Hi Chris

Where I believe John is going with this is you have already reconciled that particular cheque for the date you are out. This means you have used this cheque in a previous reconciliation in error.

I would maybe presume this amount happens regularly like a monthly payment, and you will find you are missing a previous cheque for this amount in a previous rec period.2 -

Thanks Kwikbooks. You read my mind as to where I was going to go to next!!

John L G2 -

Hi chaps, thanks for the continued input (not to mention your patience!)

As background, I'm stepping in after someone else has done the processing/entry. Not sure if it's related but it would seem to me that the process for handling this new direct debit is incorrect. An attempt has been made to enter a matching bill whereas on other packages, I would have coded it directly from the bank statement transaction (without a bill).

As it is a direct debit, the 'cheque number' is simply Debit which undoubtedly duplicates to an earlier DD. The clearing of the cheque however is against the bill created in Jan (as shown in pic), not cleared against a bill/DD in an earlier month. My understanding it should still appear in the bank rec with a tick as all payments in the month would in order for the rec to balance.

I suspect it's the way our office has treated the DD / payment / bill which has created the problem.

0 -

Hi Chris. Personally, I do not see any point in creating a bill and it is certainly not something that I would do unless there is an avenue to claim any GST in a prior period - to me it just seems like double handing of something which should be simple, as you have suggested. However, despite that, the transaction should stand on its own feet, irrespective i.e. it will still have a cheque entered, whether as a bill payment or as an expense. What I suggest you do is to go back to your prior reconciliation and have a look at the content of that reconciliation. To me it seems like the entry for 7/1/19 has been included in your reconciliation for a prior period. You can easily pick that up from the previous report by seeing the date of the transactions which have been included in the previous reconciliation. It is clear that the cheque has been reconciled, so it can only have been in a prior period if it does not show up in the current reconciliation. For something which happens on a regular basis, it is easy enough to make this mistake if one of the true entry for the prior period was not entered in the month that it should have been - in general, such an error should be picked up because the ticked entry does not seem to be in the correct place i.e. it is showing on the reconciliation process outside of the date range in which it should appear. However, in reconciling statements, people generally are probably looking for an amount, rather than a date and a corresponding amount. I feel very confident that you will find this transaction included in the prior "month/period" reconciliation. Another way to look at this is to go to the supplier's lists of transactions and you are likely to find a month missing. If there is GST involved, you will need then to add this missing transaction into a month which fall s within your BAS period still to be lodged.

John L G2 -

Gents,

You are 100% right. The rec done in Dec'18 did not include an entered txn for the DD. Just as you said, the bank rec was cleared against the Jan'19 DD. I am expecting now I have an additional manual entry (Write Cheque) in Jan'19 which I created to reflect the DD in the month which I shall have to void...

Thanks so much for your patience and guidance. Where do I now register some starts for you both?? 0

0 -

Thanks Chris. You are going to have to enter a second transaction in January. Probably for the first one that was entered, which ended up in the December reconciliation, should have a note inserted in i, stating that is what happened. Your second January transaction will then be able to be used to reconcile against the January direct debit transaction.

John L G0

This discussion has been closed.